Explore the potential of Chainlink ETFs in 2024, offering exposure to LINK. Understand their features, processes, and regulatory challenges in the U.S

As Bitcoin and Ethereum ETFs make waves in the United States, investors are eagerly anticipating what might come next. There’s a growing buzz about the potential for Chainlink ETFs to join the ranks of these regulated financial instruments. This article delves into what Chainlink ETFs could mean for investors and their status in 2024.

Understanding a Chainlink ETF

A LINK ETF allows investors to gain exposure to LINK, the native cryptocurrency of the Chainlink ecosystem. Chainlink is a decentralized oracle network that connects blockchains to real-world data, providing smart contracts with off-chain information. Essentially, if a blockchain requires data from the outside world, Chainlink is there to facilitate. Within this ecosystem, LINK is used as a payment method.

Introducing a Chainlink ETF would let investors directly interact with Chainlink’s decentralized oracle network. This means smart contracts could utilize real-world data, such as APIs and payment systems, thereby expanding the utility of blockchain technology.

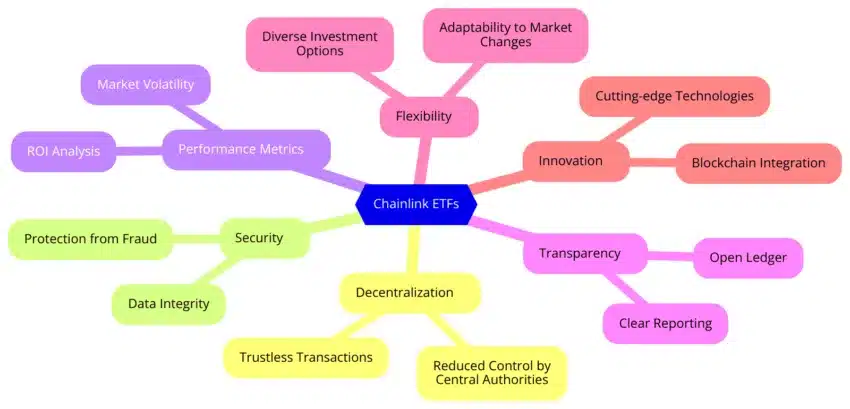

Key Features of a Chainlink ETF

Several promising features come with a link ETF. Firstly, it would hold LINK as its primary asset, offering investors a stake in the growth of the Chainlink ecosystem. Additionally, these ETFs could include mechanisms reflecting Chainlink’s principles of decentralized governance, potentially giving ETF holders a say in strategic decisions affecting the fund’s performance.

Another exciting aspect is the enhanced exposure to decentralized finance (DeFi) platforms that use Chainlink’s oracles. This could lead to opportunities in liquidity pools and yield farming, making Chainlink ETFs attractive to those interested in DeFi. Moreover, smart contracts could automatically recalibrate and rebalance the ETF’s holdings based on market conditions or other predefined criteria.

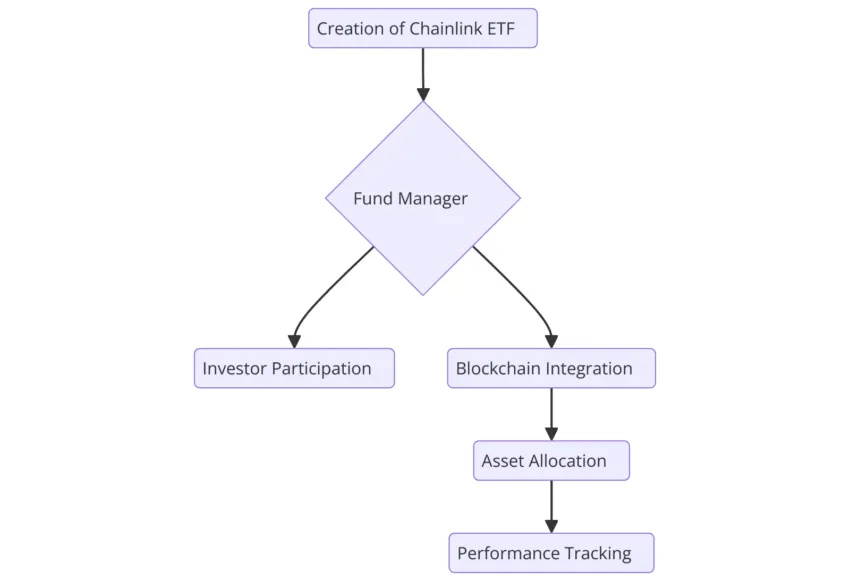

Creation and Redemption Process

The creation and redemption process of a Chainlink ETF is similar to traditional ETFs and involves authorized participants (APs). These large financial institutions create new ETF shares by depositing an equivalent value of LINK into the fund. In return, they receive shares of the ETF. Conversely, APs can redeem ETF shares for the underlying Chainlink tokens.

