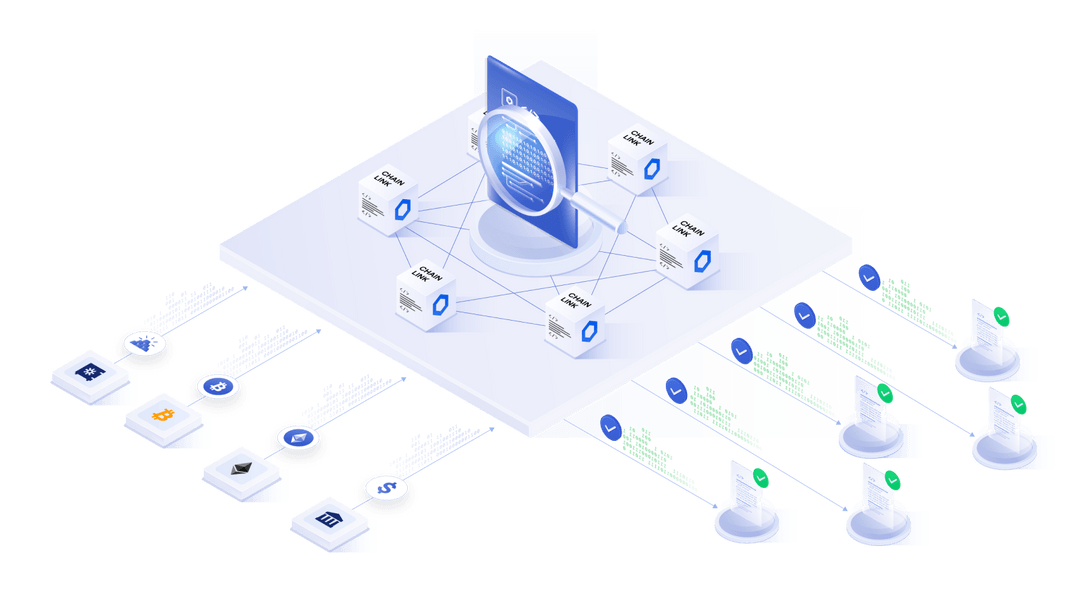

Zoniqx, a platform for tokenizing real-world assets, has integrated Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Proof of Reserve solutions on Ethereum. This integration aims to enhance the tokenization process, providing users with seamless and secure management of digital assets.

Partnership Details: Integration and Benefits

Official reports note that Zoniqx announced this week that it would integrate Chainlink’s solutions into its DyCIST and TALM platforms. Available data explains that DyCIST is Zoniqx’s Dynamic Compliant Interoperable Security Token, designed to revolutionize how assets are tokenized, managed, and exchanged. TALM, on the other hand, is its Tokenized Asset Lifecycle Management solution, which covers the entire digital lifecycle of an asset.

Zoniqx, a company whose platform reportedly offers users seamless and interoperable tokenization solutions, believes that integrating Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Proof of Reserve will unlock new capabilities. As per reports, these integrations will enhance transparency, security, and interoperability, which is crucial for the tokenization industry.

Chainlink’s sophisticated payment infrastructure will be integrated into Zoniqx’s robust blockchain and decentralized finance (DeFi) ecosystem. This partnership is expected to streamline digital payments, offering faster and more efficient transactions for users worldwide. The integration will support various functionalities within Zoniqx’s app, including real-time transaction processing, multi-currency support, and enhanced security features.

Sources reveal, Chainlink’s CCIP is a global leader in cross-chain interoperability, with several dozen blockchains using it to open their networks to other ecosystems. The protocol’s presence spans major blockchains, including Ethereum, Polygon, BNB Chain, and Arbitrum. “Without CCIP as a standardized protocol, developers would face the daunting task of creating bespoke solutions for each cross-chain interaction—an inefficient and costly endeavour,” Zoniqx explained in a press release.

Chainlink and Zoniqx Target the $16 Trillion Tokenization Industry

According to industry reports, tokenization is expected to unlock $16 trillion by the end of the decade. Zoniqx is positioning itself to exploit this market by providing end-to-end tokenization solutions, from security token issuance to liquidity management and secondary trading. Its EVM-based proprietary platform is interoperable with several networks, opening up more opportunities for users.

Zoniqx CEO Prasanth Kalangi commented, “By integrating Chainlink CCIP and Proof of Reserve, we are significantly enhancing the security and transparency of our tokenization solutions, improving RWA transparency, and enhancing the way assets are managed and traded globally.”

The integration will reportedly allow automation through Zoniqx’s ecosystem of SDKs and APIs, making the tokenization process more efficient and cost-effective. This will attract more users to the platform, driving growth in the tokenization market.

Future Plans of Zoniqx

Zoniqx has ambitious plans for the future. Insider’s claims that the company aims to leverage Chainlink’s solutions to expand its tokenization capabilities further. The integration of Chainlink’s Proof of Reserve will ensure that tokenized assets are fully backed, enhancing transparency and trust in the platform.

Zoniqx has already allegedly achieved significant milestones, including a $3.2 billion commercial real estate tokenization project, tokenized bank deposits, and corporate equity and venture capital funding tokenisation. These projects highlight the platform’s potential and its commitment to innovation in the tokenization industry.

Meanwhile, media outlets report that LINK trades at $13.9, dipping 1.5% in the past day as the overall market cap went down by 1.09%. Zoniqx has anchored notable projects, reportedly including the tokenization of a $3.2 billion commercial real estate project using its TPaaS technology. The integration with Chainlink is expected to further streamline these projects, enhancing their security and efficiency.

Proof of Reserve: The Key to Secure and Transparent Tokenization with Chainlink

The integration of Chainlink’s CCIP and Proof of Reserve solutions into Zoniqx’s platforms marks a significant step forward for the tokenization industry. By enhancing interoperability, security, and transparency, this partnership is set to revolutionize how assets are tokenized and managed.

Investors and users are advised to stay informed about these developments, as the evolving landscape of digital currencies and tokenization continues to offer new opportunities. The integration of Chainlink’s advanced solutions within Zoniqx’s platform exemplifies the dynamic nature of the cryptocurrency market and its potential for growth and innovation.

As the market continues to evolve, partnerships like these will play a crucial role in driving the adoption of blockchain technology and enhancing the utility of digital assets. The future looks promising for both Chainlink and Zoniqx as they work together to unlock the full potential of tokenization. Follow The BIT Journal to learn more about crypto news and updates.