Brian Armstrong, the CEO of Coinbase, just made a bold prediction that’s turning heads across the finance world. Speaking during the company’s Q4 2024 earnings call on February 13, he declared that blockchain is on track to power 10% of the world’s economy by 2030.

“Onchain is the new online,” Armstrong said, comparing the rise of crypto today to how businesses had to adapt to the internet in the early 2000s. The message was clear—adopt blockchain now, or risk being left behind.

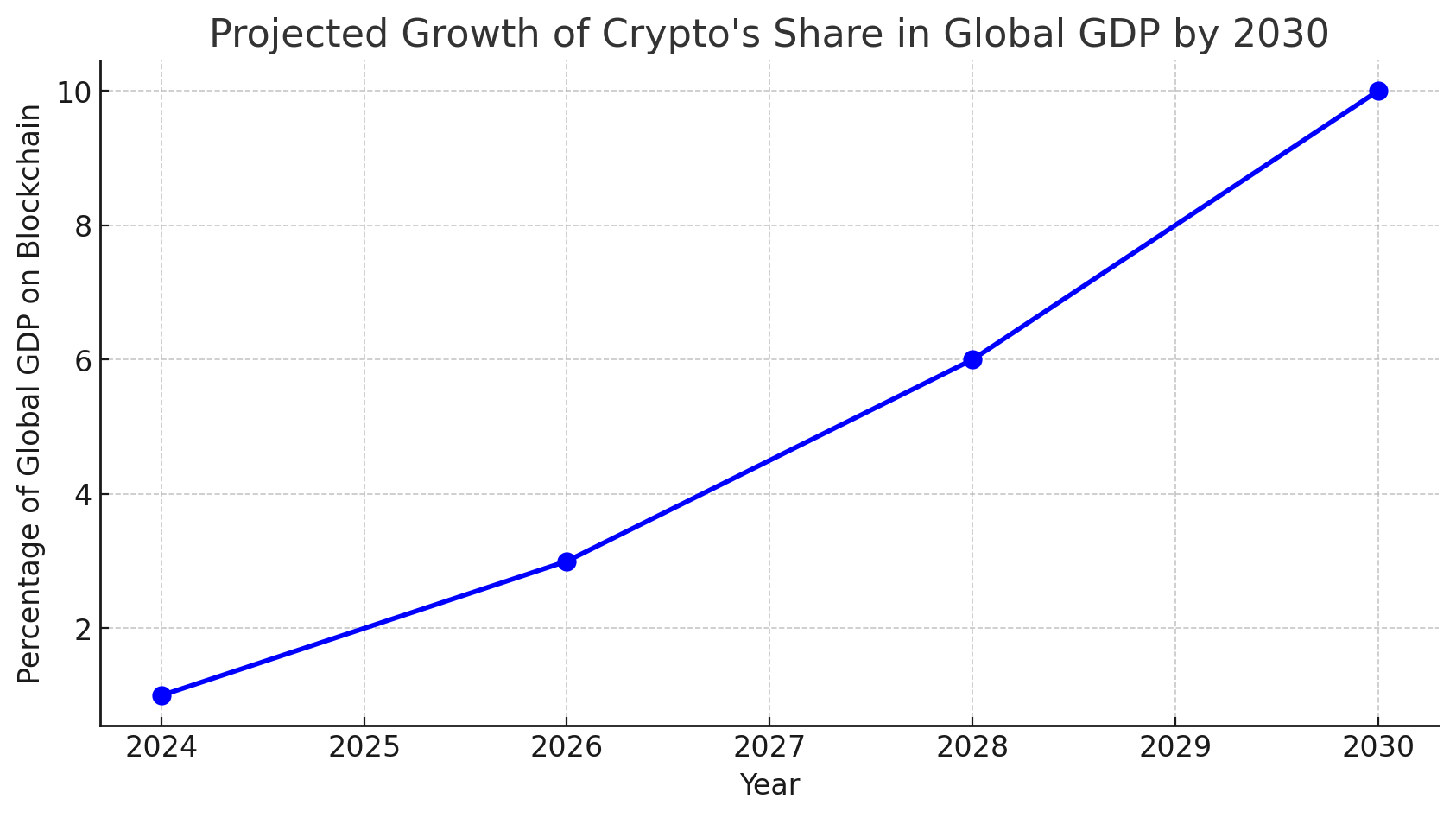

If his prediction plays out, over $10 trillion in global economic value could be running on blockchain networks, based on the World Bank’s estimate of a $100 trillion global GDP. That’s a massive shift in how money moves, and the U.S. is racing to lead the charge.

