Popcat (POPCAT) has been under the crypto spotlight after staging an impressive comeback from last month’s sharp downturn. Market watchers are asking whether the meme coin can sustain its upward momentum or if another pullback lies ahead. Recent data indicates that its price has climbed from a local low of $0.39 to as high as $0.63, leading many investors to believe that further gains might be in store. However, potential hurdles remain on the horizon.

Signs of Renewed Optimism

Just a few days ago, Popcat was trading around the $0.39 mark, reflecting a significant monthly dip of over 26%. This downward pressure had many traders feeling wary. Yet in the past three days, the coin has surged to around $0.63 before settling near $0.5762 at press time—an intraday increase of 4.67%. This price rebound has sparked renewed optimism, particularly among short-term traders hoping to see Popcat recapture its previous highs.

This shift in attitude is further backed by a notable change in Weighted Sentiment, which has turned positive for the first time in the last seven days. A positive Weighted Sentiment suggests that the broader market mood is leaning toward a bullish outlook. While meme coins are often prone to sudden price fluctuations, this uptick in sentiment points to a potential rally, provided buyers continue to show interest.

Technical Indicators Back the Bulls

According to an analysis, Popcat “seems to have hit a local bottom.” It indicates that the recent dip created an opportunity for new buyers to reenter the market, thereby boosting overall buying pressure. This influx of demand has strengthened the upward momentum, counteracting the lingering downtrend. The Relative Strength Index (RSI) is a sign of this momentum shift. A bullish crossover there means buyers now outweigh sellers, potentially driving prices higher.

The Stoch RSI also shows a bullish crossover, hinting that this upward momentum could persist. Moreover, Popcat crypto’s spot flow has dipped into negative territory after four consecutive days of net inflows. When NetFlow turns negative, it typically means more tokens are leaving exchanges than entering them. This outflow can signify an increased rate of accumulation, as investors may be moving their holdings to private or cold wallets in anticipation of further price gains.

Market Sentiment and Demand

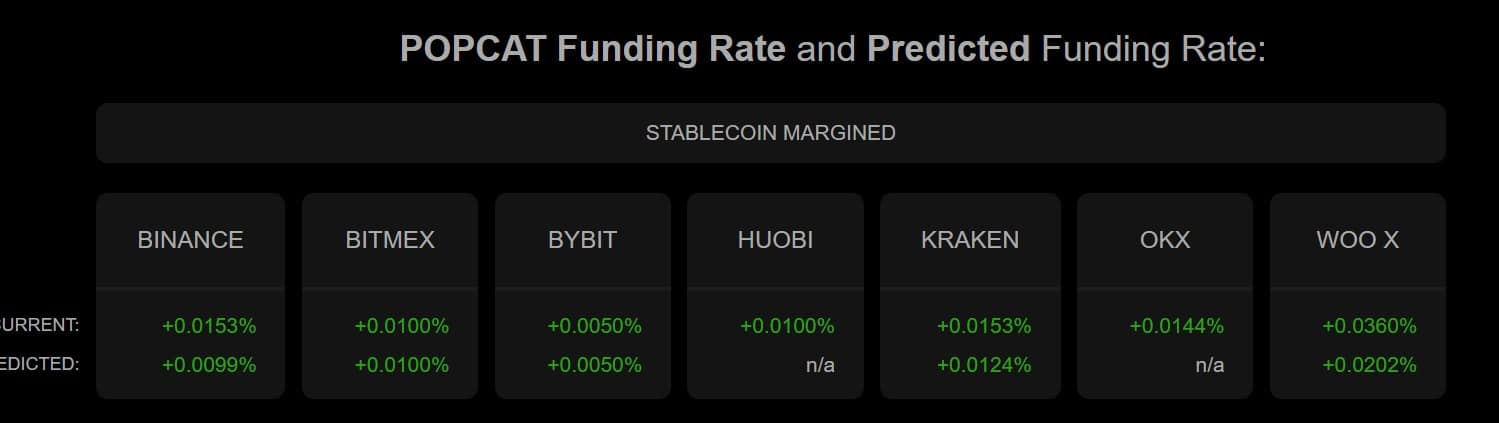

Further bolstering the bullish argument is Popcat’s Funding Rate, which remains positive across all monitored exchanges, according to data from Coinalyze. A positive funding rate usually signifies high demand for long positions, with traders paying short-sellers for the privilege of keeping these bullish bets open.

In essence, investors are expressing confidence in the possibility of continued price growth. Still, it’s crucial to remember that sentiment can shift quickly, especially for meme coins. While the current mood appears upbeat, any sudden market-wide downturn could reverse Popcat’s fortunes.

Critical Levels to Watch

Looking ahead, Popcat’s ability to maintain its bullish stance hinges on holding several key support levels. Analysts highlight $0.5 as a crucial price floor that could determine whether the memecoin’s bullish trend continues. According to one perspective, if buyers manage to keep the price above $0.5, this meme coin could rally back to $0.6 in the short term and potentially face its next major resistance around $0.9.

Conversely, failing to stay above $0.5 might lead to a sharper pullback, with $0.47 emerging as the next significant support zone. Any break below that level could shift the broader outlook from bullish to bearish once again.

Can Popcat Hold Its Ground?

Popcat’s recent upswing signals a possible turning point after a month of declines. Bullish sentiment is growing, backed by strong technical signals and more coins leaving exchanges. This paints a cautiously optimistic outlook for the memecoin. However, the market remains volatile, and Popcat’s future largely depends on whether it can stay above key support levels like $0.5.

Conclusion:

Popcat’s performance over the next few weeks will be a test of the memecoin’s staying power. If the bulls continue to drive prices higher, traders could be eyeing $0.6 and beyond as the next milestones. But should profit-taking or sudden market shocks push the price below $0.5, a return to bearish conditions is all too possible. For now, the meme coin appears determined to stay on its upward path, but investors should keep a watchful eye on these pivotal price points.

Stay tuned to The BIT Journal and watch Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Frequently Asked Questions (FAQs)

1. What caused Popcat’s recent price rebound?

A surge from $0.39 to $0.63, backed by positive Weighted Sentiment and technical indicators, sparked renewed optimism.

2. Can Popcat maintain its upward momentum?

Holding key support levels like $0.5 will be crucial for sustaining the bullish trend.

3. What are the key technical indicators supporting Popcat’s rally?

Bullish crossovers in RSI and Stoch RSI, along with negative net flows and positive funding rates, indicate strong demand.

4. Why is $0.5 a critical level for Popcat?

Staying above $0.5 could lead to a rally toward $0.6 and potentially $0.9 while breaking below could trigger a sharper pullback.

5. How does Popcat’s Weighted Sentiment impact its outlook?

A positive shift in sentiment suggests a bullish market mood, boosting investor confidence.

6. What does Popcat’s negative netflow mean?

More tokens are leaving exchanges, signaling accumulation by investors anticipating further gains.