Hedera’s native cryptocurrency, HBAR, has recently grabbed attention with a significant price jump. Some analysts believe it could gain another 22%, potentially revisiting its all-time high (ATH) of $0.465. Yet, multiple indicators—from exchange outflows to trader sentiment—highlight a clear split: long-term holders expecting more upside versus short-term traders staying wary.

Market Overview

Cryptocurrency markets, overall, have been showing signs of recovery, sparking optimism among investors. HBAR, in particular, has enjoyed an impressive upward trajectory, gaining more than 8% in the last 24 hours and climbing to around $0.364 at press time. With trading volume up by approximately 60%, the token’s momentum has turned heads throughout the crypto space.

Despite this encouraging movement, questions linger as to whether this altcoin can maintain its pace and break through the crucial resistance point near $0.378. If the asset succeeds, some analysts see a clear path for HBAR to test its ATH of $0.465. Failure to do so could mean prolonged consolidation or a pullback, especially given the broader market’s susceptibility to sudden volatility.

$14 Million Outflow Signals Bullish Holders

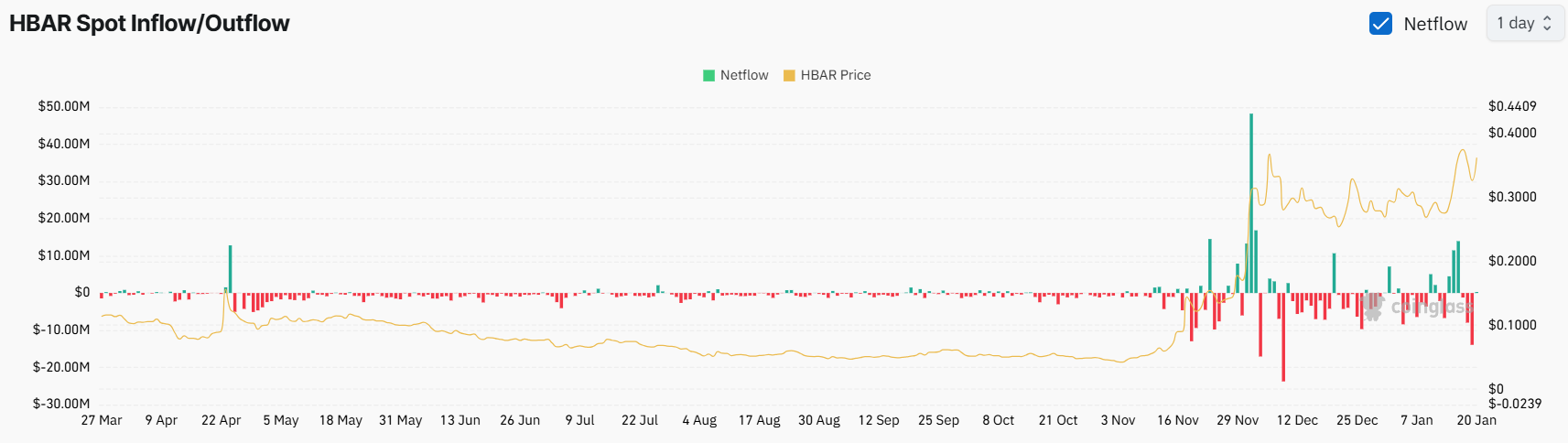

According to on-chain analytics firm Coinglass, “Exchanges have witnessed an outflow of $13.9 million worth of HBAR in the past 24 hours.”

This substantial outflow often implies that investors are moving their tokens off trading platforms and into personal wallets—a move commonly associated with more bullish, long-term positioning.

Such outflows can indicate increased confidence among this altcoin’s core investor base. Many of these participants may be held in anticipation of further gains. Indeed, when traders withdraw their tokens from exchanges, they reduce the available supply in the open market, potentially boosting upward price pressure.

Traders Lean Bearish Despite Long-Term Optimism

While long-term holders appear to be betting on a price ascent, the derivative data suggests a more cautious stance among short-term market participants. “HBAR’s Long/Short Ratio was 0.89 at press time,” Coinglass data shows, “indicating bearish sentiment among traders.”

A ratio below 1.0 means there are more short positions than long ones. Specifically, 53% of top traders hold short positions, while only 47.2% maintain long positions. This split highlights the contrasting views: investors who see HBAR as undervalued and ripe for growth versus traders who may be speculating on a near-term correction.

Technical Setup and Momentum

HBAR’s price structure has offered additional clues about its potential path forward. The token’s recent surge coincided with the successful retest of a bullish symmetrical triangle pattern on the daily chart. This kind of pattern often indicates an impending trend continuation once a breakout is confirmed.

Currently, the coin faces mild resistance around $0.378. However, the formation of a large green candle and a bullish engulfing pattern has bolstered the outlook for further upward movement. Technical analysts often view these signals as supportive evidence of increasing buying pressure.

Eyeing a 22% Rally

If HBAR decisively breaks above $0.378 and closes a daily candle beyond that threshold, some market watchers project it could rally by an additional 22%, eventually touching $0.465. Such a move would mark a significant milestone for Hedera, potentially reinforcing its position among large-cap digital assets and drawing in new waves of retail and institutional capital.

Still, it’s essential to consider that cryptocurrencies often experience sharp price corrections following strong rallies. Traders expecting a swift climb to $0.465 might be caught off-guard by sudden dips, particularly if broader market sentiment sours or macroeconomic factors shift unpredictably.

Conclusion

Hedera’s recent performance showcases both promise and caution. However, plenty of traders are betting against the altcoin, signaling some doubt about whether this rally can keep going. Even so, the token’s path toward $0.465 will likely depend on its ability to break past nearby resistance and stay strong in the face of potential sell-offs.

As with any cryptocurrency, investors must balance their excitement over high price targets with the realities of market volatility and shifting sentiment. Ultimately, whether HBAR can reclaim its all-time high—and maybe even push further—will depend on how bullish holders and cautious traders navigate these next few weeks.

Stay tuned to The BIT Journal and watch Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Frequently Asked Questions (FAQs)

Why is HBAR gaining attention?

It recently jumped in price and could rally another 22% toward its $0.465 ATH.

What’s the significance of the $14 million outflow from exchanges?

Investors moving HBAR off exchanges often signals bullish, long-term positioning.

Are traders optimistic or cautious?

Short-term traders lean bearish, with a Long/Short Ratio of 0.89 suggesting more shorts than longs.

Why is $0.378 a key resistance?

Clearing it could validate a symmetrical triangle breakout and open the door to further gains.

Can HBAR retest its $0.465 all-time high?

Analysts believe a strong breakout above $0.378 might fuel a 22% rally toward the ATH.

Should investors expect market volatility?

Yes; sudden shifts could cause pullbacks or extended consolidation periods.

How crucial is overall sentiment to HBAR’s rally?

Market optimism and reduced exchange supply can support higher prices, while cautious traders could trigger short-term dips.