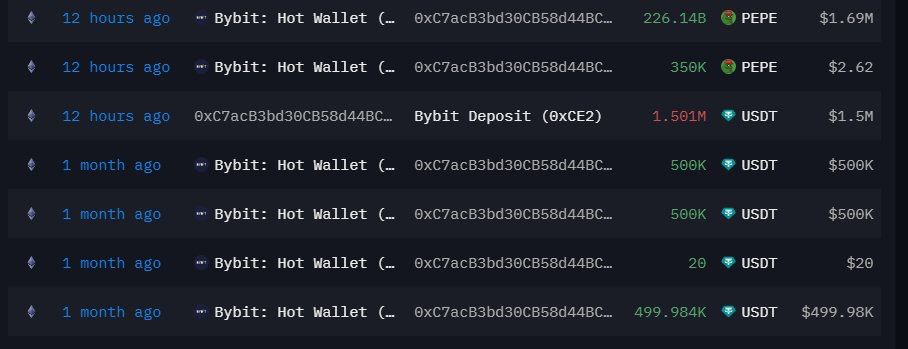

Blockchain data has revealed that Bybit, one of the leading cryptocurrency exchanges, has been quietly accumulating PEPE through undisclosed wallets, prompting speculation about the meme coin’s future trajectory. Analysts tracking on-chain activity have noticed significant purchases made over the past month, suggesting that the current price levels could be important for PEPE’s next move.

According to reports, Bybit’s accumulation began when a hidden wallet associated with the exchange received a $1 million USDT deposit, which was subsequently used to acquire large amounts of PEPE. Further analysis indicates that additional wallets have followed a similar pattern, reinforcing the theory that institutional buyers may be positioning for a potential market shift. This accumulation trend has been interpreted as a signal of prospective price expansion, mirroring historical patterns where large-scale buying activity preceded a surge in PEPE’s value.

Liquidity Sweep and Market Implications

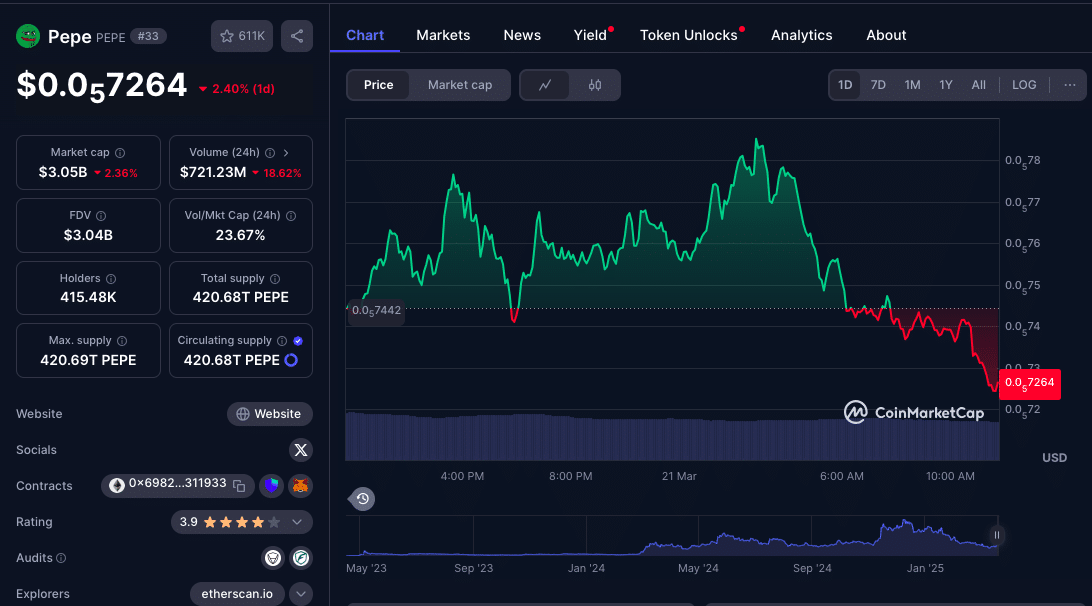

PEPE’s price has recently exhibited key signals of a potential reversal. After a prolonged downtrend, the token experienced a liquidity sweep at $0.00000589, marking a temporary low. This event triggered a 10-day uptrend, pushing PEPE’s price to $0.00000758. However, as at the time of this writing, PEPE price stands at $0.000007264.

A liquidity sweep occurs when the market clears out sell orders at a certain level before shifting direction. This process often precedes major price movements, as weak hands exit while strong buyers step in. The fact that Bybit’s accumulation aligns with this liquidity event suggests that the exchange, or the investors behind these wallets, may be anticipating an uptrend.

Technical indicators suggest that PEPE could see further upside if bullish sentiment persists. The Moving Average Convergence Divergence (MACD) line has crossed above the Signal line, indicating strong positive momentum. Additionally, a widening histogram suggests growing buying pressure, which historically aligns with continued upward movement.

