Circle has officially launched its USD Coin (USDC) stablecoin on the XRP Ledger (XRPL) mainnet. The move allows native support for USDC without third-party tools or bridges. Developers and users can now access high-speed, secure transactions directly on XRPL using USDC.

This expansion is part of Circle’s broader multi-chain strategy to increase USDC’s accessibility. After its launches on World Chain and Sonic, XRPL becomes the 22nd blockchain to support USDC. The integration enables seamless liquidity paths across blockchain ecosystems.

With a market capitalization of $61 billion, USDC remains the second-largest stablecoin globally, just behind Tether’s $155 billion market cap.

USDC Launch on XRPL Expands Multi-Chain Strategy

Circle selected the XRP Ledger due to its trusted infrastructure and quick settlement capabilities. The ledger supports fast and cost-effective transactions, making it ideal for USDC’s operations. The native launch eliminates cross-chain barriers and enables efficient app development.

USDC is now live on the XRP Ledger (@RippleXDev)!

With the launch of native @USDC on the XRPL, developers, institutions, and users gain the support of the world’s largest regulated stablecoin.

✅ Enterprise B2B payments: Use USDC for global money movement and improve capital… pic.twitter.com/WjXr7ui2Kp

— Circle (@circle) June 12, 2025

The deployment allows projects to issue, transfer, and use USDC without relying on external chains. This reduces both transaction risk and operational complexity. Businesses now gain better liquidity access within XRPL’s environment.

USDC’s integration marks a notable milestone for XRPL’s cross-chain capabilities. The network’s enhanced support for stablecoins strengthens its appeal to enterprises and developers. With this launch, Circle builds on its ongoing efforts to expand USDC utility.

OUSG Joins XRPL, Bringing Tokenized Treasuries to the Network

Ondo Finance has launched its tokenized US Treasury product, OUSG, on the XRP Ledger. The expansion follows previous deployments on Ethereum, Polygon, and Solana. This move gives institutional investors another route to access tokenized U.S. Treasuries.

The integration enables direct subscriptions and redemptions using Ripple’s RLUSD stablecoin. This increases efficiency for institutional workflows operating on XRPL. It also supports XRPL’s growing focus on real-world asset tokenization.

With a $692 million market value, OUSG is one of the largest tokenized Treasury funds available. Its launch on XRPL diversifies investor access and expands liquidity options. XRPL continues to attract institutions by adding regulated asset platforms.

Guggenheim’s DCP Platform Launches on XRP Ledger

Guggenheim Treasury Services has introduced its Digital Commercial Paper (DCP) platform on XRPL. This follows its Ethereum deployment and offers blockchain-based access to short-term debt instruments. The platform is backed by U.S. Treasury bonds and offers customized maturity options.

To date, DCP has handled over $280 million in issuances. The shift to XRPL reflects growing interest in scalable and cost-efficient alternatives. XRPL’s low fees and finality make it suitable for enterprise-grade financial instruments.

Ripple has pledged a $10 million investment into the DCP platform. This underlines Ripple’s commitment to expanding XRPL’s financial infrastructure. It also signals confidence in XRPL’s potential for institutional-grade products.

