Cardano is gearing up for the Chang hard fork, a significant development that will usher in the Voltaire era by implementing on-chain governance. This upgrade is set to empower ADA holders to participate directly in key decisions, propelling the platform toward a fully decentralized blockchain ecosystem. But what exactly is the Cardano Chang hard fork, and what should we expect from this pivotal update?

A Deep Dive into Cardano’s Development Stages

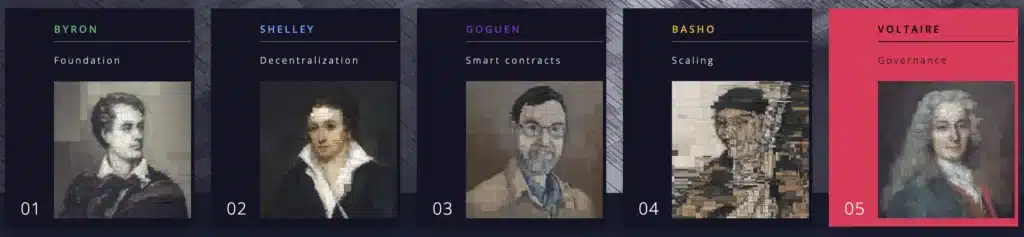

Cardano’s development is meticulously planned and divided into phases called “eras,” each named after influential poets, mathematicians, or computer scientists. These eras serve to introduce new functionalities via hard forks, enhancing the platform step by step.

- Byron: Established Cardano’s foundational network, facilitating ADA transactions.

- Shelley: Shifted the network to a decentralized model with community-led block production.

- Goguen: Brought smart contracts into the ecosystem, enabling decentralized application (DApp) development.

- Basho: Aimed at enhancing scalability and interoperability.

- Voltaire: Set to implement decentralized governance.

Each main phase may feature various sub-eras, as seen with Goguen, which included Allegra, Mary, and Alonzo. The Cardano Chang hard fork marks the initial hard fork and sub-era of Voltaire, bringing new and exciting changes.

What is the Cardano Chang Hard Fork?

So, what exactly is the Cardano Chang hard fork? This upgrade will allow ADA holders to vote on protocol modifications and governance actions, with the option to delegate their voting rights to designated representatives known as DReps. This marks a significant step towards a more democratic and decentralized blockchain ecosystem.

In addition to governance enhancements, the Cardano Chang hard fork will upgrade Cardano’s smart contract functionality with the introduction of PlutusV3. This version includes new cryptographic primitives designed to secure data and blockchain transactions. The new cryptographic functions—BLS12-381 and Keccak-256—enhance the security and efficiency of operations such as zero-knowledge proofs and digital signatures, resulting in faster and more reliable processes.

Introduction of Bitwise Primitives

Additionally, the Cardano Chang hard fork introduces bitwise primitives, enabling developers to perform low-level data manipulations in smart contracts. These bitwise tools can optimize contract data handling and storage, improving execution speed and reducing costs for DApps. This will facilitate developers in creating more intricate and effective DApps on Cardano.

The upgrade further refines transaction fee calculations for DApps by modifying protocol parameters related to reference scripts. Reference scripts play a pivotal role in minimizing transaction sizes, thus lowering user costs and boosting the network’s ability to process a higher volume of simultaneous transactions.

Preparing for the Hard Fork

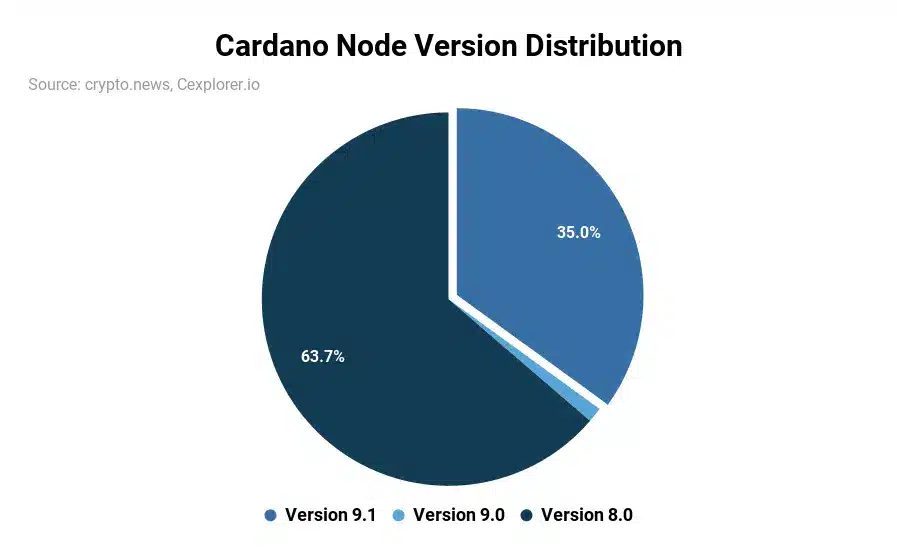

Node operators, particularly those running stake pools, must upgrade to version 9.1 to accommodate the new governance models and smart contract advancements introduced by the Cardano Chang hard fork. For the hard fork to be successfully implemented, 70% of the network’s stake pool operators must transition to version 9.1. The new version was made available on July 25, and just twelve days later, over a third of the network had already upgraded. As of August 5, nearly 63.7% of operators were still using version 8.0, 1.3% remained on version 9.0, while about 35% had transitioned to version 9.1.

Three Key Drivers for Cardano’s Potential Recovery in Late 2024

Cardano has faced challenges in early 2024, experiencing a 34% decline thus far, distinguishing it negatively among the top ten cryptocurrencies by market capitalization. However, several key factors might drive Cardano’s recovery in the latter part of the year.

Firstly, the U.S. Securities and Exchange Commission (SEC) has clarified its position, stating that Cardano will not be classified as a security. This is in contrast to its actions against other crypto firms such as Coinbase and Binance in 2023. This clarification provides relief from potential legal challenges for Cardano, making it more appealing to investors. The anticipated re-listing by platforms like Robinhood could further boost investor confidence and market stability.

Secondly, Cardano’s upcoming Chang hard fork, characterized by co-founder Charles Hoskinson as a critical milestone for the platform and the broader crypto landscape, is expected to enhance efficiency and governance. This upgrade could significantly impact Cardano’s operational dynamics and public perception, despite varying opinions on its significance.

Finally, with the launch of spot Bitcoin ETFs in January, speculation grows about the potential introduction of a Cardano ETF. Although Cardano struggles with institutional support due to its smaller $14 billion market cap relative to Bitcoin’s $1.4 trillion, a Cardano ETF could attract broader market interest.

Conclusion

As the Cardano Chang hard fork approaches, the crypto community is eager to see how these changes will impact the platform and the broader blockchain ecosystem. With enhanced governance and smart contract capabilities, Cardano is poised for significant advancements. Stay tuned for more updates on this evolving story as Cardano continues to develop and adapt in the dynamic world of cryptocurrency. Stay tuned for more updates on this evolving story on The Bit Journal