Analysts have identified key resistance levels at $0.00000850 and $0.00001000. A breakout above these points could reinforce the bullish narrative, potentially propelling PEPE toward long-term buy-side liquidity levels at $0.00002834. However, failure to sustain gains above the $0.00000700 mark could lead to a retracement, with potential downside targets at $0.00000670 and $0.00000589. A breach of these levels might invalidate the bullish reversal hypothesis, leading to a renewed bearish outlook.

Holder Profitability and Market Sentiment in Focus

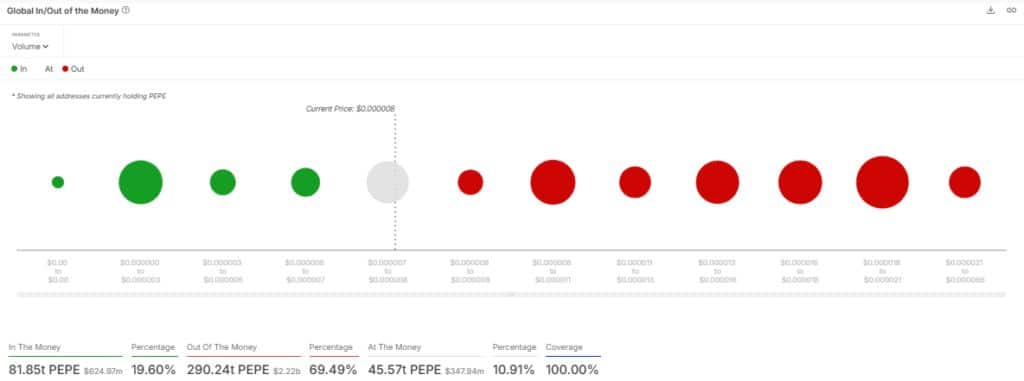

The profitability of PEPE holders has become a crucial factor in determining future price action. On-chain data indicates that approximately 81.85% of investors are currently in profit, while 19.60% are at break-even. A relatively small portion of holders, around 69.49%, remain at a loss, suggesting that most participants are seeing gains.

This composition of holders has contributed to a broadly positive market sentiment. Investors classified as ‘In The Money’ typically reinforce support levels by holding onto their assets, while those categorized as ‘Out of The Money’ may seek to sell if prices drop further. The balance between these two groups will likely play a significant role in shaping PEPE’s short-term price action.

Market Outlook: Is a PEPE Rally on the Horizon?

Bybit’s continued accumulation of PEPE, coupled with bullish technical signals and strong holder profitability, suggests the possibility of further price appreciation. If PEPE maintains support above key trendlines while breaking through resistance levels, the token could experience a notable rally. However, market participants should remain cautious, as a failure to hold above critical support zones could result in a bearish reversal.

The meme coin sector has always been volatile, with large-scale whale activity often influencing price swings. Bybit’s undisclosed PEPE purchases add another layer of intrigue to the evolving narrative, leaving investors to watch closely for further signals of institutional intent. As liquidity shifts and technical indicators develop, the coming weeks may determine whether PEPE embarks on its next major breakout or faces renewed downward pressure.

Wrapping Up

Bybit’s undisclosed accumulation of PEPE adds an intriguing layer to the meme coin’s market outlook. The strategic buying pattern aligns with key liquidity events and bullish technical indicators, reinforcing the possibility of a sustained upward move.

If PEPE can maintain support above crucial levels and break through $0.00000850 and $0.00001000, a more significant rally could unfold. However, a failure to hold above $0.00000700 might lead to further corrections, challenging the bullish thesis.

With on-chain data, institutional accumulation, and liquidity trends all playing a role, PEPE’s next moves could set the stage for either a breakout or a deeper retracement. Investors should watch for further wallet activity and resistance tests to gauge the meme coin’s trajectory.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

Why is Bybit’s accumulation of PEPE important?

Bybit’s undisclosed purchases suggest that institutional buyers might be positioning for a major market movement, potentially indicating a price reversal.

What does a liquidity sweep mean for PEPE?

A liquidity sweep occurs when sell-side orders are cleared out, often before a price reversal. The recent sweep at $0.00000589 led to a strong rebound, reinforcing bullish sentiment.

What are PEPE’s key resistance and support levels?

Resistance: $0.00000850 and $0.00001000; Support: $0.00000670 and $0.00000589. A breakdown below these could invalidate the bullish outlook.

How does the MACD indicator support PEPE’s bullish case?

The MACD line crossing above the Signal line indicates strong buying momentum, while histogram expansion suggests further upside potential.

Could PEPE reach new highs soon?

If bullish momentum continues and PEPE breaks key resistance levels, a larger rally could occur. However, failure to maintain support may lead to a price correction.

Glossary

Liquidity Sweep: A market event where sell or buy orders are cleared out, often before a reversal occurs.

MACD (Moving Average Convergence Divergence): A technical indicator used to measure market momentum and trend direction.

Buy-Side Liquidity: A price level where large buy orders exist, often acting as strong support zones.

Resistance Level: A price point where selling pressure increases, making it difficult for the asset to move higher.

Institutional Accumulation: A gradual buying strategy by large investors, often done through hidden wallets to avoid market impact.