The crypto market is in freefall, erasing all gains since Donald Trump’s election win in November. The global crypto market cap has plunged by 8%, dropping to $2.7 trillion, while Bitcoin (BTC) tumbled 7% to $80,000, its lowest level since November. The market crash was triggered by Trump’s latest tariff announcement, which imposed fresh trade restrictions on Chinese imports. This move has intensified fears of a global economic slowdown, pushing investors toward safer assets and accelerating the crypto market downturn.

Trump’s Trade War And Correlation with the Stock Market

According to The Kobeissi Letter, the crypto market has shed $800 billion since trade war concerns began on January 20. Despite Trump being the most pro-crypto president in history, sources say his aggressive stance on Chinese tariffs has spooked investors, leading to a sharp sell-off.

Once seen as a hedge against inflation and economic uncertainty, Bitcoin now moves in sync with traditional risk assets. In 2024, Bitcoin’s correlation with the S&P 500 reached 0.88, meaning it has mirrored stock market movements 88% of the time.

Michaël van de Poppe, CEO of MN Trading, noted:

“Bitcoin is behaving less like digital gold and more like a high-risk tech stock. The market is reacting to macro forces, and this trend is likely to continue.”

Market liquidity is also drying up, raising concerns that crypto investors may face the biggest crash ever as capital continues to exit the market.

Ethereum Erases All Post-Election Gains—Down 50% From Highs

Ethereum (ETH) has followed Bitcoin’s lead, suffering a major decline that has erased all gains since Trump’s victory in November. ETH has plunged 9% since Nov. 5, with The Kobeissi Letter questioning whether the crypto market has officially entered a bear phase.

Ethereum’s price action:

- ETH is now down nearly 50% from its election highs

- Current price: Near $2,000—its lowest since November

- Bearish sentiment dominates as traders exit altcoin positions

This sharp decline reflects a broader shift in market sentiment, as traders reconsider risk exposure in the face of growing economic uncertainty.

