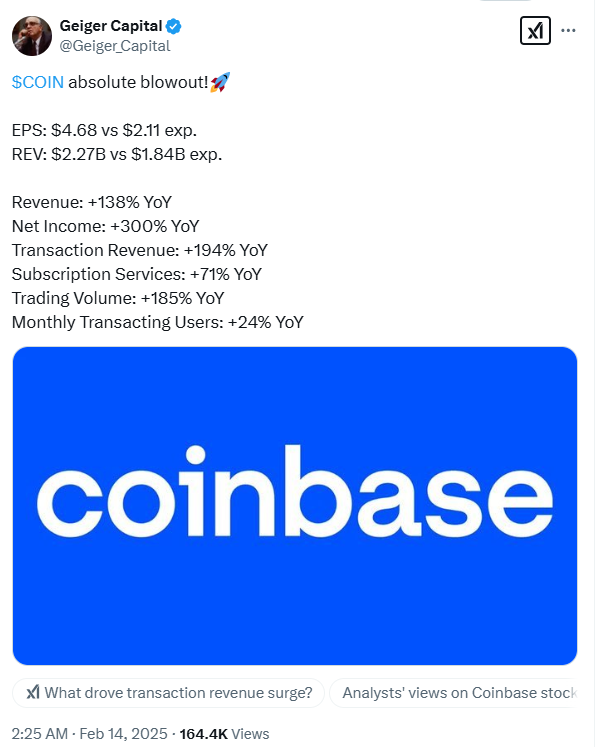

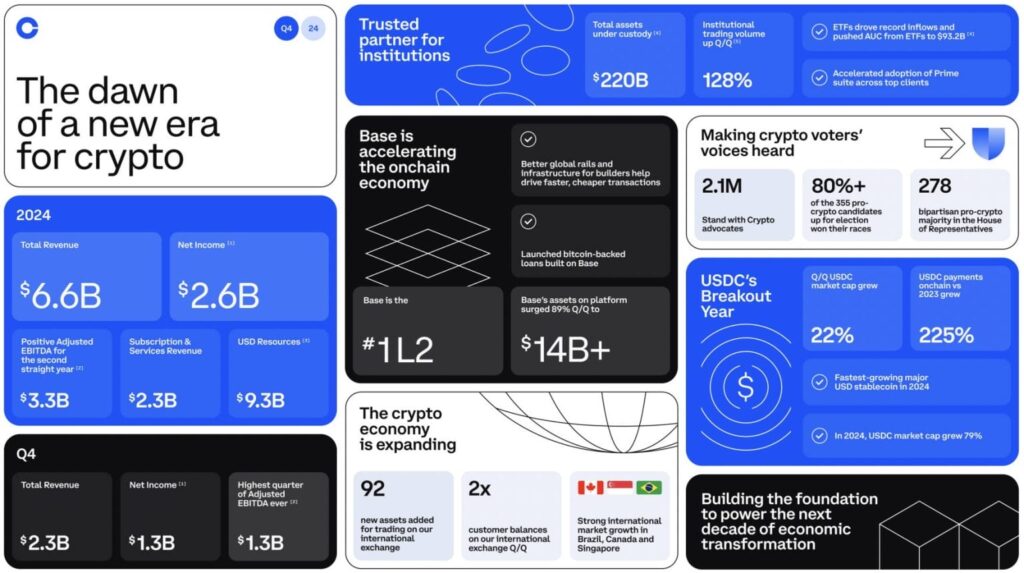

Coinbase achieved exceptional fourth-quarter financial results by exceeding the predicted profits. During the fourth quarter, Coinbase generated $1.3 billion in net income, which amounted to $4.68 per share compared to $273 million with $1.04 per share in the previous period. The combination of increased Bitcoin trading and other digital tokens led to record-breaking revenue growth during the U.S. election period.

The exchange demonstrates strong performance because of positive regulatory reforms and political deregulations. The Trump administration’s newfound crypto-friendly policies work as a catalyst for the business growth of Coinbase.

Overview of Q4 Performance

Coinbase earned $2.3 billion in revenue for this quarter marking a substantial 140% increase when compared to its previous year’s financial numbers. The transaction revenue sector nearly doubled its value to reach $1.56 billion which surpassed market predictions of $1.29 billion. Retail traders accounted for much of the enforced rise in platform usage which occurred during this period.

