Emerging as a key player among crypto investment firms, Canary Capital Group has made a groundbreaking move by submitting an ETF application for the popular altcoin Solana (SOL). Here’s a closer look at this pivotal development.

Canary Capital Files for Solana ETF

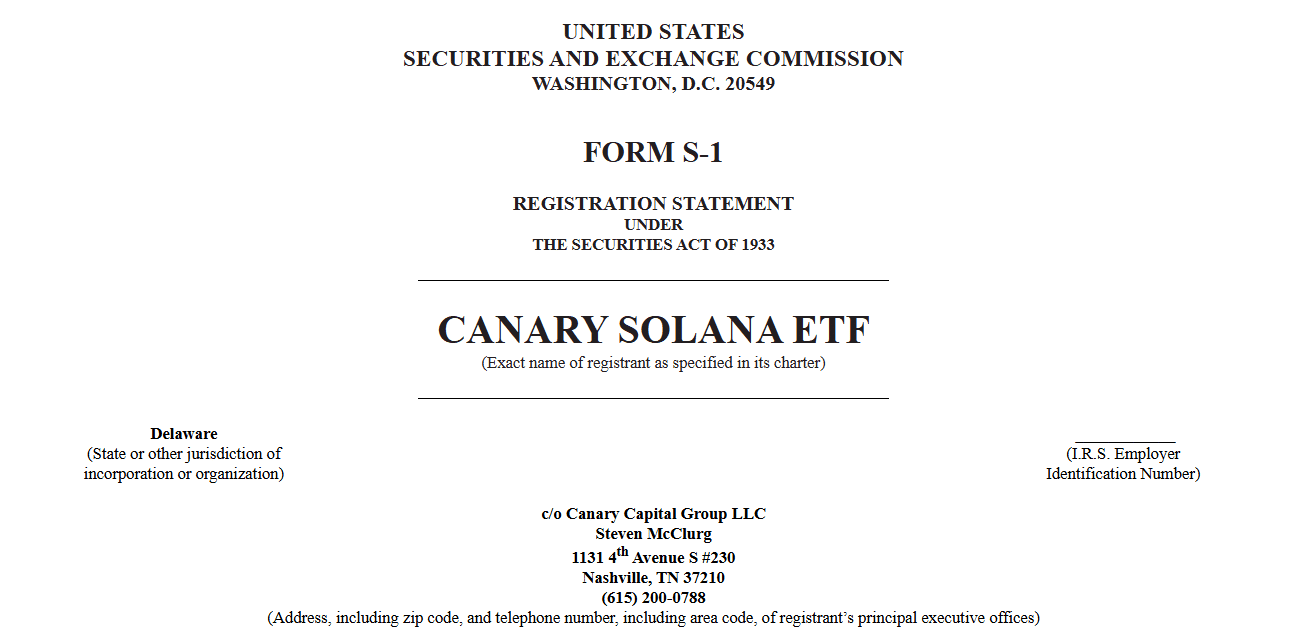

Led by former Valkyrie Funds co-founder Steven McClurg, Canary Capital has taken a significant step to position itself in the U.S. market for spot altcoin and crypto ETFs. On October 30, the firm filed Form S-1 with the U.S. Securities and Exchange Commission (SEC), a vital step under the Securities Act of 1933 for companies aiming to offer securities. This marks Canary’s first attempt to introduce a spot Solana (SOL) ETF to the market.

Form S-1 provides detailed financial information and conditions for the security offering. Additionally, Canary will need to submit Form 19b-4, detailing proposed rule changes for the exchange where the ETF will be listed. This process will enable the Solana ETF application to advance to its next regulatory review stage. With this filing, Canary Capital joins other firms like VanEck and 21Shares, who submitted similar applications in June. Meanwhile, Franklin Templeton is also considering a spot SOL ETF proposal.

What Is the Solana ETF?

The proposed spot Solana ETF aims to track SOL’s price through the CME CF Solana Index, which provides real-time market reference for SOL. By tracking this index, the ETF aims to give investors a traditional entry point into the Solana market, minimizing direct custody risks and lowering entry barriers. Solana has recently gained attention as a leading candidate for SEC approval following Bitcoin and Ethereum spot ETF approvals earlier this year.

In recent filings, Canary Capital also applied for spot XRP ETF and spot LTC ETF on October 8 and 15, respectively, signaling its intent to expand its presence in the crypto asset space. These steps reflect Canary’s goal to offer investors a range of crypto investment options. As of this report, SOL is trading around $179.01, with a slight 0.5% dip over the past 24 hours.

Canary Capital’s proactive approach underscores an important development for crypto investors, hinting at greater activity in the crypto ETF market in the coming months.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!