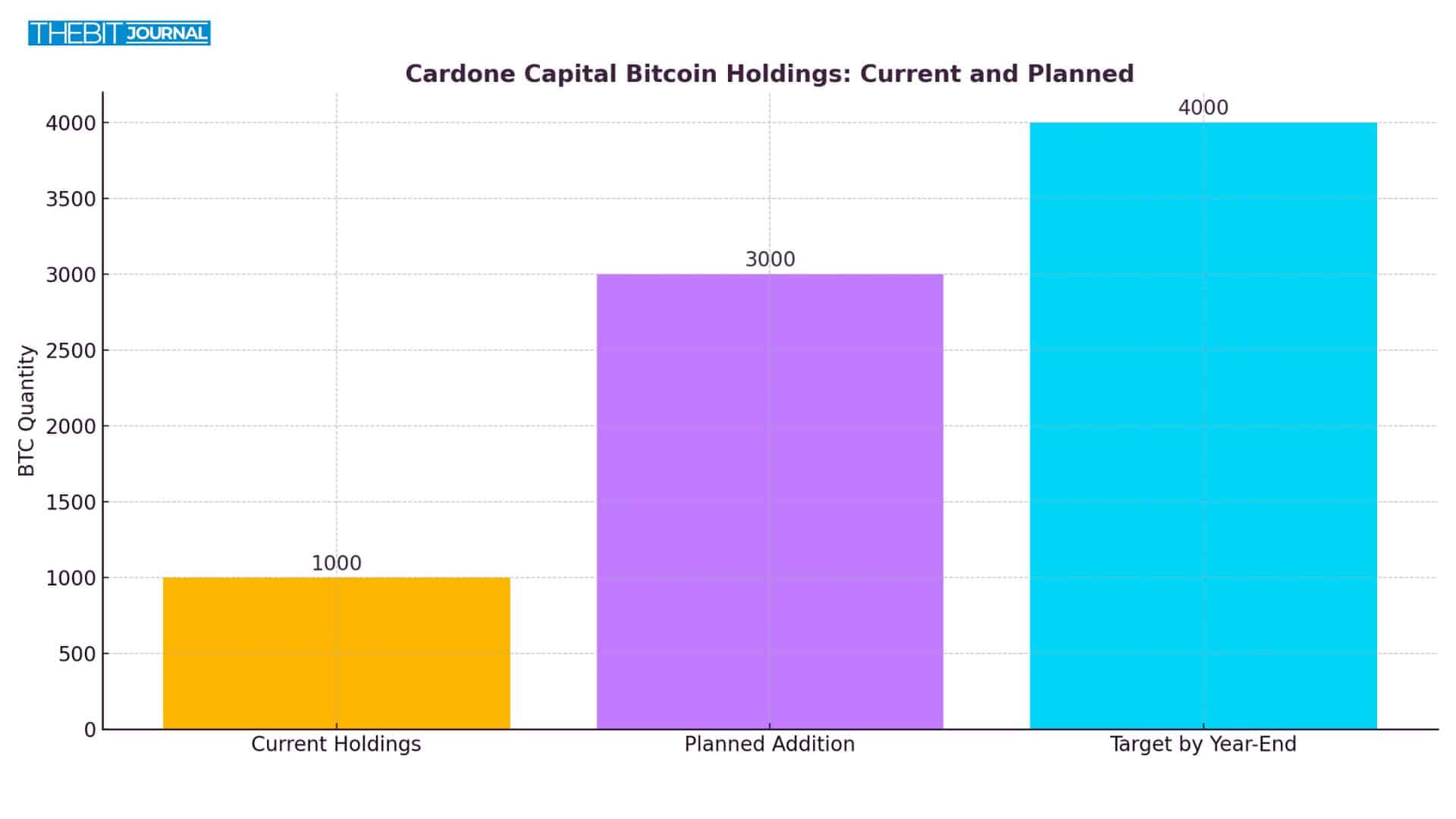

According to the source, Cardone Capital entered the Bitcoin space with a significant investment of 1,000 BTC, valued at nearly $100 million. This shakeup transforms one of the largest real estate-focused investment firms, and it is clear that Bitcoin is no longer limited to technology firms and hedge funds.

