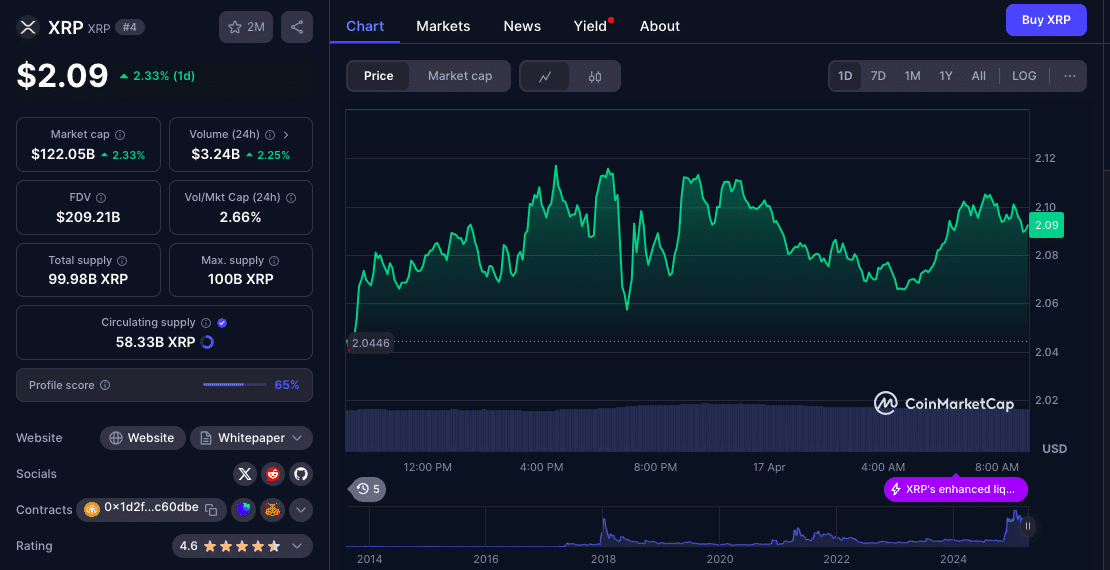

XRP is at a crossroads again as it hovers above the XRP $2 support. What initially appeared to be a healthy correction has evolved into a standoff between bulls holding onto key levels and bears pushing for a deeper decline. While technicals are losing steam, broader market signals, regulatory news and exchange behavior are all fueling the speculation around XRP’s next move.

XRP Pulls Back From $2.25—Support Tested Again

The latest drop from $2.25 was quick and sharp, taking XRP below $2.15 and $2.12. It briefly went under $2.05 before consolidating. A local bottom formed at $2.036 and bulls tried to rebound to test $2.12 again but failed to reclaim the 100-hourly SMA and got stuck below the trendline resistance of $2.13.

Now the XRP $2 support is in focus as it’s both psychological and technical. If this level breaks, bears may take XRP down to $1.92 or even $1.84, which were accumulation zones in early April.

Bearish Indicators Weigh on Momentum

XRP’s technicals are bearish. RSI is below 50 on multiple timeframes and hourly MACD is weakening. Volume also dropped by 17% from both sides.

According to reports, Exchange inflows are adding pressure. 55 million XRP were moved to exchanges this week, which could be selling. Large inflows like this historically precede price drops especially when combined with bearish sentiment.

Another Twist: Bullish Pattern Forms

Despite near-term weakness, XRP may not be done with the upside. An inverse head-and-shoulders pattern is forming on the 4-hour chart with the neckline at $2.20. A breakout above that could take XRP to $2.78 in the short term, a 30% move from current levels.

And to top it off, the pause in SEC-Ripple litigation is adding to the bullish case. No new filings until April 22 so investor anxiety around legal developments has subsided. This breathing space often coincides with speculative optimism and some are already rotating back into XRP in anticipation of a favorable outcome or settlement.

Institutional Interest and Whale Behavior

On-chain data shows some long-term holders are accumulating around the XRP $2 support. A spike in wallet activity among addresses holding 1M-10M XRP means some whales see this price as a discount. Recent reports also show some US-based funds have added XRP back to their portfolio as regulatory clarity improves.

But it’s not a one-way game. Reports say whale sell-offs from older addresses (holding for more than 180 days) are still happening, showing a divergence between older and newer investors. This tug of war has left XRP’s midterm trend in limbo.

Expert Analysis: XRP at a Crossroads

Market strategists are watching closely around the XRP $2 support level. According to FXStreet, a break below this zone would send XRP to $1.84 or lower. Holding XRP $2 support and reclaiming $2.20 would put $2.50 and $2.78 on the table.

Analysts also point to Bitcoin dominance which has dropped below 53% and altcoins like XRP are getting some breathing room. If Bitcoin stays range bound, altcoins could outperform in the short term, giving XRP another chance to break out.

Conclusion: Decision Time at $2.00

The next few days will decide XRP’s short-term trajectory. The XRP $2 support level is the most-watched support on the charts. Hold it and XRP could complete a bullish reversal to $2.78; lose it and sellers may drag the token to $1.84 or worse.

With technical uncertainty, legal suspense, and market-wide indecision, XRP is at a crossroads. For traders, it’s not just about long or short—it’s about timing. For now all eyes are on XRP $2 support.

FAQs

Why is the XRP $2 support level important ?

It’s a psychological and technical level. Break below, and it could trigger more downside; break above, and it could set up a bullish reversal pattern.

What’s the bullish scenario for XRP?

If XRP can reclaim $2.20 and break above $2.25 the next targets are $2.50 and $2.78 supported by the inverse head-and-shoulders pattern.

How is the SEC lawsuit affecting XRP now?

With filings paused until April 22, there’s short-term relief in the market. Traders are hopeful Ripple will get a favorable outcome or settlement.

Are whales buying or selling XRP?

Mixed signal. Some whales are accumulating at $2.00, others—long term holders—are reducing exposure.

What indicators to watch this week?

Watch the RSI, MACD and $2.00 and $2.20 levels. Volume spikes and exchange inflows are also key indicators of upcoming moves.

Glossary

Support: A price where buyers enter and prevent further downside.

Resistance: A price where selling pressure emerges and the price halts.

Inverse Head-and-Shoulders: A bullish reversal pattern.

RSI (Relative Strength Index): A ‘momentum oscillator that shows overbought and oversold conditions.

MACD (Moving Average Convergence Divergence): A trend following momentum indicator.

Sources

Disclaimer: This article is for informational purposes only and not financial advice. Cryptocurrency is very volatile and carries risks. Traders and investors are urged to carry out their own research before any cryptocurrency investments.