Bitcoin miners’ “market influence” pales in comparison to the ETFs and exchanges when it comes to BTC price pressure, says Glassnode. Bitcoin miners have increasingly little impact on BTC price action during sell-offs, new research confirms. In the latest edition of its weekly newsletter, “The Week Onchain,” analytics firm Glassnode dispelled myths over Bitcoin miners driving markets lower.

Bitcoin Exchanges, ETFs Dwarf Miners’ Market Influence

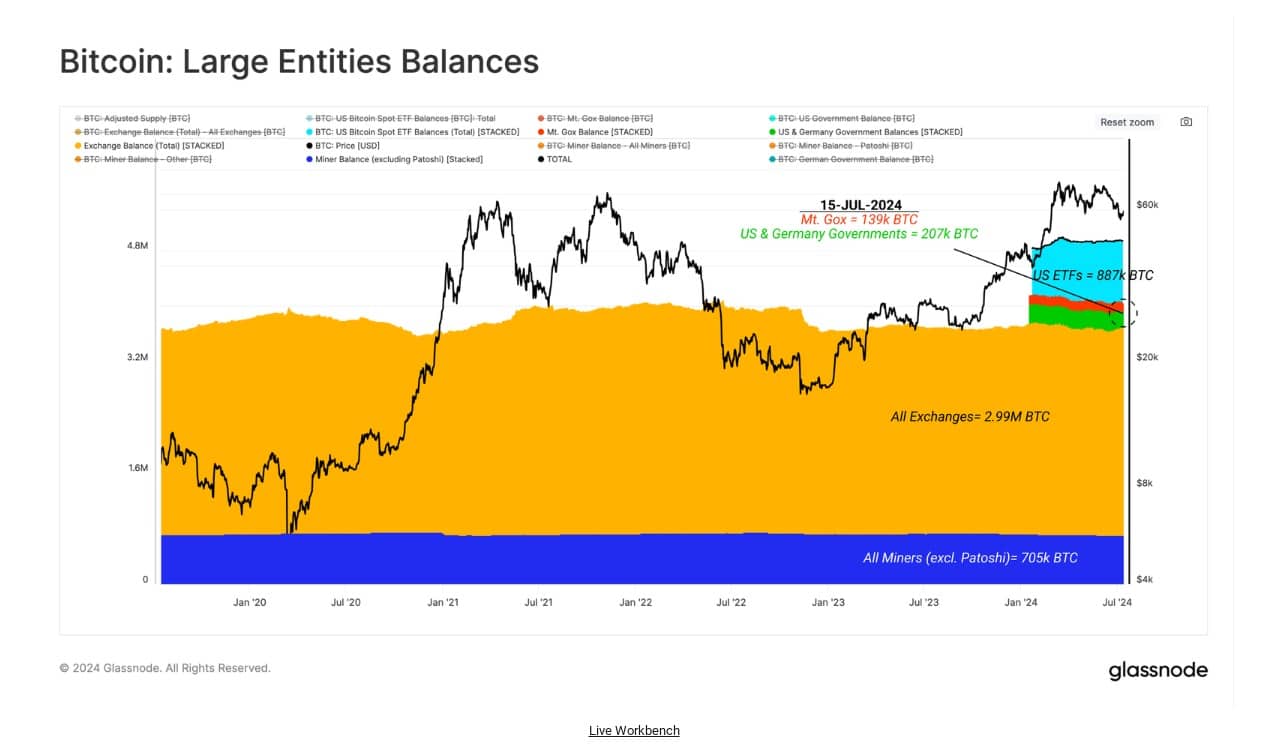

Bitcoin miners may have seen tough times since the latest block subsidy halving cut the block reward by 50%, but they should be the least of bulls’ concerns. Analyzing the largest investor entities, Glassnode shows that it is in fact centralized exchanges and the United States spot Bitcoin exchange-traded funds (ETFs) that hold the most sway over BTC price movement.

According to Glassnode, exchanges still hold over 3 million BTC as of July 2024, while the ETFs have 887,000 BTC in assets under management. By contrast, known miner-affiliated wallets hold around 705,000 BTC.

“Through history, large coin holdings have ended up custodied by market agnostic entities, such as the Mt.Gox trustee, tasked with holding the coins recovered after the collapse and bankruptcy of the Mt.Gox exchange. Similarly, significant coin volumes have been seized by government law enforcement, which are periodically sold off in tranches,” Glassnode explained.

“More recently, institutional grade custodians and ETFs have entered the picture. The suite of 11 new US spot ETFs have now accrued a combined +887K BTC, making their combined balance the second largest pool of Bitcoin that we monitor,” officials say.

On a week-by-week basis, Glassnode shows miner balances shifting up and down by around 500 BTC. This is a fraction of the balance changes of both exchanges and the ETFs.

ETF Dominance in BTC Price Influence

“Miners have historically been a primary source of sell-side pressure; however, their supply relevance does decrease with each halving event,” “The Week Onchain” continued. Exchange and ETF balances can change by around 4,000 BTC each week, suggesting flows through these entities are likely to have a market influence of around 4x to 8x larger than for miners. The recent selling by the German government provided another competitor to miners. While “tremendous,” onchain data suggests that markets priced in Germany’s multi-billion-dollar distribution in advance.

“The Bitcoin market absorbed a significant 48k BTC across the last month as the German Government achieved a full distribution of their balance sheet,” Glassnode concluded.

“This complete exhaustion of the German Government sell-side pressure has provided the market with ample relief, whilst initial glimmers of a renewed demand-side have stimulated positive price action.”

Future Prospects for Bitcoin Miners

Meanwhile, the future may already be looking up for miners themselves. As Cointelegraph reported, hashrate has attempted to spike to all-time highs over the past week, and Bitcoin’s hash ribbons indicator suggests that profitability conditions are slowly improving.

The indicator, which measures 60-day and 30-day rolling hashrate, nonetheless shows that a miner “capitulation” phase is ongoing. “The faster moving average is growing again and will soon surpass the slower one. This means that the total hash rate, which is correlated with the price, has started to grow again,” onchain data platform Bitcoin is Data told followers on X on July 15.

Conclusion

The findings from Glassnode emphasize the significant BTC price influence exerted by ETFs and exchanges compared to Bitcoin miners. While miners’ market influence has historically been notable, the increasing dominance of ETFs in the BTC market dynamics is reshaping the landscape. As BTC price influence shifts towards these institutional players, understanding their market behaviour becomes crucial for investors navigating the volatile crypto market.

According to reports, this shift in BTC price influence underscores the evolving nature of Bitcoin’s market structure, where institutional entities like ETFs are now central to price movements. Based on the data, it is clear that the BTC price influence of miners is diminishing, giving way to the more substantial impact of exchanges and ETFs. This changing dynamic highlights the importance of monitoring these large entities to gauge future BTC price trends effectively. The BIT Journal has more crypto breaking news.