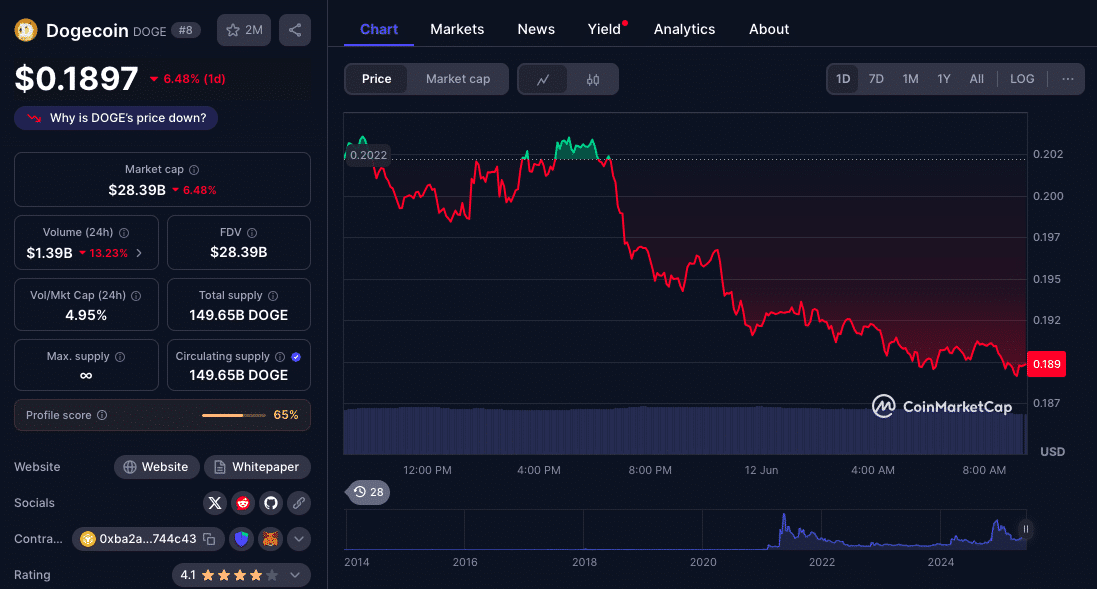

Dogecoin rallied more than 6% after Elon Musk’s surprise statement aimed at mending ties with Donald Trump. Following the Musk-Trump truce, market data reports that the trading volume jumped by over 800%. Prices breached the critical $0.19 resistance level and briefly hit $0.20 before correcting slightly.

Musk’s influence on Dogecoin’s price is nothing new, but this time his words seem to carry more weight. A political reconciliation with Trump who according to sources had previously threatened to pull federal contracts from SpaceX, reduces systemic risk around Musk’s ventures and renews confidence among meme coin investors who have historically treated Musk’s statements as catalysts.

But beyond the noise, will Dogecoin hold above $0.20, or is this just another short-lived spike driven by sentiment?

Musk-Trump Truce Sends Volumes Soaring, But Underlying Momentum Matters

Elon Musk’s statement admitting he had “gone too far” in recent criticisms of Donald Trump is a rare public reversal and the market responded. On-chain and off-chain data immediately reflected this. DOGE trading volumes surged to $1.65 billion, up 827% from the previous day, according to CoinMarketCap data. This wasn’t just algorithmic volatility. This was retail and institutional interest converging.

The breakout from the $0.19 resistance level also aligned with technical signals that hinted at a reversal. The 50-day EMA sat at $0.1933 and Dogecoin closed slightly above it.

But momentum indicators are mixed. The RSI is at 48 which is neutral and there’s still room for buyers to push upward. The ADX (Average Directional Index) is at 21 meaning bearish momentum is fading but the new uptrend is still in its early stages.

Institutional Optimism: DOGE ETF Approval Odds Now at 80%

Perhaps more important than Musk’s apology is the growing belief that Dogecoin could be the next crypto asset to get an ETF. Bloomberg analyst Eric Balchunas and his team have now put Dogecoin’s spot ETF approval odds at 80%, higher than Polkadot (75%) and Cardano (also 75%).

This is a big deal for Dogecoin which has long been seen as “just a meme coin”. While its roots are firmly in internet culture, the availability of CFTC regulated DOGE futures has given it institutional credibility. If approved, a DOGE ETF would open the floodgates for pension funds, hedge funds and other institutions to get exposure to the asset through traditional brokerage channels.

Dogecoin Chart Analysis: Breakout or Bull Trap?

From a technical standpoint, Dogecoin is on the verge of a breakout but there is still resistance ahead. Immediate resistance is at $0.214 which is the next test for the bulls. If that level is cleared with conviction, price could enter a new bullish structure and head towards $0.25 again. Currently, it’s trading at $0.1897 due to broader market consolidation.

More long term bullish signs are emerging. A golden cross (50-day moving average above 200-day) is still in play. Although the gap between the two averages stopped narrowing on May 30th, it suggests if current momentum continues a multi week bullish trend could be confirmed in the next few days.

On the flip side, if DOGE can’t hold above $0.193-$0.195, then support at $0.186 becomes critical. A break below that would confirm this as a sentiment rally not a structural reversal.

