A new study by banking giant Citigroup has made a bold prediction for the stablecoin market in 2030, giving the likely scenarios in either bullish or bearish market conditions.

According to a report by the group’s research organization, the global stablecoin market could reach highs of $3.7 trillion by 2030 in a bullish scenario with a base case of $1.5 trillion. However, the paper warned that the figure could be as low as $0.5 trillion in a bearish market. Nonetheless, the report remained largely optimistic.

Potential to Transform the Market

The Citigroup prediction for the stablecoin market was based on factors such as whether a percentage of cash would switch domestically and globally and the amount that would remain in bank balances and term deposits.

However, the report observed that the adoption rate of blockchain and cryptocurrency would significantly create stablecoin balances in any possible scenario. While observing that stablecoins had the potential to cause the cryptocurrency market to undergo a historical transformation, the report stated:

“The total outstanding supply of stablecoins could grow to $1.6 trillion by 2030 in our base case and to $3.7 trillion in our bull case […] adoption in the financial and public sector, driven by regulatory change.”

Legislation Could Incentivize Long-Term Growth

The Citigroup report’s “Digital Dollars” drafters preferred to take an optimistic mode considering the emergence of friendly stablecoin regulations being developed worldwide.

The report mentioned the growing integration of stablecoins with the US dollar, adding that the move to legislate stablecoins in the US could incentivize their long-term growth. According to Artem Korenyuk, a managing director at Citi:

“Government adoption of blockchain falls into two categories: enabling new financial instruments and system modernization. Stablecoins are now major holders of US Treasuries, starting to influence global financial flows. Their growing adoption reflects sustained demand for US dollar-denominated assets.”

Drive Net New Demand for US Treasuries

While there was fear about the potential for tailwinds associated with the ongoing process within the US and EU targeting stablecoin legislation, the document was optimistic that their Prediction for the stablecoin market by 2030 would benefit from the great possibility of favorable legislation in most jurisdictions.

The Citigroup report was especially interested in emerging mandates that required stablecoin issuers to hold reserves of US Treasuries. While predicting that there would be non-USD stablecoins, including CBDCs, the report stated that they would ultimately exist on the margins, with 90% of the Prediction for the stablecoin market ultimately sticking with the US dollar. The reports said:

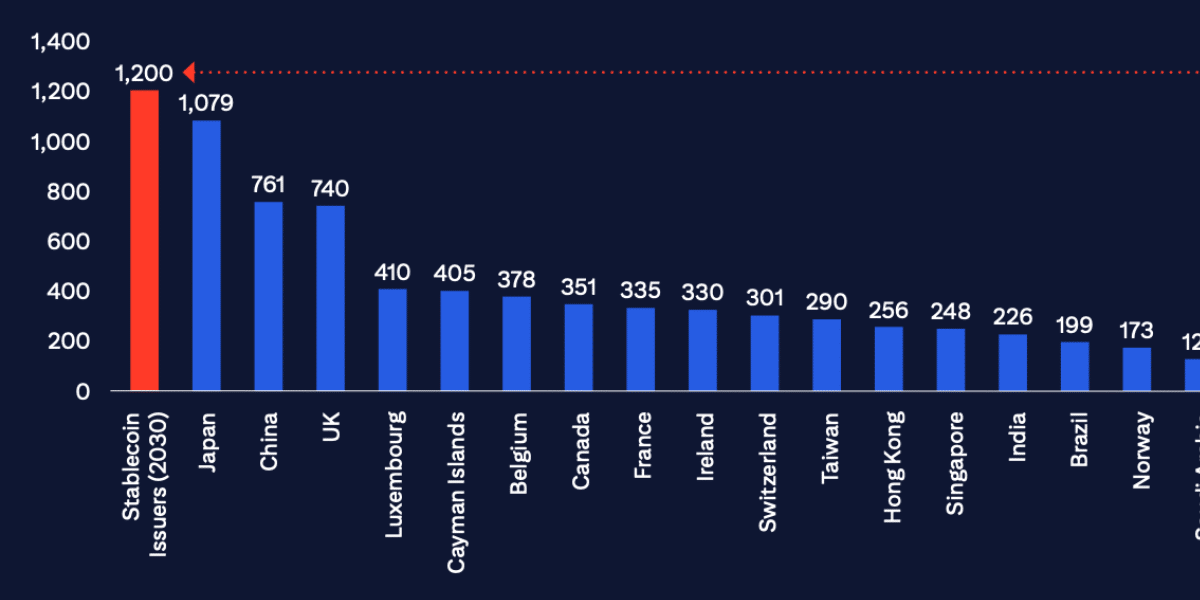

“A U.S. regulatory framework for stablecoins could drive new demand for U.S. Treasuries, making stablecoin issuers among the biggest holders of U.S. Treasuries by 2030.”

Conclusion

As Citigroup makes its bold Prediction for the stablecoin market, it also observes that they could potentially “pose some threat to traditional banking ecosystems via deposit substitution.” However, the success of the stablecoin segment within the crypto space will largely depend on whether they deliver on the promise of efficiency, accessibility, and stability while navigating the complex regulatory landscape that continues to evolve across global jurisdictions.

Frequently Asked Questions

Are stablecoins regulated?

Stablecoins are increasingly being subjected to one form of regulation or another globally, but the specifics will vary from country to country.

Are stablecoins regulated in the US?

An act currently defines stablecoins as a digital asset used for payment or settlement that is pegged to a fixed monetary value. The US President has told legislators to have the stablecoin law ready by August.

Are there countries that have stablecoin regulations in place?

Yes, there are countries such as those in the EU that have MiCA regulations in the early stages of implementation, while the UAE, Japan, Hong Kong, and the UK are also actively considering or implementing stablecoin regulations.

Appendix: Glossary to Key Terms

Stablecoins: Stablecoins are cryptocurrencies whose value is pegged or tied to that of another currency, commodity, or financial instrument.

Bullish market: Having a positive outlook about the price of a particular cryptocurrency, believing it will rise in value.

Bearish market: A market is expected to decline or has already dropped in price.