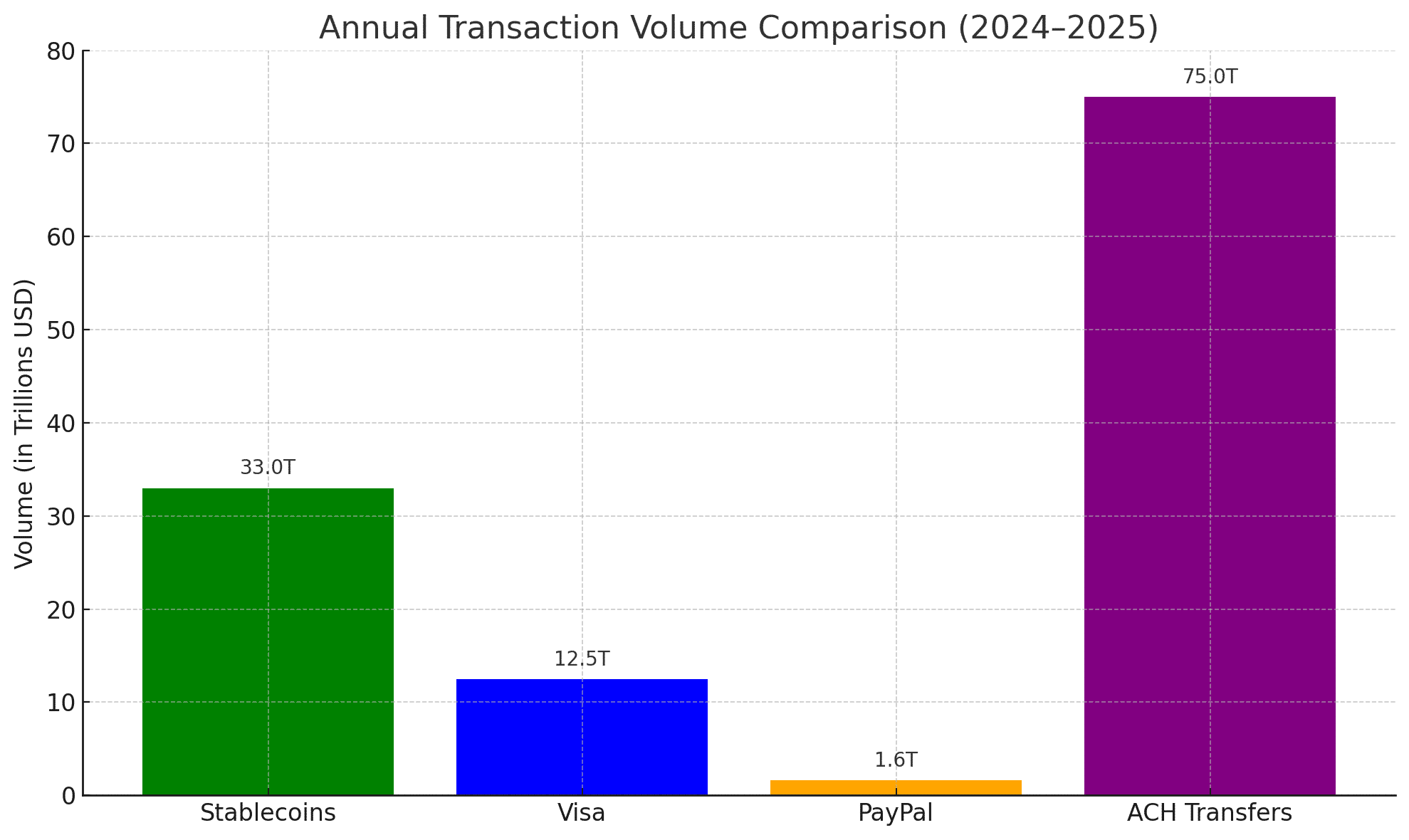

Stablecoins have quietly become the powerhouse of the digital asset economy, processing over $33 trillion in transactions in the past year alone. Yet, despite their soaring volumes and increasing adoption, the crypto industry is still waiting for a transformative tipping point. According to Jeremy Allaire, CEO of Circle, that moment, similar to the iPhone’s revolution of the internet, is still on the horizon.

“Stablecoins are the highest utility form of money ever created,” Allaire told CryptoSlate. “But we haven’t hit the iPhone moment yet.”

That moment, he explains, will arrive when developers begin widely building applications using programmable, permissionless digital dollars, opening up frictionless financial experiences for billions of users.

What Makes Stablecoins So Powerful?

