The recent Dogecoin price action has created a wave of speculation as bullish forces mount against a backdrop of declining on-chain engagement. With $DOGE rebounding off critical support levels and pushing toward the $0.19 resistance, questions abound: Will renewed whale interest and surging derivatives activity be enough to overcome weak network fundamentals? Or is this just another short-lived rally in a broader consolidation?

Derivatives Explosion Fuels DOGE Momentum Toward $0.19

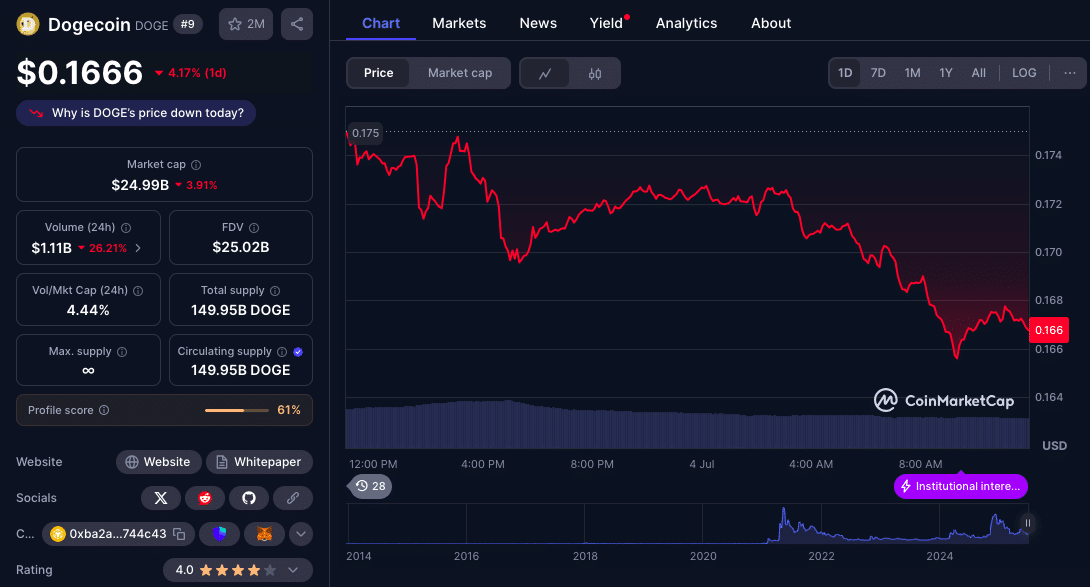

Dogecoin price rallied strongly from the $0.13–$0.15 demand zone, signaling a renewed appetite from traders. Open Interest jumped nearly 16% in just 24 hours, reaching $2.09 billion, while Options volume skyrocketed by over 400%. These figures suggest speculative positions are being built aggressively, likely targeting a breakout above $0.19.

This renewed speculative frenzy coincides with bullish technical indicators. The Stochastic RSI has pushed above 80, reflecting strong upward momentum. However, a descending trendline near $0.19 continues to cap DOGE’s advance, acting as a dynamic resistance. A clean break and close above this level on high volume would validate the bullish narrative and potentially trigger a climb toward $0.26. Currently, DOGE trades at $0.1666.

