According to official updates from Coinbase assets on X (formerly Twitter), Coinbase is preparing to launch four new bridged tokens. These include cbLTC, cbADA, cbDOGE, and cbXRP—wrapped tokens designed for use on Base, its Ethereum Layer-2 network. The move follows Coinbase’s growing efforts to bring more crypto utility to DeFi users across Ethereum-compatible ecosystems.

cbADA to Boost Cardano Integration into Base

Coinbase plans to introduce cbADA, a wrapped version of Cardano (ADA), to expand ADA’s functionality in decentralized applications. Like its predecessor cbBTC, cbADA will be backed 1:1 and secured by smart contracts. It will allow users to interact with ADA without leaving the Ethereum ecosystem.

cbADA, cbDOGE, cbLTC, cbXRP coming soon.

These assets are not yet live or available. We will announce their launch at a later date.

— Coinbase Assets 🛡️ (@CoinbaseAssets) May 13, 2025

This integration will help users swap ADA quickly and use it across dApps running on Base. Coinbase confirmed users will retain the ability to unlock ADA and return it to the Cardano network. Therefore, cbADA will offer a seamless experience between Cardano and Base.

The smart contract lock mechanism ensures security while promoting compatibility with Ethereum-based DeFi tools. Coinbase has not disclosed a launch date but emphasized the tokens are not yet live. The platform warned users to avoid unofficial versions that may be circulating.

cbDOGE Brings Dogecoin to the Base Ecosystem

Coinbase will also launch cbDOGE, enabling Dogecoin holders to access Ethereum-based DeFi applications using their DOGE. cbDOGE will act as a 1:1 wrapped asset secured by Coinbase smart contracts. This bridging process allows fast transfers while maintaining value parity with native DOGE.

The introduction of cbDOGE expands the use cases for Dogecoin, long considered a meme-based asset. It allows holders to explore yield opportunities and trading within the Base network. Coinbase aims to make these transitions simple and secure through automated unlocking mechanisms.

Scams involving fake cbDOGE tokens have already surfaced online. Coinbase has advised users to wait for the official launch to avoid fraud. The official contract for cbDOGE is: 0xcbD06E5A2B0C65597161de254AA074E489dEb510.

cbLTC and cbXRP to Increase Liquidity and Trading Options

The new cbLTC and cbXRP tokens will bring Litecoin and Ripple onto Base, expanding support for major cryptocurrencies. Users will gain the ability to trade and lend these tokens in a low-cost, high-speed environment. These wrapped assets will be secured and redeemable back to their native chains.

Coinbase shared official contract addresses to help users verify the legitimacy of each asset. The contract for cbLTC is 0xcb17C9Db87B595717C857a08468793f5bAb6445F. For cbXRP, the verified contract is expected to be announced closer to launch.

JUST IN: @CoinbaseAssets will soon launch cbLTC! A 1:1 seamless wrapped version of Litecoin expanding DeFi liquidity options. No launch date set. #Comingsoon

Note the official base contract addresses for cbLTC: 0xcb17C9Db87B595717C857a08468793f5bAb6445F pic.twitter.com/HYKEMMtYW9

— Litecoin Foundation ⚡️ (@LTCFoundation) May 13, 2025

Each wrapped token increases liquidity for Base-based platforms, especially across swaps and lending protocols. They also enhance access to blue-chip crypto assets through Ethereum-compatible dApps. Coinbase believes these new assets will create more decentralized finance opportunities.