Stablecoins like USDC (by Circle) and USDT (by Tether) are digital representations of fiat currencies, typically pegged to the U.S. dollar. They combine the trust and stability of traditional money with the efficiency, speed, and programmability of blockchain technology.

Today, stablecoin transactions cost less than $0.01 and settle in under a second, making them ideal for remittances, commerce, payroll, and lending. According to MarketWatch, the total stablecoin supply now exceeds $247 billion, accounting for nearly 10% of the U.S. M2 money supply.

Yet even with this scale, Allaire believes the full potential remains untapped.

“Programmability, cost-efficiency, and accessibility are all here,” he said. “What’s missing is the killer app that brings it to everyone.”

The “iPhone Moment” Analogy

Allaire’s reference to the iPhone isn’t about hardware but mainstream usability.

Just as Apple’s smartphone catalyzed an era of mobile-first development, the crypto sector is waiting for a single, seamless user experience that will drive mass adoption of stablecoins in everyday life.

“Think of an app where your paycheck auto-deposits in USDC, your bills auto-pay, you invest with DeFi yields, and spend instantly with global merchants,” explained Allaire. “That’s the leap we’re waiting for.”

Retail and Institutional Adoption is Brewing

That leap may be closer than it seems. According to Crypto Times and Cointelegraph, retail giants like Amazon, Walmart, and Shopify are exploring stablecoin integration for faster, cheaper settlement.

Fintech companies are also expanding in the space. Multiple sources report that stablecoins are already embedded into cross-border payment rails, payroll services, and even mortgage lending experiments in emerging markets.

Meanwhile, stablecoin infrastructure—SDKs, APIs, and compliance tooling, is being aggressively built out, particularly by Circle and its competitors.

Regulatory Momentum Building in the U.S.

Behind the scenes, the regulatory tide is shifting. Legislators are weighing bills like the GENIUS Act and the STABLE Act, both of which aim to:

Require stablecoin issuers to be licensed.

Mandate that reserves be held in insured institutions.

Apply anti-money laundering (AML) and disclosure standards.

Reuters reported that Circle’s pending IPO has brought increased scrutiny to stablecoin operations, with regulators aiming to bring transparency and oversight to a fast-growing financial segment that could rival traditional banks in influence.

Risk Factors: Will Stablecoins Destabilize the Financial System?

While stablecoin innovation excites crypto insiders, some financial watchdogs are concerned. The Wall Street Journal and Financial Times have both warned that stablecoins backed by uninsured reserves or opaque instruments could pose systemic risk, particularly if adoption accelerates without regulatory safeguards.

The worry is that mass withdrawals from stablecoins could trigger panic in the traditional financial system, especially if reserves are mismanaged or rehypothecated.

“If $250 billion of shadow banking suddenly becomes liquid and volatile, it’s a systemic event,” warned one former Fed economist in the FT.

The Bottom Line: Stablecoins Are Inevitable, But Need Their ‘iPhone’

There’s no denying it—stablecoins are transforming money. With their fast settlement, low fees, and programmability, they’ve already surpassed traditional banking rails in utility.

But to go mainstream, stablecoins need more than blockchain tech; they need intuitive, real-world applications that bridge the usability gap.

That’s the “iPhone moment” Circle’s Jeremy Allaire is waiting for. And when it arrives, it won’t just reshape crypto, it could redefine how we think about money entirely.

FAQs

What does Jeremy Allaire mean by the ‘iPhone moment’ for stablecoins?

He refers to a future breakthrough where stablecoins become as widely adopted and easy to use as the iPhone made smartphones.

Why are stablecoins called the highest utility form of money?

Because they combine the stability of fiat with the speed, programmability, and low cost of blockchain technology.

Are stablecoins regulated in the U.S. yet?

Not fully. Laws like the GENIUS and STABLE Acts are being considered to regulate stablecoin issuers and ensure financial safety.

Glossary of Key Terms

Stablecoin

A type of cryptocurrency pegged to the value of a traditional asset, usually the U.S. dollar, to minimize volatility.

USDC

USD Coin, a leading regulated stablecoin issued by Circle, fully backed by dollar reserves.

Programmable Money

Digital currency that can be embedded with code to automate financial actions like payments, interest, and permissions.

GENIUS Act / STABLE Act

Proposed U.S. legislation aimed at regulating stablecoin issuers by imposing licensing, reserve, and AML requirements.

iPhone Moment

A metaphor for a major usability breakthrough that leads to mass adoption—similar to how the iPhone revolutionized mobile tech.

Reserve Assets

The real-world funds or assets held by a stablecoin issuer to back the digital tokens in circulation.