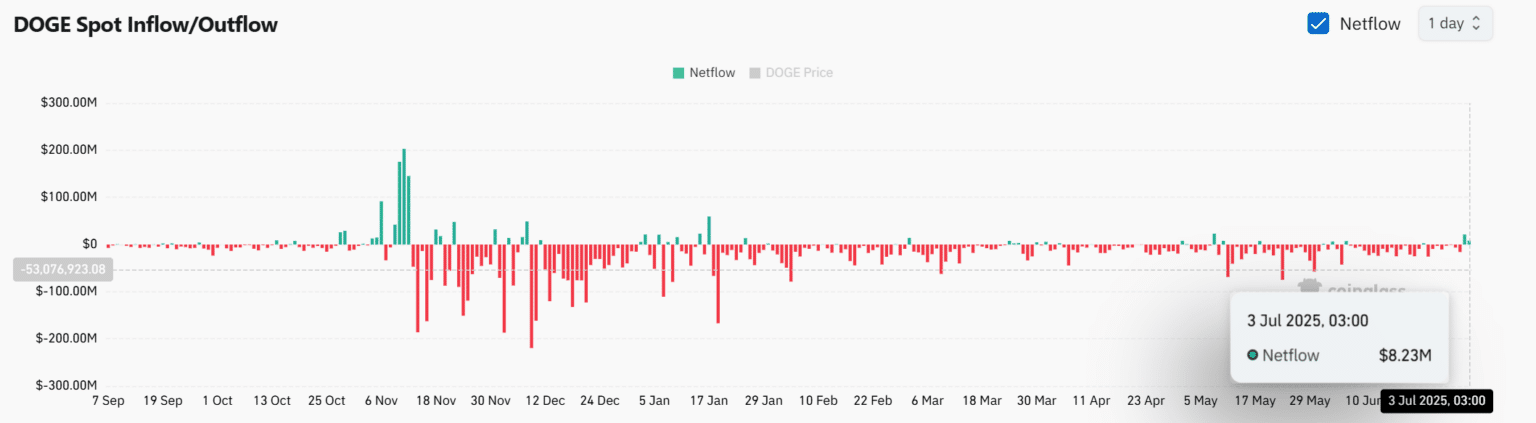

Whale Confidence Returns with $8.23 Million in Net Inflows

On-chain data shows Dogecoin recorded a net inflow of $8.23 million in recent days; an encouraging shift after weeks of persistent outflows.

Historically, positive whale netflows have aligned with bullish reversals or mid-term rallies. According to sources, Dogecoin’s previous surge toward $0.22 earlier this year was preceded by similar whale accumulation. If current inflows are sustained, they may serve as fuel to drive DOGE past $0.19 and further up toward the next psychological barrier of $0.26.

MVRV Z-Score Signals Undervaluation, But Still Room to Grow

Another piece of the puzzle comes from Dogecoin’s MVRV Z-score; a key metric that assesses market valuation relative to holder profitability. As of early July, the Z-score has climbed to 0.355 after scraping near-historic lows in late June. While still below the bullish threshold, this uptick hints that DOGE may be emerging from an undervalued zone.

The rising MVRV Z-score supports a bullish narrative, suggesting that the downside risk is diminishing. It also hints at renewed participation potential, as sidelined investors may reenter the market anticipating a reversal. However, it’s worth noting that MVRV is a lagging indicator. For this bullish momentum to hold water, price must first breach resistance levels, particularly the looming $0.19 barrier.