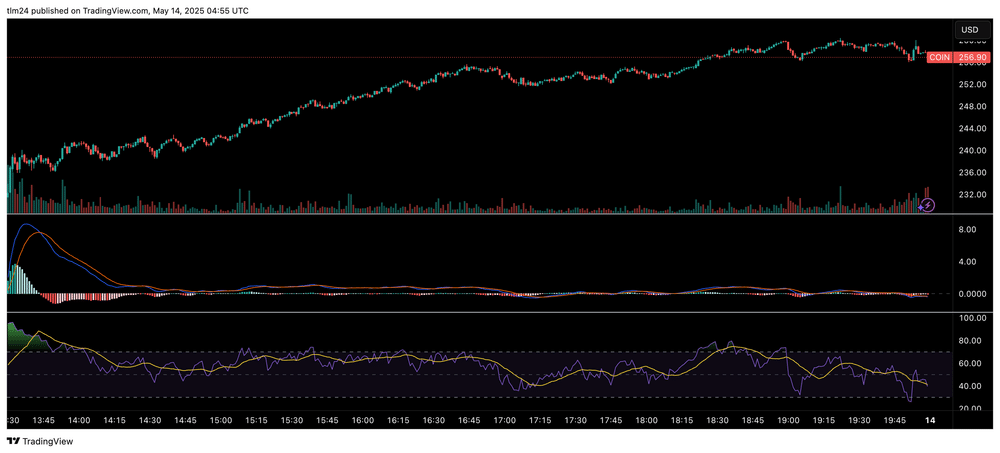

Coinbase Stock Surges on S&P 500 Inclusion

Following the token announcement, Coinbase shares surged nearly 24%, climbing $49.68 during regular trading hours. The stock closed at $256.90 and rose to $258.30 in after-hours trading. This momentum aligns with Coinbase’s upcoming inclusion in the S&P 500 index.

Coinbase will replace Discover Financial Services in the benchmark index before trading begins on May 19. Analysts say the inclusion reflects institutional recognition of Coinbase’s growing role in the financial sector. Oppenheimer raised its target price to $293, citing increased institutional demand.

Coinbase just became the first and only crypto company to join the S&P 500.

This milestone represents what the true believers, from retail investors to institutional investors to our employees and partners, knew all along.

Crypto is here to stay. https://t.co/MnMRCX8pMg

— Brian Armstrong (@brian_armstrong) May 12, 2025

Passive investment funds tracking the S&P 500 will now be required to purchase Coinbase shares. This may inject billions of dollars in capital into the stock. Coinbase has positioned itself as a leading public crypto firm amidst rising investor interest.

FAQs

When will cbLTC, cbADA, cbDOGE, and cbXRP be available?

Coinbase has not released an exact launch date yet. The tokens are in development and will go live soon.

Are there official contract addresses for the new tokens?

Yes. Coinbase has published verified contract addresses for cbADA, cbDOGE, and cbLTC to help users avoid scams.

Can users convert wrapped tokens back to their original form?

Yes. Coinbase will allow users to unlock and redeem assets through smart contracts to return them to native chains.

What is the purpose of these new tokens?

They enable users to use popular cryptocurrencies in Ethereum-based DeFi protocols and dApps via Coinbase’s Base network.

What is the security model for these tokens?

Each token will be backed 1:1 and locked in secure smart contracts monitored by Coinbase systems.

Glossary of Key Terms

Coinbase – A leading U.S. cryptocurrency exchange providing trading, custody, and decentralized finance tools.

Base – Coinbase’s Ethereum Layer-2 network offering faster and cheaper blockchain transactions.

Wrapped Token – A tokenized version of a cryptocurrency that runs on a different blockchain but retains equal value.

Smart Contract – A self-executing code that automatically processes blockchain transactions based on predefined rules.

S&P 500 – A stock market index tracking the performance of 500 large U.S. publicly traded companies.

Ethereum – A decentralized blockchain with smart contract functionality and a major platform for DeFi applications.

DeFi – Short for “decentralized finance,” it refers to financial services built on blockchain without traditional intermediaries.

cbLTC, cbADA, cbDOGE, cbXRP – Bridged and wrapped versions of Litecoin, Cardano, Dogecoin, and Ripple issued by Coinbase for use on Base.

cbBTC – Coinbase’s previously launched wrapped version of Bitcoin for the Base network.

Contract Address – A unique identifier for a smart contract on the blockchain, verifying the token’s authenticity.