The U.S. Is Stepping Up Its Crypto Game

For years, the U.S. has been a mixed bag regarding crypto regulations—sometimes welcoming, sometimes outright hostile. But Armstrong believes things are finally shifting in the right direction.

He pointed to President Trump’s fast-moving crypto policies and a more blockchain-friendly Congress as signs that the U.S. is gearing up to dominate the next phase of crypto adoption.

“This is the most pro-crypto Congress we’ve seen,” Armstrong noted, highlighting ongoing efforts to regulate stablecoins and create a clear market structure for digital assets.

He also mentioned Federal Reserve Governor Christopher Waller’s recent push for stablecoin regulations that could allow banks to issue digital assets pegged to the U.S. dollar. If that happens, crypto could be fully integrated into traditional finance faster than most people expect.

Coinbase Is Booming While Expanding Into New Markets

Coinbase isn’t just riding the crypto wave—it’s driving it. The company reported $2.3 billion in Q4 revenue, an 88% increase from the previous quarter, crushing analyst expectations.

Beyond just trading, Armstrong says Coinbase is focused on expanding its revenue streams and increasing blockchain adoption in new markets worldwide.

His plan? Make crypto easier to use and more valuable across different industries. Whether it’s payments, lending, or tokenized assets, Armstrong sees Coinbase as the gateway to the blockchain-powered economy of the future.

Coinbase Now Manages Over $420 Billion in Crypto

If you still think of Coinbase as “just an exchange,” think again. The company now holds over $420 billion in digital assets on behalf of its users—more than the 21st largest U.S. bank in terms of total assets under management (AUM).

Armstrong even pointed out that if Coinbase were classified as a brokerage firm, it would rank as the 8th largest brokerage in the country.

This level of scale puts Coinbase on par with traditional financial giants, showing just how deeply crypto has already embedded itself into the broader financial system.

The Crypto World Is Buzzing About Trump’s Blockchain Play

Armstrong met with some of the biggest names in finance and tech at the World Economic Forum (WEF) in Davos. What was the hottest topic?

Trump’s crypto-friendly stance and how it could reshape digital asset regulations worldwide.

According to Armstrong, discussions about the administration’s blockchain agenda dominated conversations with major financial leaders. Whether people love it or hate it, the message was clear—crypto is no longer a fringe topic.

It’s now a central focus for governments, banks, and financial markets worldwide.

What’s Next for Crypto and the Economy?

With global GDP projected to surpass $100 trillion by 2030, Armstrong’s forecast that 10% of it will be crypto-powered is bold but not impossible.

If blockchain adoption keeps accelerating, we could see entire industries tokenized, traditional banking integrated with crypto, and a financial system where digital assets power everything from international trade to consumer lending.

For investors, this means massive opportunities ahead—but also increased regulatory scrutiny.

The next few years will define how deeply crypto embeds itself into the global economy, and all eyes are on Washington, Wall Street, and the blockchain industry to see how it all unfolds.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What does Brian Armstrong mean by “Onchain is the new online”?

He’s comparing the rise of blockchain to how businesses had to adapt to the internet. Just like companies that ignored the internet got left behind, the same could happen with blockchain adoption.How big is Armstrong’s prediction for crypto’s share of global GDP?

He believes crypto will power 10% of the world’s economy by 2030, meaning over $10 trillion in economic value could be blockchain-based.How is the U.S. positioning itself for crypto leadership?

The government is moving toward clearer crypto regulations, with President Trump and Congress focusing on stablecoins, market structure laws, and blockchain integration into finance.How much crypto does Coinbase manage?

Coinbase holds over $420 billion in digital assets, making it larger than the 21st biggest bank in the U.S.What industries could be impacted if crypto powers 10% of GDP?

Finance, real estate, supply chains, gaming, and even social media could all shift toward blockchain-based models, using tokenized assets, decentralized applications, and smart contracts.

Glossary of Key Terms

Blockchain: A decentralized, secure ledger technology used to track transactions across a network.

Stablecoin: A cryptocurrency that’s pegged to a traditional asset like the U.S. dollar to reduce volatility.

Tokenization: The process of converting real-world assets into digital tokens on the blockchain.

Assets Under Management (AUM): The total value of assets that an investment firm or financial institution manages for its clients.

Gross Domestic Product (GDP): The total value of all goods and services produced within a country.