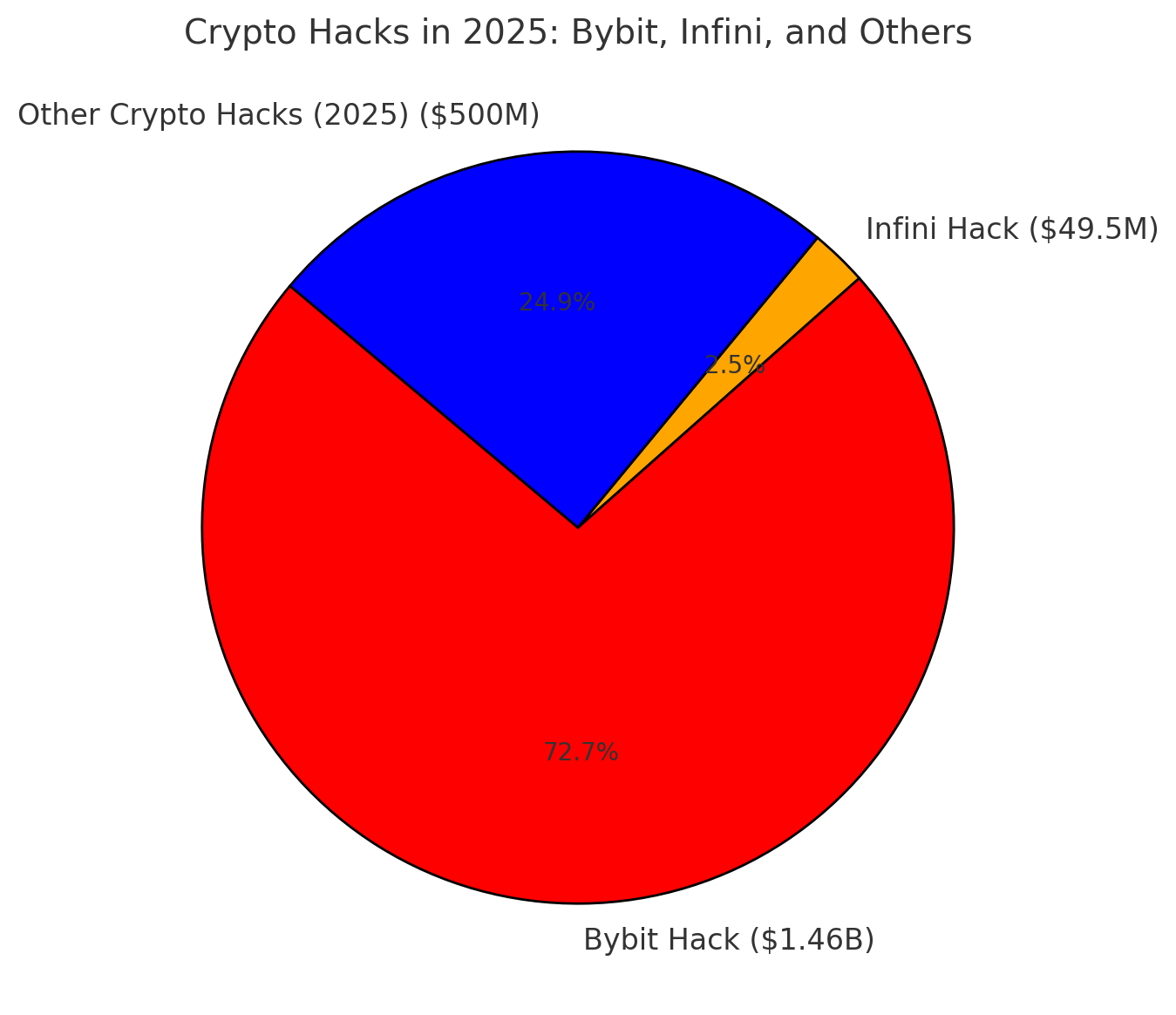

According to the source in a security breach, stablecoin bank Infini suffered a loss of approximately $49.5 million in USDC on February 24, 2025. This incident closely follows a massive $1.46 billion hack of the Bybit exchange, raising serious concerns about the security protocols within the cryptocurrency sector.

Details of the Infini Hack

The attack on Infini was orchestrated by a former developer who retained unauthorized administrative access to the platform’s smart contract. Over 100 days post-deployment, the perpetrator utilized the Tornado Cash mixer to obscure their identity, funded their address with a small amount of ETH for gas fees, and exploited the contract to drain all available funds. The stolen $49.5 million USDC was swiftly converted into 17,696 ETH and transferred to a new wallet address.