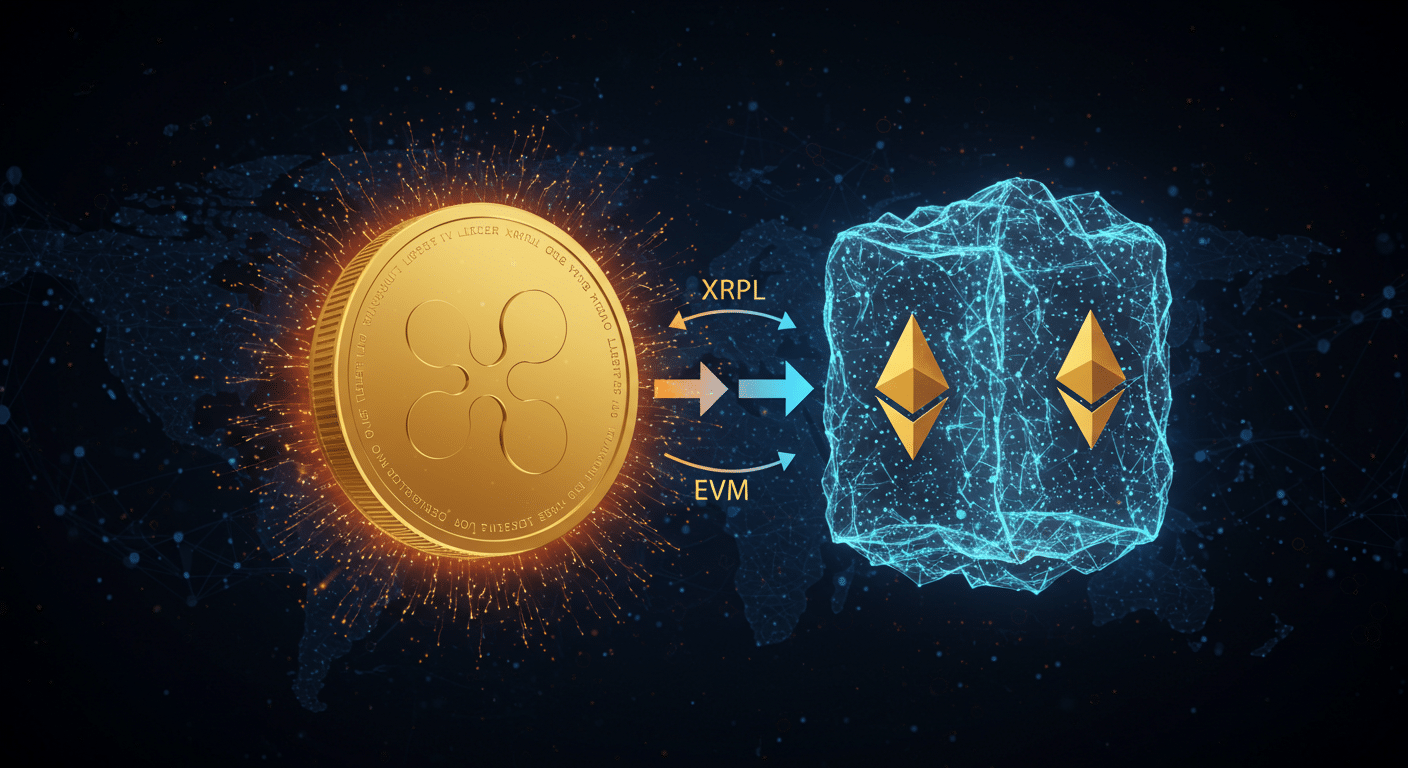

XRPL to Gain Ethereum-Compatible EVM Sidechain

Ripple CTO David Schwartz confirmed that XRPL will integrate an Ethereum Virtual Machine (EVM) sidechain in Q2 2025. The project is being built by Ripple and Peersyst using the evmOS stack. This sidechain is currently running on a testnet.

The EVM-compatible chain will support Ethereum smart contracts while retaining XRPL’s speed and cost efficiency. It will connect to the XRPL mainnet through the Axelar bridge. Wrapped XRP will serve as the gas token on the EVM chain.

The sidechain will unlock new use cases like DeFi and dApps within the XRPL ecosystem. This step broadens XRPL’s utility while enhancing interoperability. It demonstrates XRPL’s strategy to combine compliance, scalability, and smart contract flexibility.

FAQs

What does USDC’s launch on XRP Ledger mean for users?

Users can now access USDC natively on XRPL, removing the need for bridges or third-party tools.

How does this benefit developers?

Developers can build XRPL-based apps with direct USDC integration, simplifying development and improving performance.

Why did Circle choose XRPL for USDC?

Circle selected XRPL due to its security, low fees, and reliable transaction processing.

What is the significance of OUSG launching on XRPL?

OUSG’s launch gives institutions access to tokenized Treasuries on a faster and more efficient network.

What will the EVM sidechain bring to XRPL?

The sidechain will allow Ethereum smart contract support while maintaining XRPL’s speed and efficiency.

Glossary of Key Terms

XRP Ledger (XRPL): A decentralized blockchain known for fast, low-cost transactions and asset tokenization.

USDC: A U.S. dollar-pegged stablecoin issued by Circle, widely used across multiple blockchains.

Stablecoin: A cryptocurrency that maintains a stable value by being pegged to a fiat currency like USD.

EVM (Ethereum Virtual Machine): The runtime environment for smart contracts in Ethereum-compatible systems.

Digital Commercial Paper (DCP): A blockchain-based short-term debt instrument backed by traditional assets.

OUSG: A tokenized money market fund that provides exposure to U.S. Treasuries.

Axelar Bridge: A cross-chain bridge used to transfer assets and data securely between blockchains.

Wrapped XRP: A token representing XRP on other chains, used for interoperability and gas fees.