A Bullish Setup, But Weak Network Activity Clouds Outlook

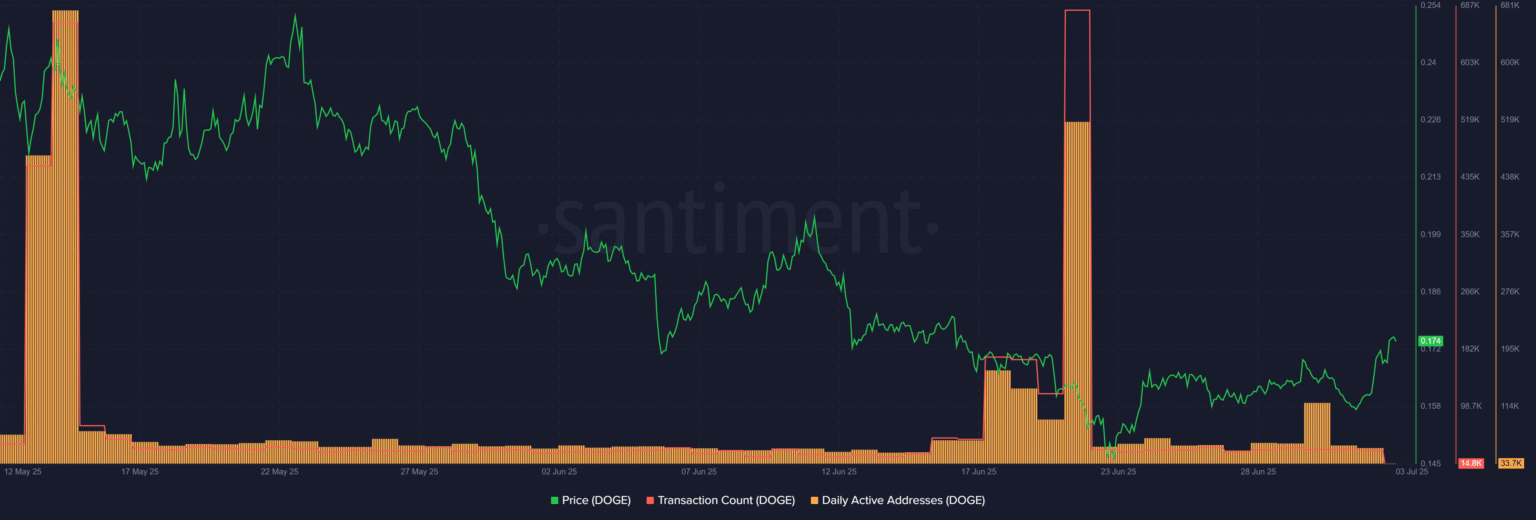

Despite technical strength and surging derivatives, Dogecoin’s fundamental activity paints a more cautious picture. Daily active addresses have slipped to just 33.7K, and daily transaction counts are down to 14.8K as of July 3. That’s a massive drop from the June 22 spike, where both metrics exceeded 500K during a meme-driven burst.

This drop-off implies that retail interest, the backbone of Dogecoin’s meme-powered rallies, is losing steam. And without robust on-chain engagement, rallies can lose momentum quickly.

However, there’s precedent for price-leading activity. Historically, Dogecoin price rallies have often triggered user engagement in hindsight. If DOGE can successfully break $0.19, network metrics may rebound accordingly.

Expert Forecasts and Technical Benchmarks

| Source / Analyst | Range | Target if Breakout | Commentary |

| “Erik” (The Market Periodical) | $0.143 to $0.150 support Resist at $0.1967 | $0.1967 then higher | “If Dogecoin successfully breaks this level…and sustains its position, a rally toward the $0.1967 resistance becomes more likely.” |

| DailyForex technical team | Consolidating at $0.189–$0.198 | $0.21–$0.25 | Bullish wedge and golden cross indicate momentum upside |

| ForexLive | Support around $0.194 to $0.195 | Target $0.20 to $0.2145, then $0.23–$0.26 | “If bulls maintain this level, DOGE might comfortably rally into the $0.20 territory.” |

| TradingView(longer term) | July avg. $0.25, high $0.39 | $0.39 by end-2025 | Hype on ETF and meme momentum |

| Ali Martinez | Mid-2025 average $0.141 | High near $0.162 | Reflects evolving sentiment; “model forecasts a 29.04% return” |

Conclusion: Will DOGE Breach $0.19?

At the current juncture, Dogecoin price sits at the intersection of bullish technical momentum and weak fundamental support. Rising Open Interest, whale accumulation, and an improving MVRV Z-score all point to a market-leaning bullish. But low usage metrics act as a red flag, suggesting the rally may be running on fumes unless broader participation kicks in.

The $0.19 resistance level remains the deciding factor. If bulls can push past this descending trendline and confirm the move with strong volume, the stage may be set for a run toward $0.26. However, rejection here would likely send DOGE back to its familiar $0.13–$0.15 base, where buyers may once again regroup. In short, Dogecoin stands at a make-or-break moment.

Summary

Dogecoin price has rebounded from key support amid rising whale inflows and a surge in derivatives activity, targeting the $0.19 resistance. Open Interest is up 15.78%, while Options volume has spiked over 400%, signaling bullish trader sentiment. The MVRV Z-score has improved, suggesting diminishing downside risk. However, network activity is weakening, with daily addresses and transactions dropping sharply. If DOGE breaks $0.19, a move toward $0.26 might be possible.

FAQs

What is the current Dogecoin price trend?

Dogecoin has rebounded from the $0.13–$0.15 zone and is attempting to break the $0.19 resistance, supported by rising derivatives activity and whale inflows.

Why is $0.19 an important level for DOGE?

$0.19 serves as dynamic resistance. A breakout above this level could signal the start of a broader rally, potentially pushing price toward $0.26.

What do derivatives metrics say about Dogecoin’s outlook?

A 15.78% rise in Open Interest and a 402% jump in Options volume indicate that traders are positioning for further upside.

Is network activity supporting the rally?

Not currently. Dogecoin’s daily active addresses and transactions have dropped, raising concerns about retail participation.

Glossary

Open Interest – The total value of outstanding futures or options contracts that haven’t been settled.

MVRV Z-score – A metric used to assess whether an asset is over or undervalued based on the difference between market value and realized value.

Stochastic RSI – A technical indicator combining the Relative Strength Index and stochastic oscillator to assess momentum.

Whale Activity – Actions taken by large holders of a cryptocurrency, often indicative of smart money behavior.

Derivatives Volume – The trading volume of financial instruments like futures or options based on the underlying crypto asset.

Sources