Crypto enthusiasts have been making a note of how the firm positions itself among the top institutional holders.

Real Estate and Bitcoin: A Surprising Match

Cardone Capital manages assets worth approximately $ 5 billion and is headed by entrepreneur Grant Cardone. It owns more space than 14,000 apartment units and over 500,000 square feet of commercial space. The company is known for its strong cash flows, which enable it to rely on real estate revenues and has recently added Bitcoin to its balance sheet.

Buying 1,000 BTC is an unstable trade. While this strategic investment firm is intended to scale up its stake, it is likely to acquire an additional 3,000 BTC by the end of 2025. This progress will see the real estate giant join corporate Bitcoin holders such as MicroStrategy and Metaplanet.

Grant Cardone proclaimed this by saying that his firm is now “combining the most stable asset class with the highest-performing asset of the last decade.”

This combination of steady rental income and long-term digital asset exposure makes Cardone Capital’s strategy unique in both sectors.

Why Cardone Capital’s Step Matters?

Corporate Bitcoin buying has always been an area with interest focused on the tech world until now. Cardone Capital’s involvement signals the transition into other industries, which may now follow suit. This act lends considerable credibility to Bitcoin, now regarded as a long-term store of value.

It also neutralizes one of the most significant issues associated with crypto investments, namely, volatility. The income from real estate provides a steady cash flow that can serve as a buffer against fluctuations in the Bitcoin price.

For Bitcoin enthusiasts, this is a sign that institutional acceptance is gaining momentum. For real estate investors, it offers a new avenue for diversification. The company now occupies a unique niche, bridging these two asset classes that seldom communicate with each other.

What’s Next?

Cardone Capital is not stopping its 1,000-Bitcoin purchase. The company plans to acquire an additional 5,000 real estate units and plans to increase its Bitcoin stockpile to 4,000 BTC by year-end. This shows its faith in Bitcoin’s long-term prospects.

The strategy also hints at broader trends. As inflationary pressures intensify and interest in alternative assets grows, companies may increasingly consider Bitcoin as a hedge and a potential upside bet. The company is arguably one of the first to make that change in the real estate sector.

This model can be followed by others, particularly those seeking to integrate conventional investments with digital assets. While income from rent provides flexibility, Bitcoin represents the upside.

Conclusion

The investment of Cardone Capital in Bitcoin transcends a news event. It symbolizes a change in the mentality of traditional firms toward digital assets. The company is attempting to create a synthesis of steady real estate income and long-term potential from Bitcoin, thus charting a new future for both industries.

As more investors take a closer look at innovative, diversifying options, the move may herald further such changes to come.

Summary

Having purchased 1,000 BTC for over USD 100 million, Cardone Capital entered the Bitcoin market. Famous for its strength in real estate, the company intends to grow property assets and Bitcoin holdings. It also represents a change in the view of digital assets by traditional companies. The company thereby sets a new direction by mixing steady income from real estate investment with that of crypto, with far-reaching implications for both sectors in the months ahead.

FAQs

Q1: How much Bitcoin does Cardone Capital own?

A: The company currently holds 1,000 BTC and plans to increase this to a total of 4,000 BTC by year-end.

Q2: Have other real estate companies made Bitcoin investments?

A: This one is among the few in real estate to publicly allocate part of its treasury to Bitcoin, thus making a significant mark on history.

Q3: Why is this decision essential?

A: This indicates that, beyond the tech sector, Bitcoin is recognized as a treasury asset.

Q4: What are the long-term plans?

A: The firm proposes to build up its real estate holdings and Bitcoin at the same time.

Glossary of Important Terms

Bitcoin (BTC): A digital currency that operates without an intermediary or central bank.

Real estate investment firm: A company deriving an income stream from property holdings.

Balance sheet: A schedule of a corporate financial position covering the assets and liabilities.

Treasury asset: Any asset of or held to be held by a corporation for preservation or enhancement of its value.