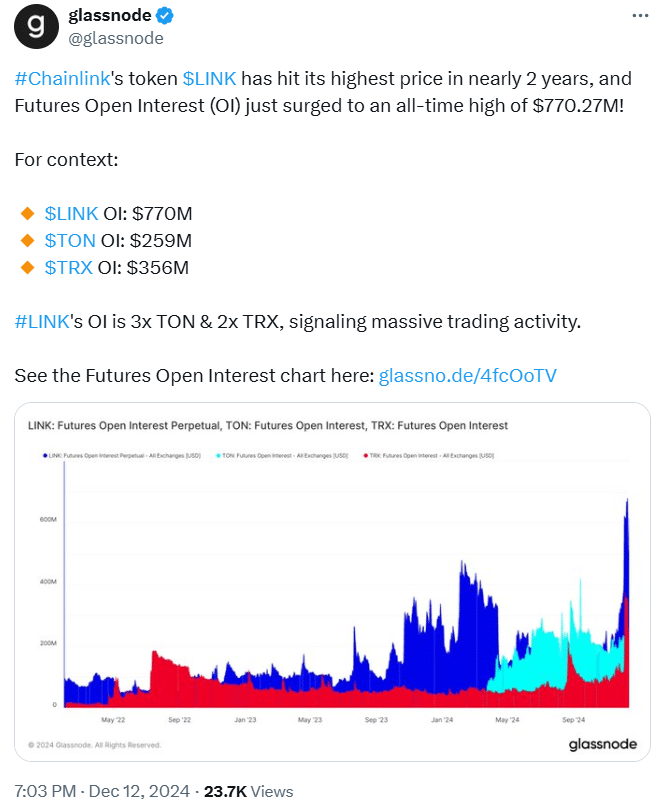

Chainlink (LINK) reached its highest in nearly three years on December 12, as LINK’s price climbed above $29 for the first time since January 2022. This came as the contract size surged to the highest-ever open interest (OI) of $770.27 million. The increase in both price and OI indicates more positivity within the market, and more so, investors are placing large bets on Chainlink’s future price appreciation.

Glass node, a premier on-chain analytics provider, recently revealed data showing that Chainlink’s open interest had gone beyond that of other competitors. It was almost three times more than Toncoin (TON) and twice that of TRON (TRX). In particular, OI for TON was $259 million, and for TRX—$356 million.

Chainlink’s Bullish Fundamentals

The futures market retains a positive outlook for the asset, but there is evidence of traders taking profits. According to Glassnode data, Chainlink had the second-best profit-taking event in the year on December 11 with $35.57 million in the realized profits. The first one was in February when $40.39 million in profits were made. As is often the case, the profit-taking was mainly done by the speculative traders. Ultra short term traders who hold positions for less than a week took 15.3% of the profits while those with holding periods of between 3 to 6 months took 22.5% of the profits.

However, the long-term holders of Chainlink were still inactive as usual despite the profit-taking. The 1-2 year cohort was the only cohort that had any appreciable movement. According to Glassnode, the overall market sentiment remained bullish. The firm noted, however, that bulls are still in control following the enhancement of fundamentals, meaning that the short-term declines for Chainlink are not necessarily bearish for the long term.

Growing Active Addresses

The network’s active addresses have been increasing, short-term SMA stands at 6,682 while the long-term SMA stands at 5,878. However, active addresses are still much behind their all-time high of 23,416 recorded back in 2021. This also shows that there is a need to expand the network in terms of the number of users.

At the time of writing, LINK is priced at $28.98, which is a 20.54% increase in the past week and 116.8% increase in the last month. This large price action has occurred in tandem with crucial partnerships and integrations that are only boosting Chainlink’s standing within the crypto market.

Among the most recent ones, there was a partnership with World Liberty Financial, a crypto project created with the idea of Trump. In November, World Liberty Financial said that it will integrate Chainlink’s oracle to help bring DeFi to the masses. This partnership shows how Chainlink’s decentralized oracles are becoming more relevant across industries.

Strategic Partnerships Strengthen Chainlink

One other strategic relationship is with Emirates NBD Digital Asset Lab to support asset tokenization and digital asset management. Besides, LINK has partnered with large financial organizations such as Swift, SBI, and UBS. These partnerships will go a long way in cementing Chainlink’s position as one of the major oracle providers in the decentralized finance marketplace.

However, there are still many positive sentiments from the analysts regarding Chainlink’s future. The adoption of the decentralized oracle solution and the partnerships that the network has established put the network in a good place for the future. The current strong fundamentals and low investor sentiment shown by the record open interest make it likely that LINK could increase in the next few months.

The impressive price surge of LINK and the record futures open interest show that there is a high possibility of a bullish trend in the network. Although there has been some profit-taking, especially in the short term, the long-term position is still strong. With the network building important partnerships and growing its ecosystem, LINK seems ready to stay relevant in the rapidly developing world of cryptocurrencies.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.