Celestia’s modular blockchain solution is making waves again, and this time, the market is paying attention. TIA, the native token of the Celestia network, has rallied over 26% in the last seven days, climbing to $1.56 as of July 8. The sharp uptick has reignited interest in the project’s long-term vision and its real-time fundamentals. Between a new proposal to slash inflation, growing developer adoption, and lucrative staking rewards, the case for continued upside is strengthening.

TIA Price Table

| Metric | Value |

|---|---|

| Current Price | $1.56 |

| 24h High / Low | $1.63 / $1.48 |

| 7-Day Change | +26% |

| Market Cap | $1.09 Billion |

| Trading Volume | $150 Million |

| Immediate Resistance | $1.71 |

| Key Support | $1.35 |

| Bullish Target | $2.26 |

Inflation Cut Proposal Sparks Momentum

One of the catalysts behind the rally is a community proposal that could reshape Celestia’s tokenomics. The suggested plan would reduce TIA’s annual inflation from 8% to just 0.25%, dramatically tightening future supply. The proposal was met with immediate market enthusiasm, pushing the token up 11.6% within 24 hours of the news.

“Cutting inflation is a game-changer,” said blockchain analyst Elijah Barrett. “Investors are hunting scarce assets again, and Celestia is delivering a compelling narrative, low inflation and high yield in one package.”

The inflation change, if passed, could become effective in Q3 2025 and is designed to increase long-term value capture for stakers and holders alike.

Staking Yields Remain Competitive

Despite the proposed inflation drop, Celestia still offers some of the most competitive staking yields in the Layer-1 space. According to data from StakingRewards, current APY stands at 11.8%, and over 38% of TIA’s circulating supply is already staked.

This means a significant portion of tokens is locked, reducing market liquidity. In bull markets, that reduction in liquid supply can amplify price moves.

Modular Hype and Lotus Upgrade

Celestia isn’t just rallying on tokenomics. Its underlying technology is becoming a magnet for developers building modular chains. The upcoming “Lotus” testnet upgrade, expected this month, adds native interoperability for zk-rollups—one of the most sought-after tools for scaling Ethereum-compatible applications.

“Developers want modular infrastructure that’s fast, scalable, and plug-and-play,” said Daisy Chen, CTO of a Cosmos-based DeFi startup. “Celestia’s ahead of the curve, especially now with Lotus making rollup deployment seamless.”

Several projects have reportedly begun migrating their rollup layers to Celestia for improved data availability and lower fees.

