XPR showing signs of making a comeback against the BTC trading pair after consecutively hitting a low in four years. The optimistic sentiment is growing, and a typical bearish turn bullish sentiment is growing as well. The bullish pattern emerging is called the triple bottom formation. The development reflects the recent BTC market trends and other developments surrounding Bitcoin (BTC) and other coins like Ethereum (ETH). This article brings you closer to the developments surrounding Bitcoin (BTC) and its potential impact on the broader crypto market.

XRP Eyes a 30% Rebound Versus Bitcoin

Analysts point out in a recent crypto update that a triple bottom pattern emerges when the price of a token hits three distinct lows, all approaching a similar trading price level, highlighting strong support from the community. The token breaks the neckline-resistant levels formed between the lows after the third low. As confirmed by technical analysis, the token rises as much as the maximum distance between the neckline and the pattern’s lowest point. The XPR /BTC pair tested its neckline support at around 793 satoshis (1 satoshi = 0.00000001 BTC) for a possible breakout as of July 12th.

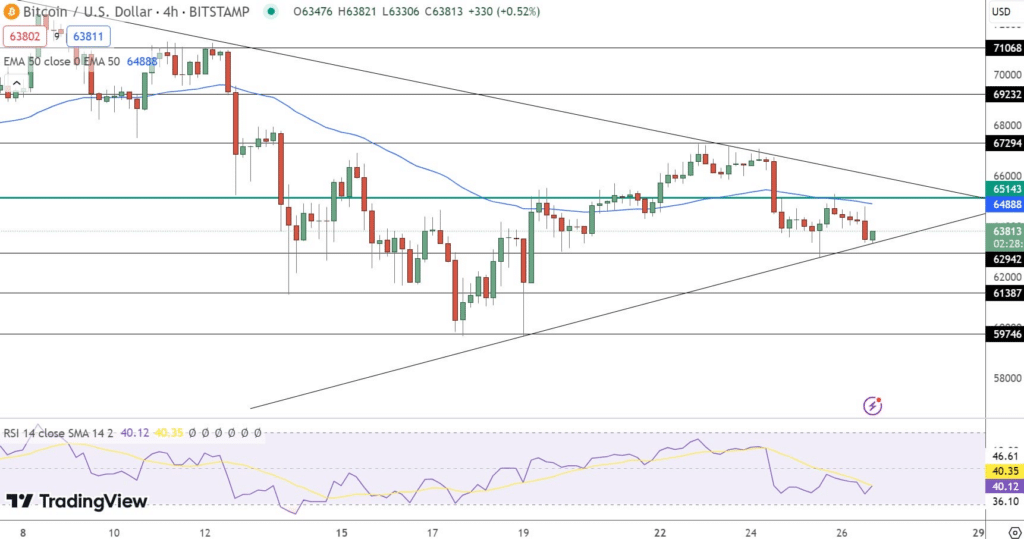

Relative Strength Index (RSI) Analysis

The pair’s weekly relative strength index (RSI) reading of around 36 indicates that XRP is undervalued versus Bitcoin, further boosting its recovery potential in the coming weeks. A decisive close above 793 satoshis will likely push XRP/BTC toward its triple bottom target of around 1,055 satoshis.

In a recent crypto update, the XPR/BTC pair had a weekly relative strength index (RSI) reading of around 36. Experts confirmed that this indicated that XPR is undervalued compared to Bitcoin (BTC) and Ethereum (ETH), and this sets the path for a potential recovery in the coming weeks. A discrete close above 793 satoshis could cause a surge for XRP/BTC toward its triple bottom target of around 1,055 satoshis.

Bitcoin’s 20% Drawdown Benefiting XRP Price

XRP’s potential combat against Bitcoin (BTC) stems from the German government’s massive selling of its BTC holdings in July. A crypto update pointed out that the wallets associated with the government have gained 46,200 BTC in outflows since mid-June, summing up to around $2.69 billion worth of potential sell-pressure. This is a critical factor in current BTC market trends.

Mt. Gox Reimbursement Impact

Additionally, the recent repayment of over 140,000 BTC to Mt. Gox creditors have turned down traders’ general interest in Bitcoin (BTC), with the XRP/BTC pair up over 20% in July. This indicates the impact of large-scale BTC activities on BTC market trends.

Bitcoin’s overall dominance declined to 54.55% on July 12 from a peak of 55.46% a week ago, pointing out that traders could be opting for altcoins like Solana and Ethereum (ETH) while the BTC price correction period settles and the market regains its bearings.

Broader Market Perspective on BTC Market Trends

XRP’s Relative Performance

Considering the bigger picture, XPR will not get as many activities as most top cryptocurrency assets, such as Ethereum (ETH), in 2024. XPR’s year-to-date returns sit around -26.50%, hinting at low activities and interest.

The weekly RSI for XRP/BTC returns after striking its lowest level in two years at around 33, just three points more than the oversold threshold. Judging from the last performance, when XRP’s weekly RSI last reached 33, it was followed by a massive 194% rally, showing a potential for significant surge.

Bitcoin’s Relative Performance

According to a recent crypto update, BTC RSI is still in correction after declining from a high of 88 in March to an average of 45.50 as of July 2024. This shows how much the bullish momentum of Bitcoin has declined in the last two months. This may help prominent cap altcoins like XPR on their road to recovery. These dynamics are essential in understanding the current BTC market trends. XRP stands to gain additional benefits from the growing activities around its “inevitable” ETF launch.

Conclusion

Many factors shape the current BTC market trends, such as the German government’s massive BTC sale and the Mt. Gox repayment, the RSI of BTC, and XRP. Even though Bitcoin (BTC) faces potential challenges, indicators show that XPR’s position hints at a possible comeback, using the current market shifts to its advantage. As this fascinating trend develops, crypto news outlets like the BIT Journal will keep covering it.