The Chainlink price spiked 13 percent to $13.51 on June 24 after Mastercard said it will route card payments through Chainlink’s CCIP, letting customers purchase crypto directly on-chain. The headline recast the Chainlink price as a barometer for TradFi-DeFi adoption.

Mastercard’s 3 Billion Cardholders Meet DeFi

Shift4 processes the swipe, ZeroHash handles compliance, XSwap taps Uniswap liquidity, and Chainlink oracles move settlement data across blockchains. Executives dubbed it “card rails converging with permissionless finance.” That narrative juiced the Chainlink price, which doubled Bitcoin’s gain.

LINK Outruns the Market

Spot turnover on Binance quadrupled and perpetual open interest jumped 18 percent, eclipsing Solana and Ethereum flows. The Chainlink price commanded 6 percent of total crypto volume, underscoring strong sponsorship.

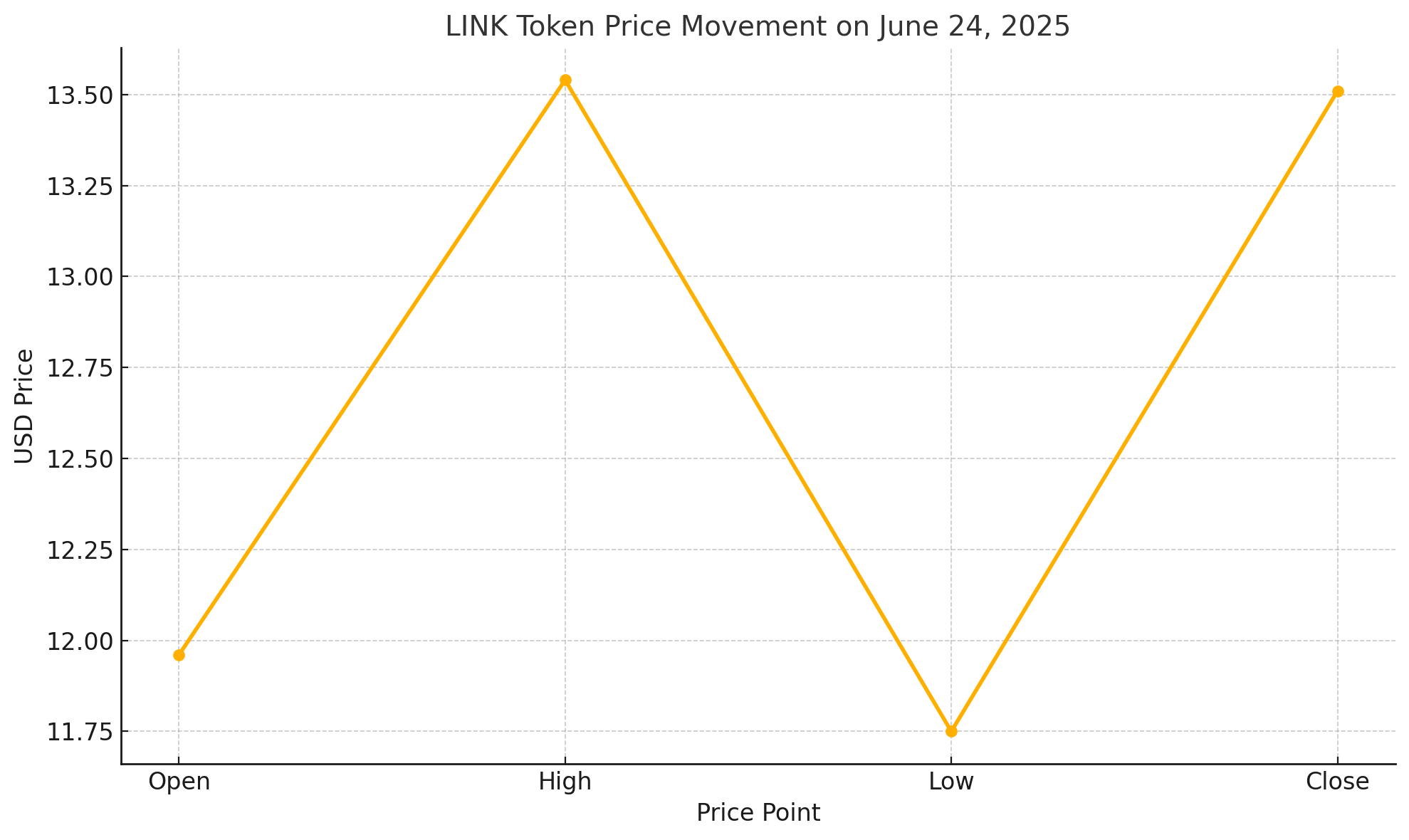

| Daily Candle (24 Jun 2025) | Open | High | Low | Close |

|---|---|---|---|---|

| LINK | 11.96 | 13.54 | 11.75 | 13.51 |

Technical Outlook: $15 in Sight?