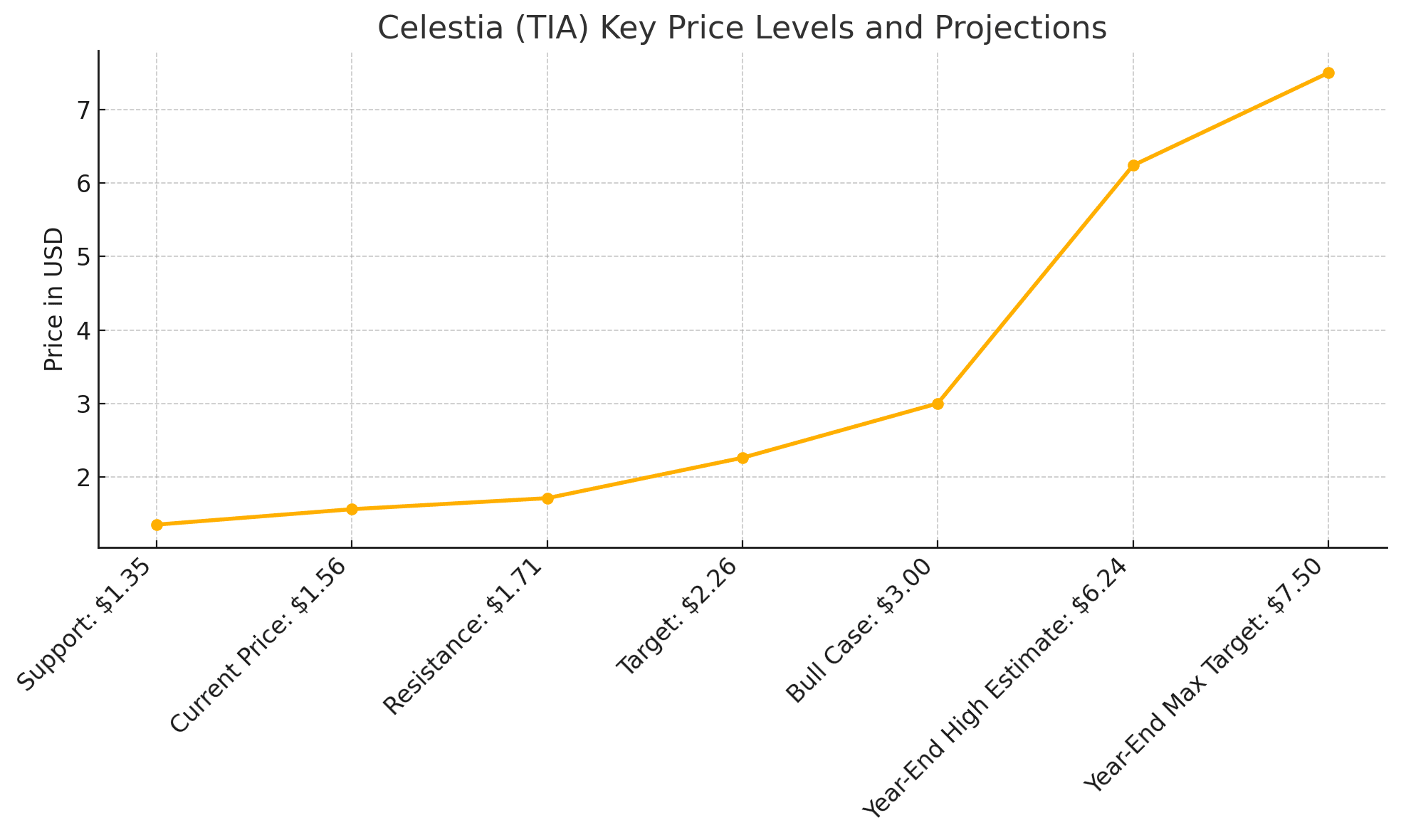

Celestia Technical Setup: Is $2.26 Within Reach?

From a charting perspective, TIA just broke out of a six-week downtrend, closing above its descending resistance line. The next significant challenge is $1.71, which aligns with the 50-day moving average. A break above this level could open a pathway toward $2.26, the previous high from late April.

Crypto trader Michaël van de Poppe tweeted, “TIA looks primed to rip. A clean break of $1.70, and we could be on track for $2.20–$2.30 quickly.”

Price Predictions: Bullish Cases Strengthen

Market analysts are now re-evaluating their price targets:

Base Case: $2.00–$2.26 by mid-August if bullish momentum sustains above $1.71.

Bull Case: $3.00 by September if Lotus adoption accelerates and inflation proposal passes.

Bear Case: Drop back to $1.35 if resistance at $1.71 fails and macro sentiment sours.

CoinStats also suggests that Celestia could trade between $6.24–$7.50 by year-end if modular blockchain adoption continues and a European-based ETP listing materializes.

Conclusion

Celestia’s TIA token is more than just another altcoin riding market wave, it’s a strong case study of how a compelling mix of real fundamentals, token economics, and technology can fuel sustainable rallies. With inflation cuts, staking incentives, and rising developer interest all working in tandem, the $2.26 resistance level might not hold for long. As long as macro sentiment remains neutral and developer traction increases, TIA appears poised to regain, and perhaps surpass, its earlier highs.

FAQs

What caused the recent rally in TIA?

The price surge was driven by a community proposal to cut inflation from 8% to 0.25%, increased staking activity, and rising developer interest.

What’s the next target for TIA?

If it breaks above $1.71 resistance, TIA could test the $2.26 level. Some analysts even project $3.00 by Q3 2025.

Is Celestia’s staking yield sustainable?

At 11.8% APY and over 38% of the supply staked, yields remain attractive, especially if inflation is reduced.

What is the Lotus upgrade?

It’s a new testnet update that will enable native support for zk-rollups, making it easier for modular chains to deploy on Celestia.

Glossary of Key Terms

TIA – Native token of the Celestia blockchain

Staking – Locking tokens to support network validation in return for yield

Inflation – The rate at which new tokens are minted or issued

Data Availability Layer – The part of the blockchain that ensures transaction data is accessible and verifiable

zk-rollup – A Layer-2 scaling solution for Ethereum that increases throughput while maintaining security

Resistance – A price level where upward trends tend to slow or reverse

Modular Blockchain – A blockchain architecture that separates core components like execution, consensus, and data storage

ETP – Exchange-Traded Product, a security that tracks the performance of an underlying asset like crypto