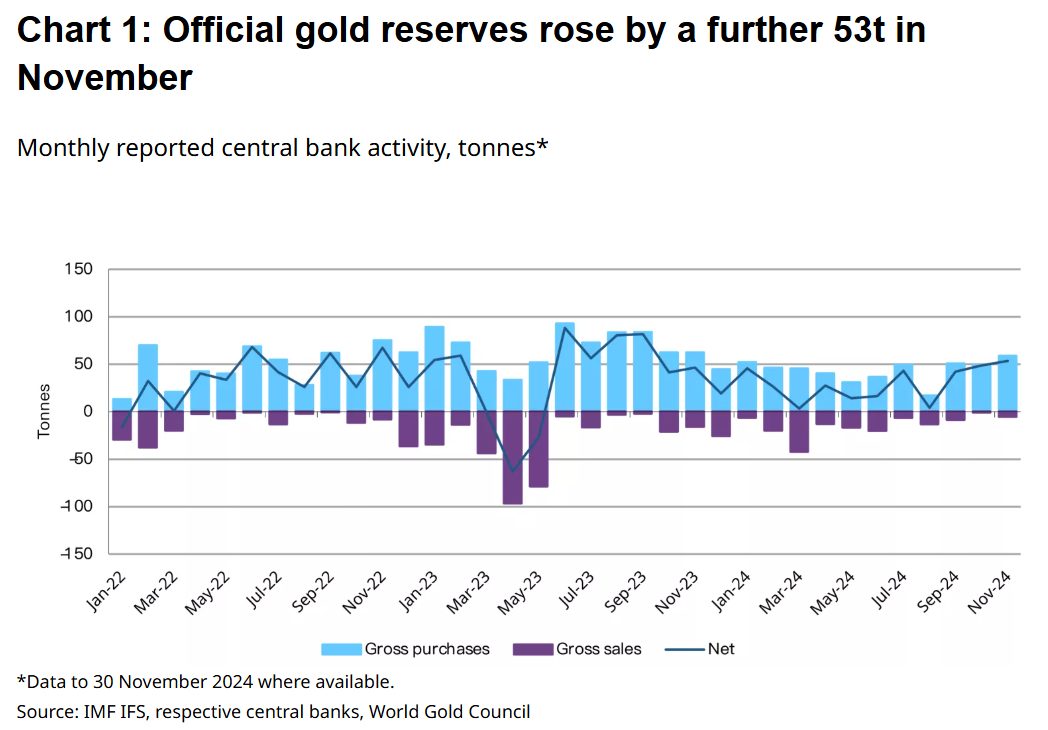

Krishan Gopaul, Senior Analyst at the World Gold Council, highlights that central banks worldwide continued their robust gold purchases in November, with emerging markets leading the charge. These acquisitions underline the ongoing global trend of using gold as a hedge against economic uncertainty and a store of value.

November Sees Significant Gold Accumulation

Based on reported data, November marked another strong month for gold acquisitions by central banks, with a net addition of 53 tons to global official reserves. Gopaul remarked, “This continues the broader trend observed throughout the year, driven by the need for a stable and secure asset amid global economic uncertainties.” Notably, the majority of these purchases originated from emerging economies.

Key Players in Gold Purchases

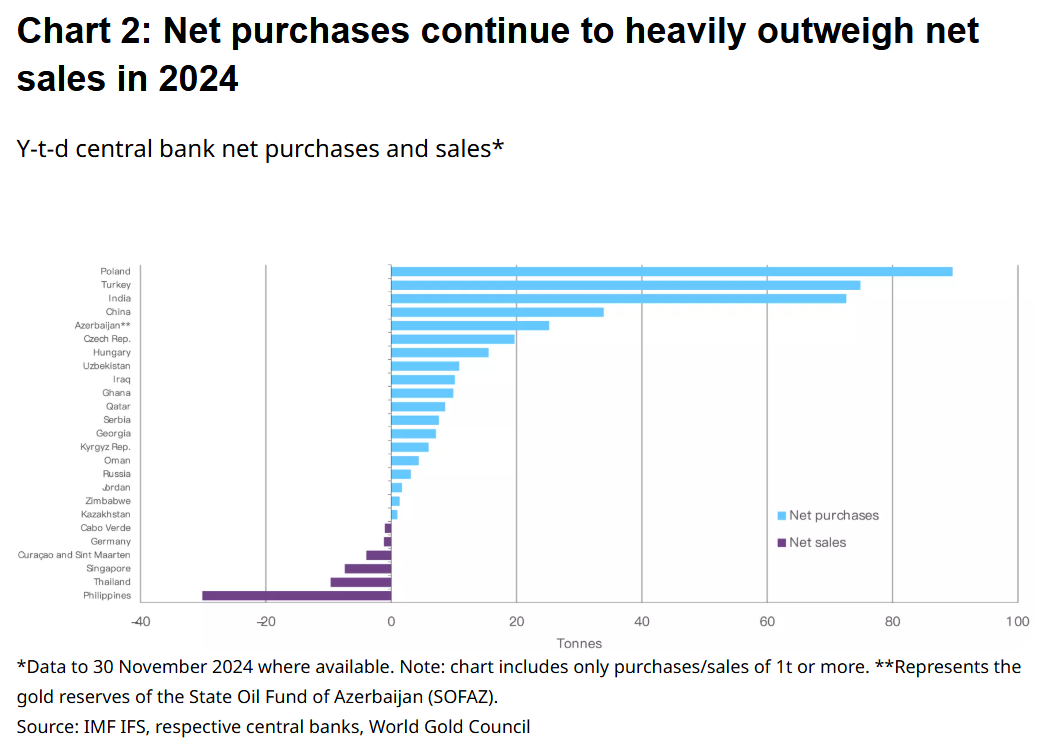

Poland emerged as the largest buyer in November, increasing its reserves by 21 tons to reach a total of 448 tons. Gold now constitutes nearly 18% of the country’s total reserves, just shy of its earlier 20% target. This brings Poland’s annual gold acquisitions to an impressive 90 tons, solidifying its position as the top buyer of 2024.

Other notable buyers include:

- Uzbekistan: Added 9 tons in November, marking its first monthly increase since July. This brings its annual net purchases to 11 tons and total reserves to 382 tons.

- India: Continued its 2024 buying spree by adding 8 tons in November, bringing its annual total to 73 tons and its overall reserves to 876 tons, making it the second-largest buyer after Poland.

- Kazakhstan: Acquired 5 tons, becoming a net buyer with a total of 1 ton in 2024.

China and Turkey Join the Fray

One of the most significant developments was China’s return to gold buying. The People’s Bank of China (PBoC) added 5 tons in November, following a six-month hiatus. This increased its annual net purchases to 34 tons and its total reported reserves to 2,264 tons, accounting for 5% of its total reserves.

Meanwhile, Turkey added 3 tons to its reserves while engaging in reverse swap agreements with local commercial banks, exchanging lira for gold to manage liquidity. The Turkish Central Bank’s strategic maneuvers highlight the versatility of gold in both reserve management and financial stability.

What Lies Ahead for Gold Demand?

Gopaul concluded, “With December data pending, it’s evident that central banks will remain significant net buyers for the 15th consecutive year. This performance underscores gold’s enduring appeal as a reliable asset.” As global economic uncertainties persist, the trend of central banks bolstering their gold reserves is unlikely to wane anytime soon.

Stay updated with The Bit Journal for more insights on how gold remains a cornerstone of financial security in an evolving global market.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!