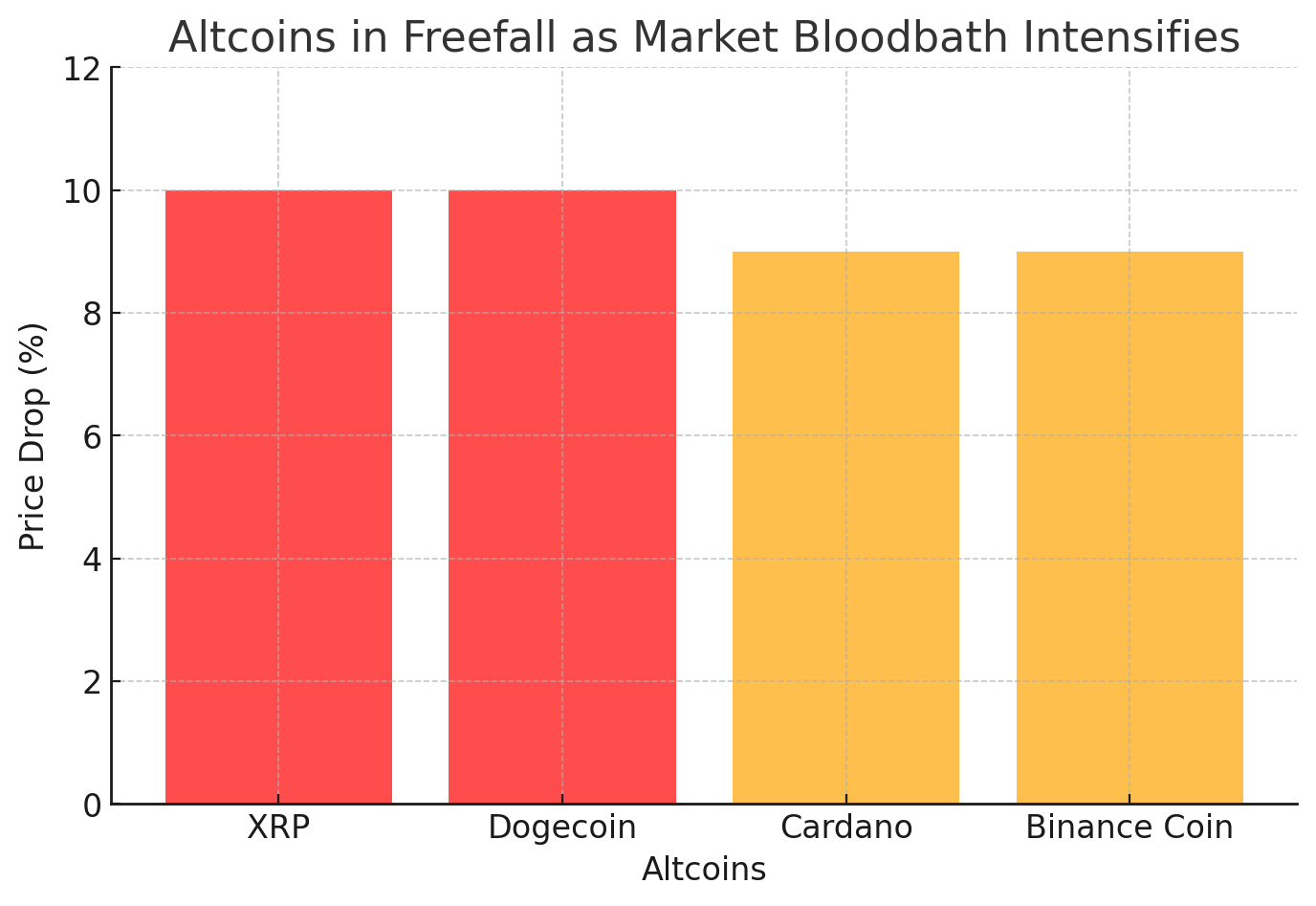

Altcoins in Freefall as Market Bloodbath Intensifies

The impact of the market crash has been brutal for altcoins, with major tokens seeing double-digit losses:

Biggest altcoin losers:

- XRP (-10%) and Dogecoin (DOGE) (-10%) led the crash after Trump’s tariff announcement.

- Cardano (ADA) and Binance Coin (BNB) fell over 9%, extending the downtrend.

- Memecoin rallies are collapsing, with liquidity drying up in speculative assets.

- Bitcoin ETF outflows are further accelerating the decline.

Alex Krüger, a macroeconomist and crypto analyst, warned:

“Liquidity is vanishing from the altcoin sector, and with macro uncertainty increasing, we could see a longer period of pain before any meaningful recovery.”

Stock Market Weakness Adds to Crypto’s Decline

Despite strong earnings from Nvidia, broader market sentiment remains deeply bearish. The S&P 500 is struggling, and analysts fear that a prolonged U.S.-China trade war will further pressure both stocks and cryptocurrencies.

According to SignalPlus analysts, bullish Bitcoin traders are exiting the market, with a growing shift toward bearish put options—a sign that investors expect further downside.

What’s Next for Crypto?

With Bitcoin hovering around $80,000, traders are questioning whether the dip is nearing its bottom or if further declines are ahead. Analysts warn that high social sentiment and excessive dip-buying optimism could signal more downside before a true rebound. Key support levels and declining retail enthusiasm will be crucial indicators to watch, as institutional investors may wait for weaker hands to exit before stepping in.

Crypto strategist Rekt Capital stated:

“Until Bitcoin reclaims key support levels, the risk of further downside remains high. Traders should watch for volume confirmation before assuming a reversal.”

Conclusion: Is This the Start of a Prolonged Crypto Bear Market?

The crypto market downturn has been swift and severe, with Bitcoin, Ethereum, and major altcoins facing heavy losses. The $800 billion wipeout since January highlights how deeply macroeconomic uncertainty and geopolitical risks are affecting digital assets. Trump’s tariff shock has triggered widespread panic, reinforcing the idea that Bitcoin is no longer a pure hedge against uncertainty but is instead moving in sync with traditional markets. The sharp decline in altcoins and memecoins further signals a flight to safety, with liquidity drying up across speculative assets.

Looking ahead, the $80,000 support level for Bitcoin is crucial—a breakdown could trigger even greater losses, while a bounce could restore confidence. Ethereum’s weakness, combined with the broader market sell-off, suggests that caution is still warranted. Until global economic conditions stabilize and investor sentiment improves, the risk of an extended crypto bear market remains high. Traders should watch for shifting market trends before making their next move.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why is the crypto market crashing?

The crypto crash is primarily driven by Donald Trump’s new tariffs on China, which have sparked fears of a global economic slowdown.

2. Will Bitcoin drop further after hitting $78K?

Analysts warn that if BTC loses support at $78K, it could see further downside, with liquidity concerns adding to selling pressure.

3. Is Ethereum in a bear market?

Ethereum has erased all post-election gains and is down nearly 50% from its highs, suggesting that a new bear market may be underway.

4. What should traders watch next?

Investors should monitor Bitcoin’s price action, altcoin performance, and global economic conditions, as these factors will influence the next market move.

Glossary

Market Capitalization: The total value of all cryptocurrencies combined.

Liquidity: The ease with which an asset can be bought or sold without affecting its price.

Correlation: A measure of how two assets move in relation to each other (0 = no correlation, 1 = perfect correlation).

Put Options: A financial contract allowing traders to bet on an asset’s price decline.

Bear Market: A prolonged period of falling asset prices.

References