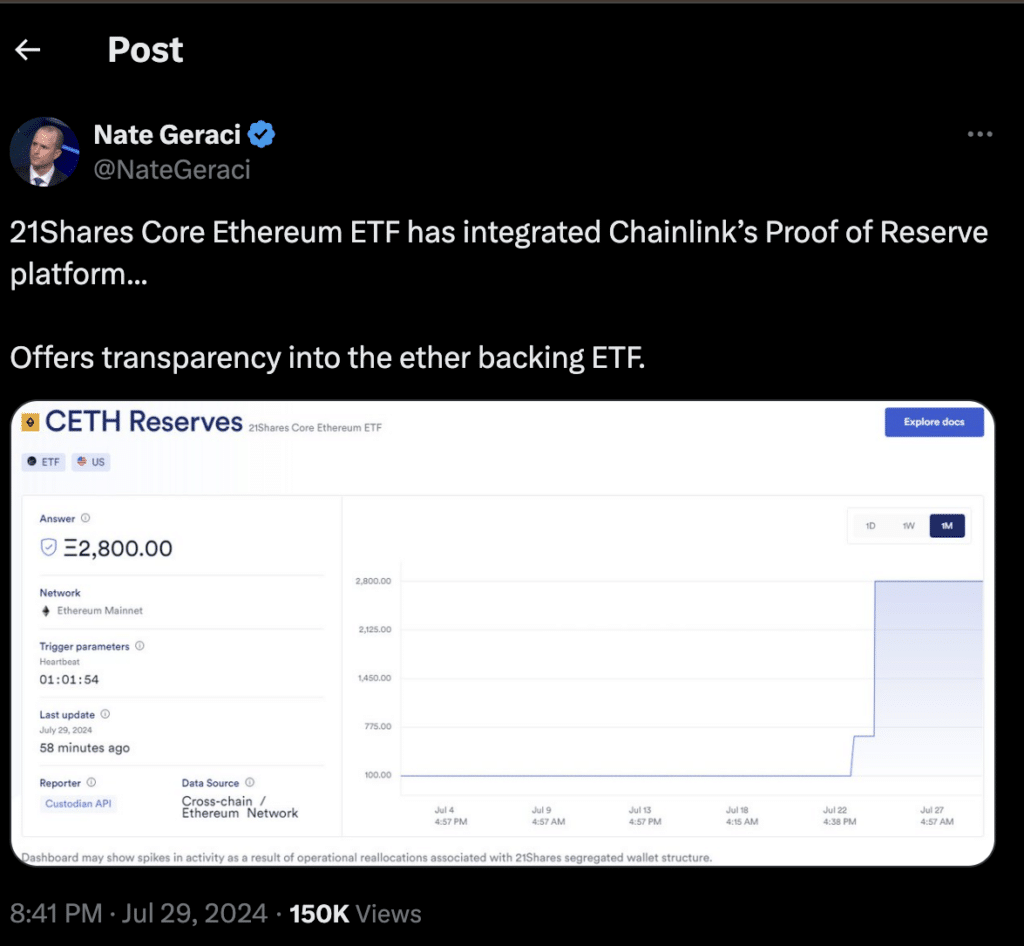

All ETFs are backed by an underlying asset. For a link ETF, this means the fund holds actual LINK tokens in a secure, institutional-grade custody solution. This backing ensures the ETF’s value is directly tied to Chainlink’s performance, providing security and assurance to investors. For instance, the 21Shares Chainlink ETP is 100% physically backed and keeps the LINK tokens in cold storage for security.

Trading Chainlink ETFs on Exchanges

Like traditional ETFs, Chainlink ETFs can be listed and traded on major stock exchanges. This makes it convenient for investors to buy and sell shares through their brokerage accounts without needing to interact directly with crypto wallets and exchanges. The Global X Chainlink ETP (LI0X), for example, is traded on exchanges like Deutsche Börse Xetra and offers cost-efficient access to Chainlink. However, as of August 2024, it remains one of the few examples available.

Navigating Regulatory Challenges for Chainlink ETFs

Despite their promising features, Chainlink ETFs must navigate the rigorous process of regulatory approval. This involves meeting the standards set by financial authorities to ensure the ETFs are safe and reliable for investors. While comparable products like Chainlink ETNs and other ETPs exist globally, link ETFs have yet to gain approval in the U.S.

The regulatory framework for ETFs aims to protect investors and maintain market integrity. The approval process for a Chainlink ETF involves scrutiny of the APs, the underlying assets (LINK in this case), and the overall structure of the fund. Although this process can be lengthy, it is crucial for ensuring the ETF’s credibility and stability.

In conclusion, the potential approval of link ETFs represents an exciting development in the world of crypto investment. By offering direct exposure to the Chainlink ecosystem, these ETFs could open new opportunities for investors and enhance the integration of blockchain technology with real-world applications. As the crypto market continues to evolve, all eyes are on Chainlink ETFs and their potential to become a significant player in the financial landscape.