Grayscale Investments has set its sights on Cardano (ADA), the blockchain platform renowned for its innovative approach to smart contracts and decentralized applications. On February 11, 2025, Grayscale filed for a Cardano exchange-traded fund (ETF) with the New York Stock Exchange (NYSE) Arca, signaling a significant expansion of its crypto offerings beyond the established giants of Bitcoin and Ethereum.

Grayscale’s Strategic Expansion into Cardano

Grayscale’s decision to pursue a Cardano ETF reflects its commitment to diversifying investment opportunities within the cryptocurrency sector. The firm has previously launched ETFs for Bitcoin and Ethereum and is now looking to broaden its portfolio to include other prominent digital assets.

“Our aim is to provide investors with access to a wide range of digital currencies through familiar investment vehicles,” stated a Grayscale spokesperson.

The proposed Cardano ETF is designed to offer investors exposure to ADA, Cardano’s native cryptocurrency, without the complexities associated with direct crypto ownership. If approved, this ETF would be the first of its kind for Cardano, allowing investors to gain ADA exposure through traditional financial markets.

Market Response and ADA’s Performance Surge

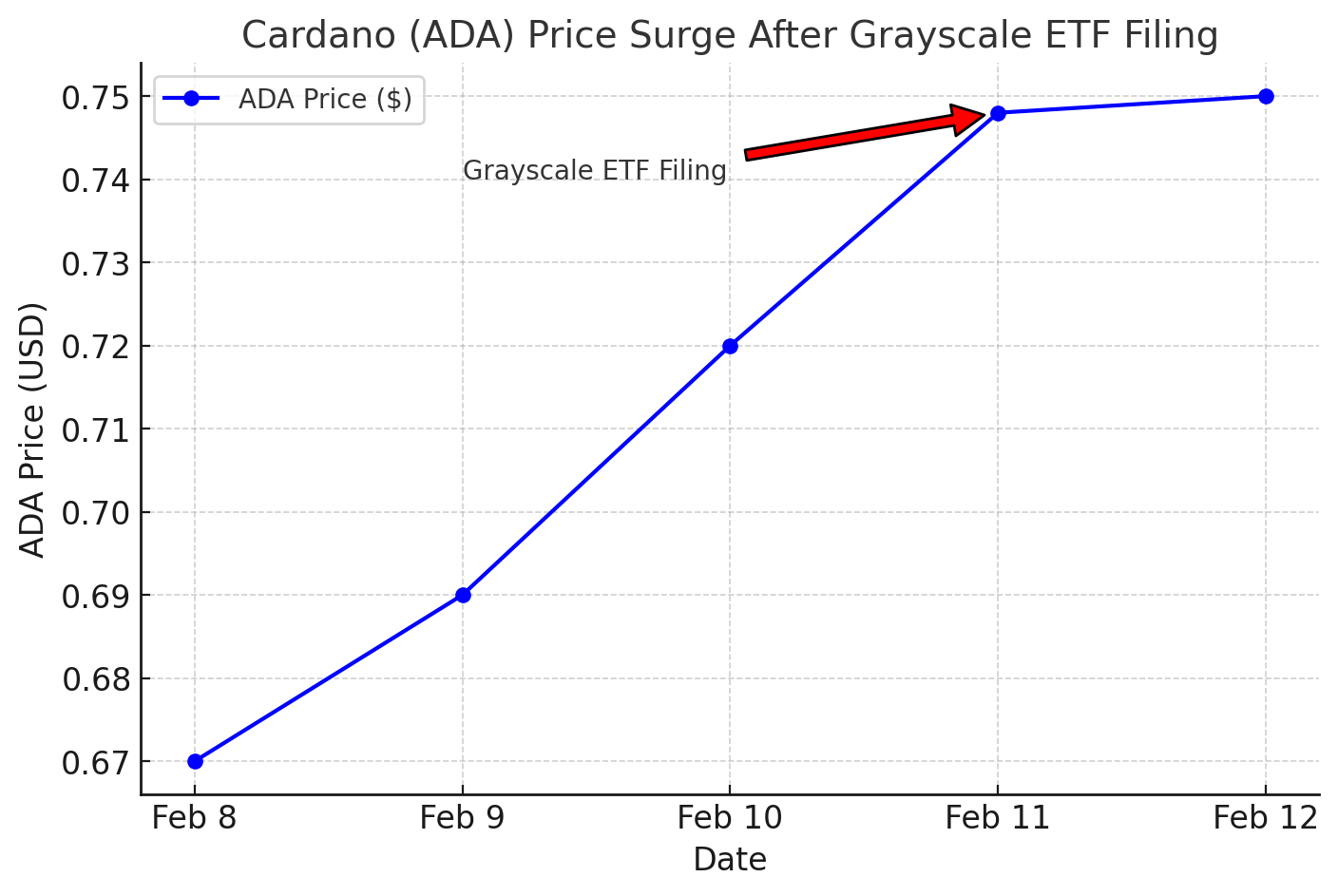

The announcement of the ETF filing had an immediate impact on ADA’s market performance. On the day of the filing, ADA experienced a significant surge, jumping 12% to $0.748, making it the largest gainer among the top 10 cryptocurrencies by market capitalization. This uptick reflects growing investor confidence in ADA’s potential and the market’s positive reception to Grayscale’s initiative.

Navigating Regulatory Waters: The Path Ahead

While the filing marks a pivotal step, the journey toward approval is laden with regulatory considerations. Only Bitcoin and Ethereum spot ETFs have received approval for trading in the United States, with the Securities and Exchange Commission (SEC) granting the green light last year. The approval process for a Cardano ETF will require thorough evaluation by regulatory bodies to ensure compliance with existing financial regulations.

Grayscale’s filing emphasizes the availability of ADA price and market information on public platforms, aiming to assure regulators of the asset’s transparency and the ETF’s alignment with investor protection standards.

“The proposed rule change is designed to promote just and equitable principles of trade and to protect investors and the public interest,” Grayscale asserted in its filing.

Broader Implications for the Crypto Investment Landscape

Grayscale’s move to introduce a Cardano ETF is part of a broader strategy to expand its suite of crypto investment products. The firm has also filed to convert existing trusts into spot ETFs for other cryptocurrencies, including Solana (SOL), XRP, and Dogecoin (DOGE). These initiatives reflect a growing demand for diversified crypto investment options and signify a maturation of the digital asset market.