RSI reads 67, firm yet cautious, while a golden cross shows the 50-day EMA above the 200-day. Traders eye $13.90; a decisive close could launch the Chainlink price toward $15.20.

| Key Levels | Support | Resistance |

|---|---|---|

| LINK | $12.80 | $13.90 |

Mastercard’s Chainlink Signals a Shift in Crypto’s Real-World Utility

The Mastercard–Chainlink integration isn’t just hype, it’s a seismic signal that traditional finance is finally embracing decentralized infrastructure for everyday use. For years, the barrier between fiat and crypto has been friction-filled: clunky interfaces, KYC roadblocks, and off-chain dependencies.

Chainlink’s CCIP breaks that wall by enabling seamless, trust-minimized messaging between payment processors and smart contracts. This puts LINK at the heart of an on-chain value flow potentially worth billions.

From an investment standpoint, this partnership transforms the Chainlink price from a speculative oracle play into a measurable proxy for adoption. Every transaction routed via CCIP triggers a fee, paid in LINK. The more Mastercard scales this system, the greater the demand for LINK tokens, both as gas and as a staked asset by node operators.

With over 3 billion Mastercard users in scope, even marginal adoption could drive consistent utility demand and potentially tip LINK into deflationary territory once full burn mechanics under Chainlink Economics 2.0 go live.

Why the Chainlink Mastercard Partnership Matters

CCIP lets metadata, price feeds, and KYC flags glide across chains without custodial trust, and every oracle call is paid in LINK. If 0.5 percent of Mastercard swipes migrate on-chain, fee revenue could eclipse annual token inflation, cementing structural demand for the Chainlink price.

Risks and Catalysts

EU spend caps and U.S. stablecoin bills may slow expansion, which could cap momentum. Conversely, a Visa copycat deal or a flawless July pilot would add fresh tailwinds.

Investor Takeaway

Staking v0.2 already locks 46 million LINK, node revenue is climbing, and developer counts rose 24 percent in Q2, metrics that underpin confidence. Beyond raw demand, LINK tokenomics improve in December when fee-capture burns start under Chainlink Economics 2.0, potentially making LINK net-deflationary if Oracle use surpasses issuance.

That looming supply squeeze, layered atop the Mastercard funnel, could anchor the Chainlink price for years. On-chain Glassnode data shows wallets holding 100k–1 m LINK grew 8 percent since May. Staking yields, meanwhile, hover near 4 percent, giving holders passive income during consolidation. Yield and burn mechanics entice long-only funds, a backdrop that may keep the Chainlink price resilient.

Conclusion on Chainlink price

A heavyweight TradFi ally, breakout volume and bullish chart signals have shoved LINK back into the spotlight. As pilots go live, the Chainlink price could become crypto’s prime adoption thermometer.

Summary

Mastercard’s CCIP integration jolted LINK to $13.51, putting the Chainlink price on traders’ radar. Golden-cross momentum, soaring liquidity and a unique 3 billion-user on-ramp make $15 plausible, yet regulatory headwinds persist. For now, the Chainlink price shines as a liquid proxy on the next wave of TradFi-DeFi convergence.

FAQs

What triggered the latest Chainlink price jump?

A confirmed Mastercard partnership using Chainlink’s CCIP for on-chain card purchases.

When will consumers notice changes?

A closed Mastercard pilot starts in July 2025 with phased global expansion by Q4.

Could LINK retrace sharply?

Failure to clear $13.90 or adverse regulation could send it back to $12.80 support.

Glossary

Chainlink price — Market value of LINK, the token securing Chainlink oracles.

CCIP — Cross-Chain Interoperability Protocol moving data across blockchains.

Oracle — Middleware feeding off-chain data to smart contracts.

Fiat on-ramp — Service converting traditional currency into crypto.

Golden cross — Bullish chart pattern where the 50-day EMA rises above the 200-day EMA.