Cardano co-founder Charles Hoskinson has rekindled controversy in the cryptocurrency market by saying that ADA might outperform Bitcoin by up to 100x or 1000x. While the speech has sparked hope among $ADA supporters, experts are split on whether such high expectations can be met in the present market environment.

$ADA’s Market Context and Potential Upside

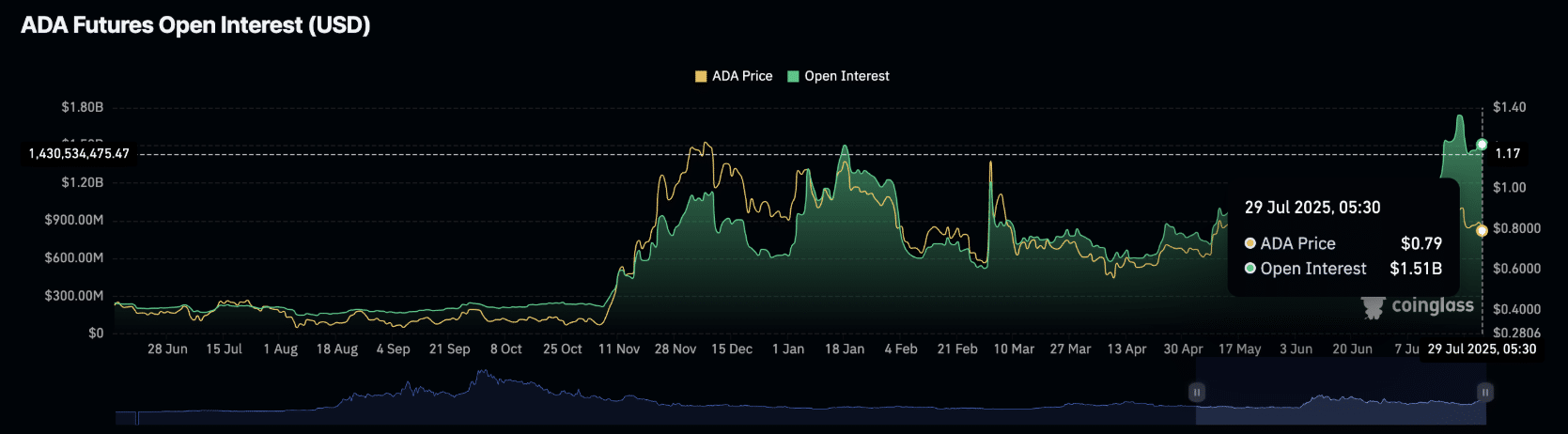

Cardano’s ADA coin is presently trading at $0.79 following a turbulent week that witnessed an 8.8% drop. Market experts are looking for critical resistance levels between $0.80 and $0.90, with optimistic aims reaching $1.40 and $1.60 later in 2025.

In contrast, failing to sustain support at $0.75 might bring the token down to $0.60. Hoskinson’s claim that ADA might outperform Bitcoin is partly due to Cardano’s substantially lower market capitalization of about $28 billion vs Bitcoin’s $1.4 trillion market value.

Charles Hoskinson said, “ADA might accomplish 100x or 1,000x. We are not second-class citizens. Cardano accomplishes much more, and it will eventually become the yield layer of Bitcoin DeFi.” His views reflect his long-held opinion that Cardano’s ecosystem is more useful than Bitcoin’s existing role as a store of wealth.

Price Table: ADA vs. Bitcoin Projections

| Asset | Current Price | Bullish 2025 Target | Bearish 2025 Target |

|---|---|---|---|

| ADA | $0.79 | $1.50 – $2.00 | $0.60 – $0.75 |

| Bitcoin | $68,200 | $85,000 – $100,000 | $55,000 – $60,000 |

The projections highlight the relative upside ADA could achieve compared to Bitcoin if the market sees a resurgence in altcoin dominance. Traders note that a break above $1.00 for ADA could signal the beginning of a stronger rally toward the $2.00 region.

Charles Hoskinson’s Bitcoin DeFi Vision

Hoskinson’s forecast that ADA would outperform Bitcoin is also based on Cardano’s long-term plan of tight integration with the Bitcoin network. The creator sees $ADA serving as a yield-generating layer for Bitcoin’s decentralized finance (DeFi) ecosystem.

Cardano holders might receive staking incentives and get access to more tokens via sidechains and smart contract-enabled features, transforming ADA into an income-generating asset.

Recent innovations, like as the Midnight sidechain and the impending NIGHT token airdrop, are essential to this ambition. These initiatives seek to improve Cardano’s privacy features and broaden its use cases, which Hoskinson thinks might dramatically increase the token’s market value in the long term.

Cardano’s Smaller Market Cap Opens the Door for Explosive Growth

One of the biggest grounds for Charles Hoskinson’s bold assumption that #ADA may outperform Bitcoin is Cardano’s substantially lower market capitalization. With Bitcoin now worth over $1.4 trillion, attaining another 100x return is practically unachievable without tremendous worldwide acceptance.

Cardano, on the other hand, has a market capitalization of about $28 billion, which allows for significant exponential growth if adoption increases. Analysts believe that Cardano’s active development, expanding DeFi ecosystem, and integration plans with Bitcoin’s yield layer might serve as major drivers.

This relative size advantage distinguishes ADA as a high-yield asset for investors looking for growth beyond Bitcoin’s more cautious trend.

Technical Signals and Market Sentiment

While Hoskinson’s bold prognosis is appealing, technical indications paint a mixed picture. Derivatives open interest for ADA has plummeted to $1.51 billion, indicating a decline in confidence among leveraged traders.

The spot taker cumulative volume differential also indicates significant selling pressure, although on-chain data, such as realized capitalization, indicate that investors are gradually returning to ADA accumulation.

Market analysts feel that recovering $1.00 is key for ADA’s momentum to become strongly positive. Without this breakthrough, the token may continue to fall behind Bitcoin in the immediate future, despite Hoskinson’s confidence.

Conclusion

Charles Hoskinson’s conviction that ADA may outperform Bitcoin by up to 100 times is both ambitious and representative of Cardano’s larger goals. While the route to such exponential growth is unknown, the network’s expanding ecosystem, lower market capitalization, and ambitions for integration with Bitcoin’s DeFi architecture may create a basis for long-term appreciation.

For investors, the next several months will be essential in evaluating if ADA can overcome major resistance levels and live up to Hoskinson’s big projection.

FAQs

Can ADA really outperform Bitcoin?

Hoskinson believes ADA’s smaller market cap and broader utility give it exponential upside over Bitcoin’s projected growth.

What would 100x gains for ADA mean?

At current prices, a 100x increase would place ADA around $79, while a 1000x rise would value it near $790.

What price levels should traders watch?

The $1.00 resistance remains key, with bullish targets of $1.50 to $2.00 if broken. Failure to hold $0.75 could lead to further downside.

Glossary

Outperform Bitcoin: Achieving higher returns or adoption compared to Bitcoin over a specific period.

Yield Layer: A blockchain function enabling holders to earn rewards through staking and DeFi activities.

Open Interest: The total number of active derivatives contracts, often used to gauge market sentiment.

Sidechain: A separate blockchain interoperable with a main chain like Cardano, enabling additional features.