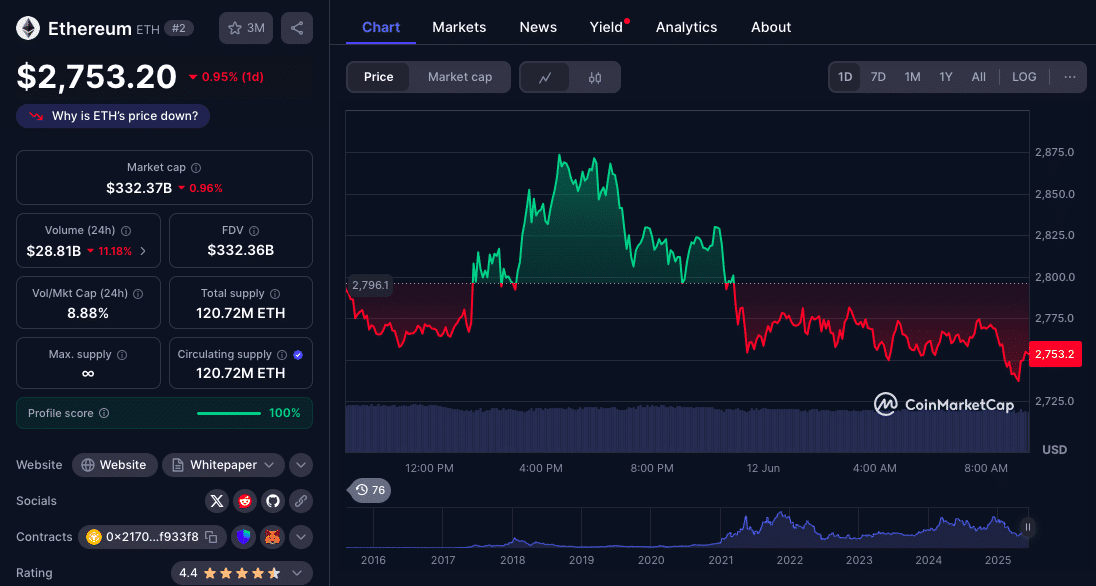

Ethereum Rides the Same Wave But Deeper

While Dogecoin stole the headlines, Ethereum quietly gained 2.3% and touched $2,880 before settling at $2,819. Currently, it’s trading at $2,753 due to broader market consolidation. Unlike DOGE, Ethereum’s rally is rooted in fundamental strength with $125 million in ETF inflows in the last 24 hours.

This influx of capital is partly in response to increasing political pressure on the SEC to clarify Ethereum’s status. The bipartisan CLARITY Act which would formally define ETH as a commodity under CFTC oversight is about to be voted on in Congress. This would eliminate the long standing legal uncertainty and clear the path for more regulated institutional products.

Technical charts confirm the strength of this move. ETH is above both its 10-day ($2,472) and 50-day ($2,395) EMAs a strong sign the market sees long term upside. RSI is at 68 approaching overbought but still has room to move up. ADX is 24 which means current bullish momentum is gaining strength.

Caution Signs: Day Trader Fatigue and Network Competition

Despite the price action, both Dogecoin and Ethereum have headwinds that could limit further gains in the short term. For Dogecoin, it’s all sentiment. If ETF approval doesn’t happen or the political narrative changes again Dogecoin could reverse just as quickly. Also technical indicators like the low ADX suggest this rally has no conviction.

Ethereum while stronger in fundamentals is facing competition from Solana’s ecosystem which now processes 5x the daily transactions of ETH. That threatens Ethereum’s dominance in the narrative around scalability and speed, even as it maintains its lead in stablecoin volume ($908 billion vs Solana’s $18 billion).

Sentiment Tailwinds: Fear & Greed Index Hits 72

The overall crypto sentiment is very much risk-on. The Crypto Fear & Greed Index is at 72, in “greed” territory, up from 57 last week. That’s good for speculative assets like Dogecoin and high-beta majors like Ethereum.

In fact, the meme coin sector is outperforming. The SPX6900 token is up 80% in the last 30 days and even Trump-themed meme tokens are back in vogue this week.

While speculative rotations are normal in crypto, the alignment of sentiment, news catalysts and technical breakout zones makes this current move more interesting than previous pumps.

Can DOGE and ETH hold?

Dogecoin’s move above $0.19 was driven by Musk’s political détente and ETF speculation. But can it hold above $0.20 and break $0.214? That depends on momentum, ETF news and retail enthusiasm.

Ethereum is looking more fundamentally based, with ETF inflows, regulatory clarity and technicals all in its favor. Next test could be $2,900, with support at $2,600-$2,400.

For now, both DOGE and ETH look good short term but investors should stay alert. Volatility is high and confirmation of trends, especially for DOGE, is not yet guaranteed.

FAQs

Why did Dogecoin go up?

Musk-Trump truce and fresh ETF optimism pushed trading volume up 827%.

Is the Dogecoin ETF going to get approved?

According to Bloomberg analyst Eric Balchunas, DOGE now has an 80% chance of ETF approval, higher than Cardano and Polkadot.

What levels should I watch for DOGE?

Resistance is at $0.214. If that breaks $0.25 may be next. Support is at $0.186

Why is Ethereum up?

Ethereum rose after $125 million flowed into ETH ETFs and the CLARITY Act gained momentum in Congress.

Glossary

Golden Cross: A bullish technical indicator where the 50-day moving average crosses above the 200-day.

Doji: A candlestick pattern of indecision often after a big move.

ADX (Average Directional Index): Measures trend strength. Below 20 = weak trend; above 25 = strong trend.

CFTC-Regulated Futures: Derivatives overseen by the U.S. Commodity Futures Trading Commission, making an asset more legitimate.

CLARITY Act: A proposed U.S. law to define digital assets’ regulatory classification especially around SEC vs. CFTC jurisdiction.