According to recent market trends, Chainlink (LINK) continues to stabilize following recent fluctuations, maintaining steady momentum despite declining trading volume. The cryptocurrency trades at $15.46, a 1.31% increase in the last 24 hours. Market capitalization has also risen by the same percentage to $9.86 billion, indicating sustained investor interest.

Chainlink Whales Drive Accumulation and Profit-Taking

Chainlink’s trading volume has dropped by 31.24% to $657.29 million, reflecting lower trading activity among market participants. However, its Fully Diluted Valuation (FDV) remains at $15.46 billion, supported by a circulating supply of 638.09 million LINK out of 1 billion LINK. The market sentiment remains strong because trading volume declined without affecting the price stability.

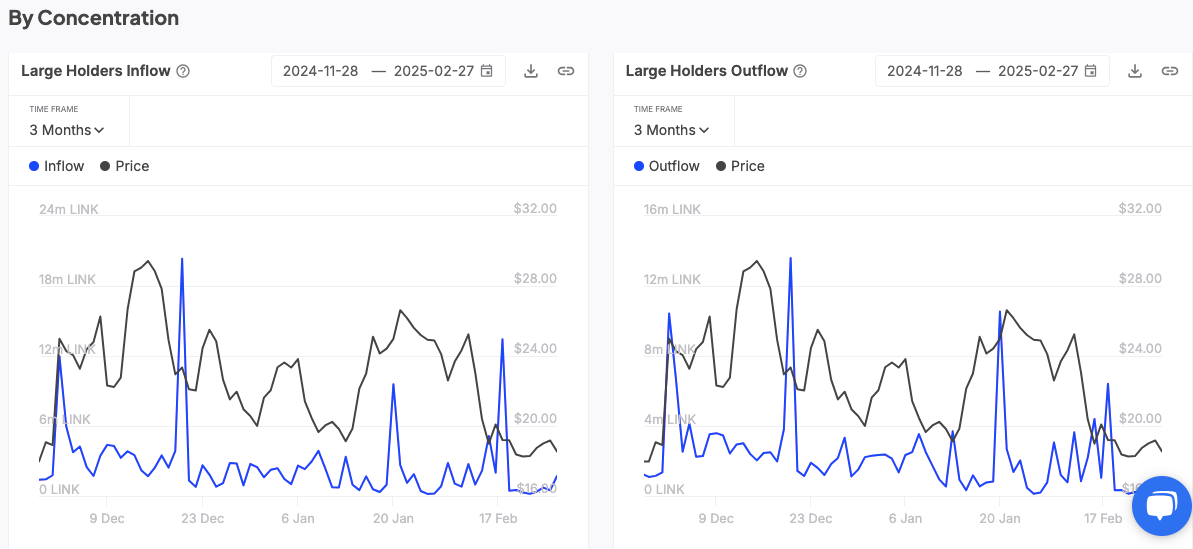

The movement of large wallet investments has undergone substantial changes during the past three months because of evolving buying interests and market profit extraction. Major investors have shown rising interest due to the significant increase in large holder inflow observed during mid-December and late January. Large investor profits are responsible for the significant capital outflows during December and January.

Data from IntoTheBlock reveals that large holder inflows have occasionally exceeded 18 million LINK, showing strong accumulation phases. Strategic buying activity by primary investors causes inflows to rise in the market. Such spikes show that major investors have taken steps to accumulate LINK holdings. However, except for brief surges, inflows have generally remained below 12 million LINK.

On the outflow side, substantial selling activity has occurred at key moments, with outflows exceeding 12 million LINK at times. The market experiences significant price volatility because large investors reform their investment positions continuously. The price trend reveals that outflows manifest when LINK reaches its highest point, thus indicating investors conduct profit-selling activities during this time.

The relationship between buying and selling activities has caused market dynamics, which resulted in price swings between $16 and $32. New influxes and outflows have decreased in recent times, which indicates an ongoing phase of market consolidation. The market price rested inside the $16-$20 zone, demonstrating lower price fluctuations.

Technical Indicators and Market Sentiment

CoinGlass data from Binance’s 1-hour chart shows LINK stabilizing around $15.45, with a modest 0.84% increase in the last session. The price has declined above $18, but now shows minor upward movement, suggesting a potential recovery. Trading volume remains moderate, with a 9-period SMA volume at 10.239 million, indicating steady market participation.

The Cumulative Volume Delta (CVD) remains negative at -5.715 million, highlighting persistent selling pressure. The Aggregated Spot CVD remains negative at -3.584 million, reinforcing bearish sentiment. Despite this, the selling pace has slowed, allowing LINK to maintain its current price level.

Future contract Funding rates stand at 0.0093, showing mild bullish sentiment among derivative traders. Open interest is rising at 4.863 million LINK, suggesting traders anticipate a potential rebound. The Aggregated Futures Bid & Ask Delta shows an increase of 171.25K LINK, indicating a gradual return of buying interest.

Price Outlook and Future Prospects

Chainlink’s price movements suggest a consolidation phase, with resistance near $16 and support around $14. LINK could test higher levels if buying volume increases, strengthening its recovery potential. Market pressure for selling activities might drive prices down to $14.

Analysts exhibit conflicting market signals because some traders bet on price increases, but others remain watchful and hesitant. The price behavior remains unpredictable because of Whale activity, which continues to shape market movements in short-term periods. Long-term prospects remain strong as Chainlink maintains its relevance in the decentralized oracle space.

Conclusion

Chainlink’s price is stabilizing despite a drop in trading volume, supported by steady market interest. Large holder activity shows accumulation and profit-taking, contributing to price fluctuations. Technical indicators suggest consolidation, with the potential for a breakout if buying pressure increases.

FAQs

What is Chainlink (LINK)?

Chainlink is a decentralized oracle network that enables smart contracts to interact with real-world data and APIs securely.

Why is LINK’s price consolidating?

LINK stabilizes due to reduced trading activity and balanced buying and selling pressure among investors.

What does a negative CVD indicate?

A negative CVD means selling pressure is dominant, leading to lower-level price declines or stabilization.

What is the significance of large holder inflows and outflows?

Large holder inflows indicate buying by whales, while outflows suggest selling or redistribution, impacting price movements.

What are the key resistance and support levels for LINK?

Current resistance is near $16, while support is around $14, defining the short-term trading range.

Glossary

Market Capitalization: The total value of all coins in circulation, calculated by multiplying the price per coin by the total supply.

Fully Diluted Valuation (FDV): The total market value if all tokens were circulated.

Large Holder Inflows: The total amount of LINK purchased by major investors or whales.

Large Holder Outflows: The total amount of LINK sold or moved by major investors.

Cumulative Volume Delta (CVD): An indicator showing net buying and selling pressure in the market.

Funding Rate: The fee paid between long and short traders in futures contracts to maintain price equilibrium.

Open Interest: The total number of outstanding derivative contracts, indicating market participation.