Founder’s Response and Assurance

In the aftermath, Infini’s founder, Christian Li, took full responsibility for the oversight in transferring contract authority. He assured users that the platform remains liquid and capable of fully compensating all affected parties. Li stated,

“There is no problem with liquidity. Full compensation can be paid, and the funds are being traced.”

He also mentioned that the suspected hacker’s computer had been identified and reported to law enforcement agencies.

Industry-Wide Implications

This breach underscores the vulnerabilities present in decentralized finance (DeFi) platforms, especially concerning insider threats and the critical importance of stringent administrative controls. The Infini hack, occurring just days after the Bybit incident, has intensified discussions about the need for robust security measures and comprehensive audits within the crypto industry.

Bybit’s Security Breach

On February 21, 2025, Bybit, a prominent cryptocurrency exchange, experienced a catastrophic security failure resulting in the theft of approximately $1.46 billion in various tokens, predominantly Ethereum and staked Ethereum. The attackers exploited a vulnerability in Bybit’s Ethereum cold wallet system during a routine transfer to a warm wallet. Bybit’s CEO, Ben Zhou, confirmed the breach, stating that the hacker manipulated the user interface and employed social engineering tactics to deceive the platform’s security protocols.

Market Repercussions

The magnitude of these hacks has sent shockwaves throughout the cryptocurrency market. Following the Bybit breach, the exchange witnessed an outflow exceeding $6.7 billion as users rushed to withdraw their assets amidst security concerns. Similarly, the Infini hack has prompted users to reassess the security measures of DeFi platforms, leading to increased scrutiny and calls for enhanced protective mechanisms.

Preventative Measures and Future Outlook

These incidents highlight the pressing need for the cryptocurrency industry to adopt more rigorous security frameworks. Implementing multi-signature authentication, conducting regular security audits, and ensuring proper transfer of administrative privileges are essential steps to safeguard user assets. As the industry evolves, fostering a culture of transparency and accountability will be pivotal in restoring and maintaining investor confidence.

In conclusion, the recent security breaches at Infini and Bybit serve as stark reminders of the vulnerabilities inherent in the rapidly growing cryptocurrency landscape. Proactive measures, coupled with industry-wide collaboration, are imperative to fortify platforms against such malicious activities and to protect the interests of all stakeholders involved.

FAQs

1. What happened to Infini Stablecoin Bank?

Infini Stablecoin Bank was hacked for $49.5 million in USDC due to an insider exploit, where a former developer retained unauthorized admin access.

2. How was Infini’s stablecoin reserve stolen?

The hacker manipulated Infini’s smart contract, drained funds, converted USDC to 17,696 ETH, and transferred it to a new wallet.

3. How does the Infini hack relate to the Bybit $1.46 billion breach?

The Bybit hack occurred just days before Infini’s attack, highlighting major security flaws in centralized and DeFi platforms.

4. What security measures can prevent such crypto hacks?

Platforms need multi-signature authentication, strict admin access controls, and regular security audits to prevent unauthorized exploits.

5. What should crypto investors do to protect their funds?

Investors should use hardware wallets, enable two-factor authentication (2FA), and withdraw funds from vulnerable platforms if security risks arise.

Glossary of Key Terms

Stablecoin – A cryptocurrency pegged to a stable asset (e.g., USDC pegged to USD) to reduce volatility.

Smart Contract – A self-executing contract with preset conditions on the blockchain, often used in DeFi applications.

Insider Exploit – A security breach caused by someone with prior internal access, as seen in the Infini hack.

Cold Wallet – An offline crypto storage method that reduces the risk of hacks.

Tornado Cash – A privacy tool used to obscure blockchain transactions, often linked to laundering stolen crypto.

Multi-Signature Authentication – A security process requiring multiple private keys to approve transactions, reducing single-point failures.

Liquidity – The ease with which assets can be bought or sold without significantly affecting price.

Ethereum (ETH) – The second-largest cryptocurrency, often used in DeFi applications and smart contracts.

DeFi (Decentralized Finance) – Blockchain-based financial services without centralized intermediaries, but vulnerable to smart contract exploits.

Security Audit – A review of a platform’s smart contracts and security infrastructure to identify vulnerabilities.