The buzz around Pi Network’s long-awaited listing on bigger exchanges has intensified, with many community members eyeing Binance as the ideal destination. But within parts of the Pi ecosystem, there’s a growing belief that the Pi Network Coinbase listing could carry far more weight, especially for those focused on long-term utility in the United States.

Coinbase, a publicly traded and fully regulated U.S.-based exchange, doesn’t just offer crypto trading, it enables real-life use cases. Some market observers now think that utility layer could be what takes Pi from speculation to genuine adoption.

More Than a Listing: Why Coinbase Means Usability

Unlike Binance, which operates two separate platforms, Binance.com and Binance.US, Coinbase has one cohesive platform directly integrated into the U.S. financial system. That makes it more than just an exchange; it’s a gateway to everyday crypto utility.

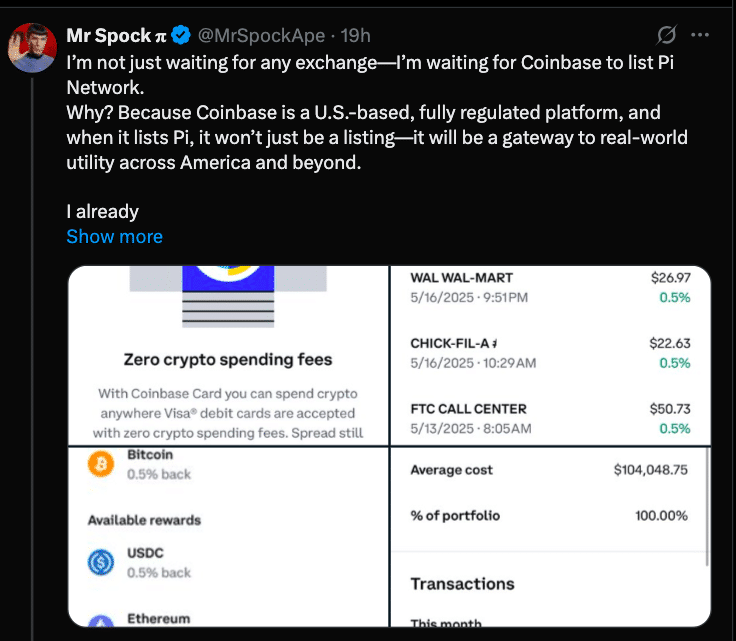

Crypto commentator and Pi supporter “Mr. Spock 𝛑” recently shared why he believes a Pi Network Coinbase listing could finally bring the project’s purpose into focus.

“With Coinbase, it’s not just about listing a token, it’s about enabling a token to work for you in real life,” he said in a recent post on X (formerly Twitter).

He gave examples from his own experience, using Coinbase’s Visa debit card to pay for groceries, withdraw cash from ATMs, and shop at stores like Walmart, all while earning Bitcoin rewards. If Pi Coin were to be added to Coinbase’s ecosystem, those same tools could allow holders to spend their tokens on everyday purchases without needing to cash out to fiat.

Coinbase’s Regulatory Advantage Over Binance

One of the central points in this debate is regulatory clarity. Binance has reportedly faced mounting regulatory challenges in the U.S., culminating in a $4.3 billion settlement with U.S. authorities in 2023, as confirmed by the U.S. Department of Justice. Meanwhile, Coinbase continues to operate as a publicly listed company under the scrutiny of the SEC and U.S. financial laws.

Binance.com remains off-limits to American users due to these hurdles, while Binance.US, a separate entity, offers limited features and fewer listed assets. By contrast, Coinbase is accessible nationwide and has broader integration with U.S. banks, payment processors, and financial services.

Even after going into its open mainnet phase in February 2025, for a project like Pi Network , a Coinbase debut could symbolize credibility and compliance. It would also tap into a more stable and regulated user base, setting the stage for Pi’s real-world application.

What’s Really at Stake for Pi Network

For many Pi users, this is about more than price speculation. A listing on Coinbase could be a turn from idle mining and anticipation to actual spending and engagement.

Mr. Spock expressed a vision shared by many in the community:

“Imagine buying lunch, paying for fuel, or shopping online with Pi Coin, then getting cashback or crypto rewards—all from the same card. That’s not some distant future. That’s what Coinbase already offers with other assets.”

Community forums and discussions show a recurring theme: usability matters more than hype. Getting listed on a platform that supports off-ramps, debit card integration, and regulatory stability could be Pi’s bridge to mainstream adoption.

Market Sentiment and What’s Next

While Pi Network hasn’t officially confirmed a listing on any of these exchanges, several indicators suggest that preparation for a more public listing is underway. The Pi Core Team has reiterated that only current listings endorsed in their open Mainnet phase remain valid, emphasizing a commitment to legal clarity and network maturity.

Still, the community keeps pressing, with many urging the team to prioritize exchanges like Coinbase over others. Whether or not Coinbase is the first stop, it’s increasingly seen as the benchmark for Pi’s long-term success in the U.S. market.

Conclusion

The excitement around a Pi Network listing is understandable. But when it comes to real-world relevance, particularly in the United States, a Pi Network Coinbase listing could be a real booster.

While Binance offers large-scale exposure, it’s Coinbase that offers the tools and legal pathways to help Pi Coin function as more than just a speculative token. For Pi to evolve from an idea into a spendable currency, it needs infrastructure that supports everyday utility. That’s where Coinbase shines.

FAQs

Has Pi Network been listed on Coinbase or Binance yet?

No. Although Pi Network transitioned to the open mainnet on February 20, 2025 and has been listed on other exchanges, it hasn’t been listed yet on Binance and Coinbase.

Why would Coinbase be better than Binance for Pi Network?

Coinbase operates under U.S. regulations and offers tools like a crypto Visa card that allows users to spend their tokens in daily life. Binance, on the other hand, has restrictions for U.S. users and operates two separate platforms.

What does Mr. Spock 𝛑 say about Pi and Coinbase?

He believes that Coinbase offers more than trading—it provides real-world spending tools, which could turn Pi into a usable currency for everyday needs.

Will a Coinbase listing automatically raise Pi’s price?

Price movement is speculative and depends on market sentiment, demand, and Pi’s actual utility. A listing could increase visibility and trust, but there are no guarantees of a price surge.

Glossary

Mainnet: The fully developed and deployed version of a blockchain where transactions are publicly recorded.

Coinbase Visa Card: A debit card offered by Coinbase that lets users spend crypto from their Coinbase wallet and earn crypto rewards.

Enclosed Mainnet: A phase where Pi Network is live but not yet listed on external exchanges to allow for ecosystem development.

Off-ramp: A method or platform allowing crypto to be converted into fiat money or real-world use.

Regulatory clarity: The presence of clear legal guidelines and compliance for financial operations, often associated with licensed U.S. platforms like Coinbase.