Trading revenue generated $750 million by February 11 as exchange achieved profitable growth in the early stages of 2025. According to company projections this financial pattern will stay consistent into the upcoming quarter.

Political Support for Crypto Grows

Coinbase’s financial growth matches the expanding support cryptocurrency receives from political leaders. Former President Donald Trump declared that his administration will transform the United States into a global leader of cryptocurrency markets. His administration demonstrates support for digital currencies by appointing people who back cryptocurrency.

Paul Atkins was appointed as head of the Securities and Exchange Commission (SEC). Atkins stands as an advocate for crypto since many years while exhibiting clear differences against the former SEC Chair Gensler who expressed skepticism about digital currencies. The regulatory changes indicate that U.S. rules governing cryptocurrency operations will become more favorable.

Coinbase CEO’s Positive Outlook

During the earnings call Brian Armstrong expressed positive sentiments as the Coinbase CEO. In his view the coming year of 2025 would bring “very good year” outcomes for crypto markets because of regulatory changes and market expansion. According to Armstrong, the company functions as a pioneer of blockchain innovation while advocating financial freedom. He added:

The regulatory overhang is lifting. Governments are leaning in, and we’re shaping the next chapter of crypto from trading to payments to consumer apps and beyond. 2025 is going to be a very good year,

Revenue Breakdown

Trading continues to generate the highest revenue for exchange since it contributed to 68.5% of the company’s total income in Q4. The company focuses on building multiple revenue streams despite its original trading revenue base. Coinbase added 13 new assets to include the meme coins PEPE and WIF within their platform during the quarter.

According to the company statistics Monthly Transacting Users (MTUs) expanded 24% to achieve 9.7 million active users. The user base comprised approximately 50% of new customers and returning users who had been absent for an extended period.

Subscription and Services Revenue

The subscription and service segment at exchange achieved significant expansion during this period. The revenue from subscription products and services climbed to $2.3 billion during 2024 while demonstrating a 64% growth since the previous year. The current subscription and service revenue exceeds 2021 bull market numbers by a substantial margin.

The combination between blockchain rewards and stablecoin transactions alongside the Coinbase One subscription service generated this substantial growth. Subscriptions along with services generated $641 million worth of revenue within the quarter.

Stablecoin Revenue and USDC Growth

Stablecoin revenue generated by Coinbase experienced a 9% decrease during the fourth quarter. USDC which is Coinbase’s native stablecoin achieved major expansion during this period. The growing market value of USDC strengthened its position within exchange’s product range.

New stablecoin competition alongside lower effective interest rates did not impact USDC’s performance negatively. The platform plans to develop its stablecoin into the leading digital currency of the market.

Future Expansion Plans

The company plans to extend its business operations through additional product development. The company is active in developing better stability for its platform while enhancing user experience at the same time. The priority objective of Armstrong includes achieving top market position for USDC as the dominant stablecoin.

The revenue stream expansion efforts combined with platform enhancement initiatives at Coinbase will probably boost their future business growth.

Conclusion

Coinbase delivered exceptionally strong results from its last quarter because the crypto market continues to grow. As Coinbase gains political facilitation while trading volume rises and their revenue profile matures they show signs to expand with success. New stablecoin ventures and asset expansion show Coinbase will stay dominant in the evolving cryptocurrency market.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

How did Coinbase outperform expectations in Q4?

The company passed financial expectations by earning $1.3 billion in net income through increased trading volumes.

What fueled Coinbase’s revenue spike in Q4?

Coinbase experienced a remarkable surge in Bitcoin and digital token trading rates which peaked during the U.S. election period.

How has political support impacted Coinbase’s growth?

Coinbase benefited from Trump administration support along with key appointments to establish a favorable environment in which the company could grow.

What is Coinbase’s strategy for the future?

The company aims to boost its platform reliability and extend its service range while making USDC the top stablecoin worldwide.

Appendix Glossary of Key Terms

Net Income: The profit of a company after all expenses and taxes have been deducted from total revenue.

Transaction Revenue: Earnings generated from the buying and selling of cryptocurrencies on a platform.

Stablecoin: A type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, such as the U.S. dollar.

USDC: A type of stablecoin issued by Coinbase and Circle, pegged to the U.S. dollar.

Monthly Transacting Users (MTUs): The number of unique users who make transactions on a platform within a given month.

References

CoinDesk – coindesk.com

Crypto News – cryptonews.com

Fortune – fortune.com

Q4’24 Shareholder Letter – coinbase report