Chainlink is making waves in the tokenization industry with its latest innovation: the Digital Assets Sandbox (DAS). This new turnkey solution is designed for institutions eager to conduct tokenization trials. It promises to accelerate digital asset innovation and open new doors for financial institutions. Let’s delve into what this means for the future of finance.

Unveiling the Chainlink Tokenization Sandbox

The Chainlink tokenization sandbox, known officially as the Digital Assets Sandbox (DAS), is a groundbreaking development aimed at financial institutions. It offers a secure environment for institutions to experiment with digital asset innovation. This includes opportunities like bond tokenization, which can be explored with greater efficiency and speed.

Angela Walker, the global head of banking and capital markets at Chainlink Labs, highlighted the demand for such a platform. “The Chainlink Digital Asset Sandbox addresses this need by enabling institutions to create rapid Proof of Concepts in days, not months, and leverage Chainlink Labs’ experience in research and development to bring these use cases to life,” Walker shared in an announcement with news reporters.

Driving Innovation with Chainlink Tokenization Sandbox

The introduction of the Chainlink tokenization sandbox responds to the increasing institutional demand for secure digital asset experimentation environments. By providing this sandbox, Chainlink is empowering large institutions to innovate more freely and develop new blockchain use cases.

Walker further explained, “The institutional world needs access to the blockchain industry, and Chainlink is the safe and secure standard that has the capabilities to facilitate onchain finance at scale, improving financial industry infrastructure.” This highlights the importance of having a reliable and secure platform like the Chainlink tokenization sandbox.

Expanding Horizons Beyond Bond Tokenization

The Chainlink tokenization sandbox is not limited to bond tokenization alone. It offers institutions ready-to-use digital asset workflows, enabling them to experiment with real-world asset (RWA) tokenization. This capability helps institutions build stronger business and investment cases for their digital asset strategies.

Kevin Johnson, head of Euroclear’s innovation competence centre, emphasised this: “The Digital Asset Sandbox provides market participants with a safe environment where financial institutions and fintechs alike can experiment and understand how the technology impacts operating and business models.” Thus, The Chainlink tokenisation sandbox is a vital tool for financial institutions looking to explore and harness the power of digital assets.

The Future of Tokenization: A Multitrillion-Dollar Opportunity

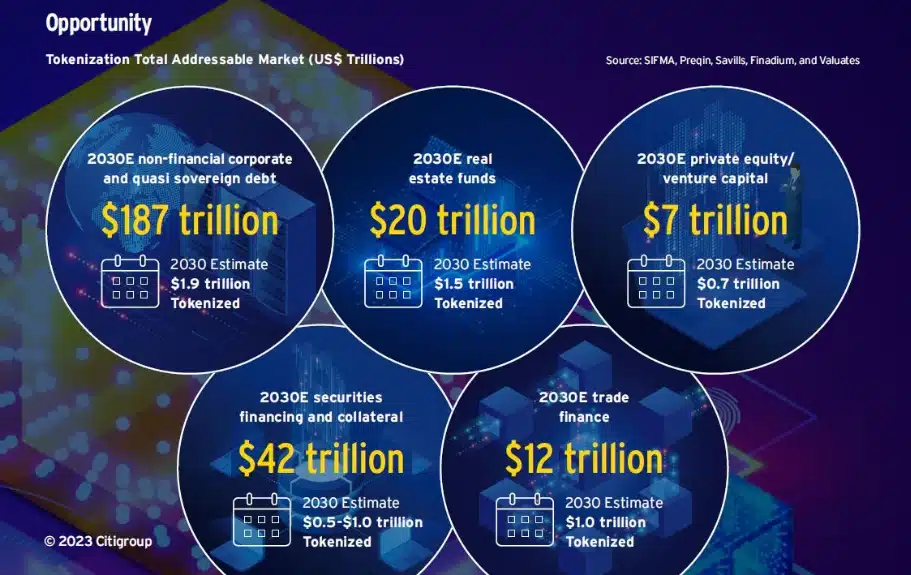

Tokenization is poised to become a significant market opportunity, with estimates suggesting it could grow into a $16 trillion market by 2030. The Global Financial Markets Association (GFMA) and Boston Consulting Group have released a report predicting this substantial growth in tokenized illiquid assets.

Even more conservative estimates from Citigroup indicate that $4 trillion to $5 trillion worth of tokenized digital securities will be minted by 2030. According to Northern Trust and HSBC, 5% to 10% of all assets could be digitally tokenized by that year. The Chainlink tokenization sandbox is well-positioned to play a crucial role in this burgeoning market, providing the necessary infrastructure for institutions to participate in this digital revolution.

Conclusion

The Chainlink tokenization sandbox is a pioneering solution that offers financial institutions a secure and efficient platform to explore digital asset innovation. Its ability to facilitate rapid Proof of Concepts and provide a safe environment for experimentation will drive significant advancements in the tokenization industry.

As the market for tokenized assets continues to grow, the Chainlink tokenization sandbox will likely become an essential tool for institutions looking to stay ahead of the curve. By leveraging the expertise of Chainlink Labs and providing ready-to-use digital asset workflows, this sandbox is poised to revolutionise how financial institutions approach digital assets.

In summary, the Chainlink tokenization sandbox is not just a technological innovation but a gateway to the future of finance. Its introduction marks a significant milestone in the journey towards a more digital, efficient, and secure financial landscape.