The introduction of ETFs for a wider range of cryptocurrencies could democratize access to digital assets, allowing investors to engage with the crypto market through regulated and familiar investment vehicles. This development is poised to attract both institutional and retail investors seeking exposure to the burgeoning crypto sector.

Conclusion

Grayscale’s pursuit of a Cardano ETF represents a significant milestone in integrating digital assets into traditional financial markets. As the firm awaits regulatory approval, the crypto community and investors alike keenly observe the potential implications for ADA’s market presence and the broader adoption of cryptocurrency ETFs. This move not only highlights the increasing legitimacy of digital assets but also underscores the dynamic evolution of investment opportunities in the crypto space.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment fund that trades on stock exchanges, holding assets such as stocks, commodities, or bonds. ETFs offer investors a way to invest in a diversified portfolio without owning the underlying assets directly.

What is Cardano (ADA)?

Cardano is a blockchain platform that focuses on security, scalability, and sustainability. ADA is the native cryptocurrency of the Cardano platform, used for transactions and smart contracts.

How does a Cardano ETF benefit investors?

A Cardano ETF allows investors to gain exposure to ADA without the need to manage digital wallets or navigate cryptocurrency exchanges, providing a more accessible and regulated investment vehicle.

What are the risks associated with cryptocurrency ETFs?

As with any investment, cryptocurrency ETFs carry risks, including market volatility, regulatory uncertainties, and the potential for loss. It’s essential for investors to conduct thorough research and consider their risk tolerance.

When will the Cardano ETF be available?

The availability of the Cardano ETF is subject to regulatory approval. The timeline for approval can vary, and investors should monitor official communications from Grayscale and regulatory bodies for updates.

Glossary of Key Terms

Exchange-Traded Fund (ETF): An investment fund traded on stock exchanges, holding a collection of assets.

Cardano (ADA): A blockchain platform with a focus on security and scalability; ADA is its native cryptocurrency.

Securities and Exchange Commission (SEC): The U.S. federal agency responsible for regulating securities markets.

Spot ETF: An ETF that holds the actual underlying asset, such as a cryptocurrency, rather than derivatives or futures contracts.

Digital Asset: A non-tangible asset that is created, traded, and stored in a digital format, such as cryptocurrencies.