In the world of Bitcoin (BTC), large investors, known as “whales,” are making significant moves. Recently, there’s been a notable increase in BTC whales accumulation, which has caught the attention of both industry experts and enthusiasts.

Increased Whale Activity

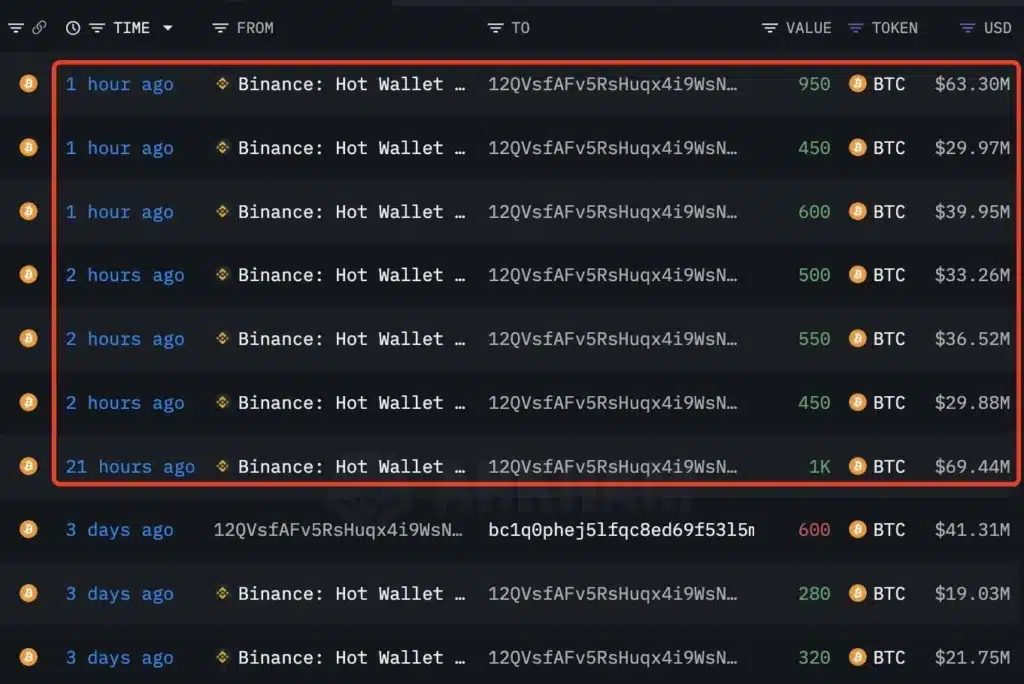

A whale identified as ’12QVsf’ recently withdrew a staggering 4,500 BTC, worth $302 million, from Binance within just 22 hours. This substantial withdrawal is just the beginning. In addition, three wallets, possibly linked to the same whale, pulled out a total of 1,400 BTC, valued at $94 million, from Bitfinex today. These wallets also made a notable move on June 20, withdrawing 2,510 BTC, equivalent to $163 million, from Bitfinex.

The volume of these transactions has sparked significant interest within the cryptocurrency community, as it marks a considerable shift in holdings by major market players. Analysts and traders are closely monitoring this BTC whales accumulation.

Record-Breaking Accumulation Levels

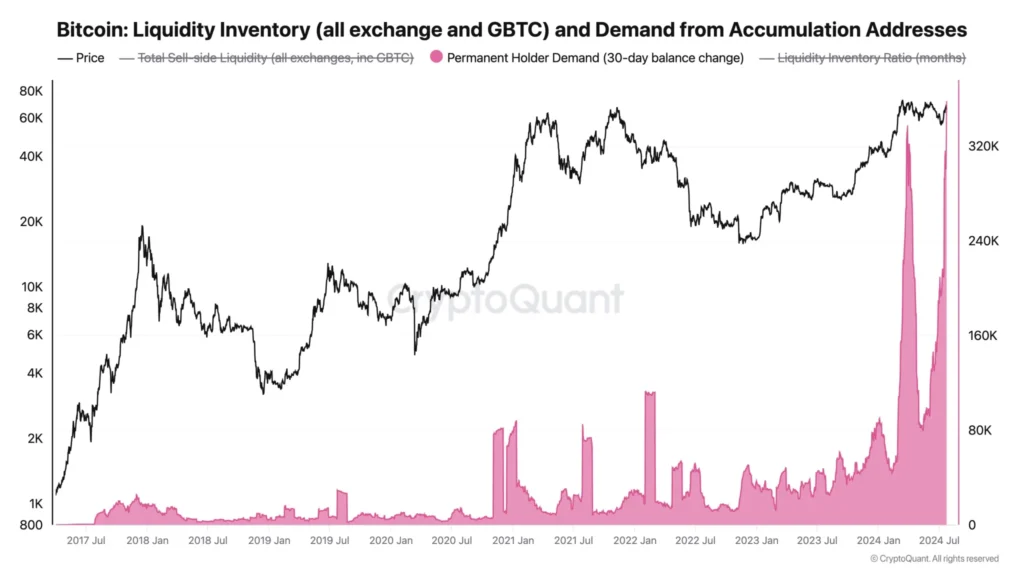

Ki Young Ju, CEO of CryptoQuant, shared his insights on social media, highlighting that Bitcoin is currently in a major accumulation phase. In the past month alone, a massive 358,000 BTC has been moved to permanent holder addresses.

Ju also noted that global spot exchange-traded fund (ETF) inflows in July were only 53,000 BTC. He explained, “Though not all remaining BTC is in custody wallets, whales are clearly accumulating. And it’s an unprecedented level. The recent Bitcoin inflows to permanent holder addresses are not due to ETF wallets. These wallets are neither exchange nor miner wallets and have no outflows; they are mostly custodial wallets.”

This observation emphasizes the scale of BTC whales accumulation, as these permanent holder addresses show no signs of outflows, indicating that these whales are holding onto their Bitcoin for the long term.

Decoding Accumulation and Distribution Patterns

To better understand these market dynamics, Ju explained the signs of a transition between accumulation and distribution phases. He said, “To gauge retail distribution on-chain, I use indicators capturing the increase in realized cap within a month. If there are low inflows to accumulation addresses and a high realized cap for under a month, driven by retail activities like deposits to exchanges, I would say it’s a distributive environment.”

The realized cap metric, which records the price of each Bitcoin when it last moved, is crucial for understanding whether the market is in an accumulation phase dominated by whales or a distribution phase with more retail investor activity.

BTC Whales Accumulation: Market Impact and Future Projections

In light of the fact that Bitcoin is presently trading at $65,720, the continued BTC whale accumulation has huge ramifications for the market. The acts of these significant investors have the potential to influence price movements and the sentiment of the global market. Whales are investors who often hold onto their assets for extended periods, allowing them to reduce the quantity of Bitcoin in the market. When whales accumulate Bitcoin, it is often a sign that the market is optimistic.

On the other hand, if these huge investors make the decision to sell, it can result in significant price decreases and instability in the market. As a result, having a firm grasp on these Bitcoin whales’ actions is essential to a comprehensive understanding of various market movements.

Last but not least, the recent buildup of Bitcoin whales sheds light on the strategic actions that large investors in the Bitcoin market have been engaging in. It is clear that these huge investors are making preparations for the future, as evidenced by the significant outflows of funds from important exchanges and the transfer of substantial assets to permanent addresses. The bitcoin market is always evolving, and the activities of these significant players provide vital insights into potential future trends. This is something that has persisted throughout the years.