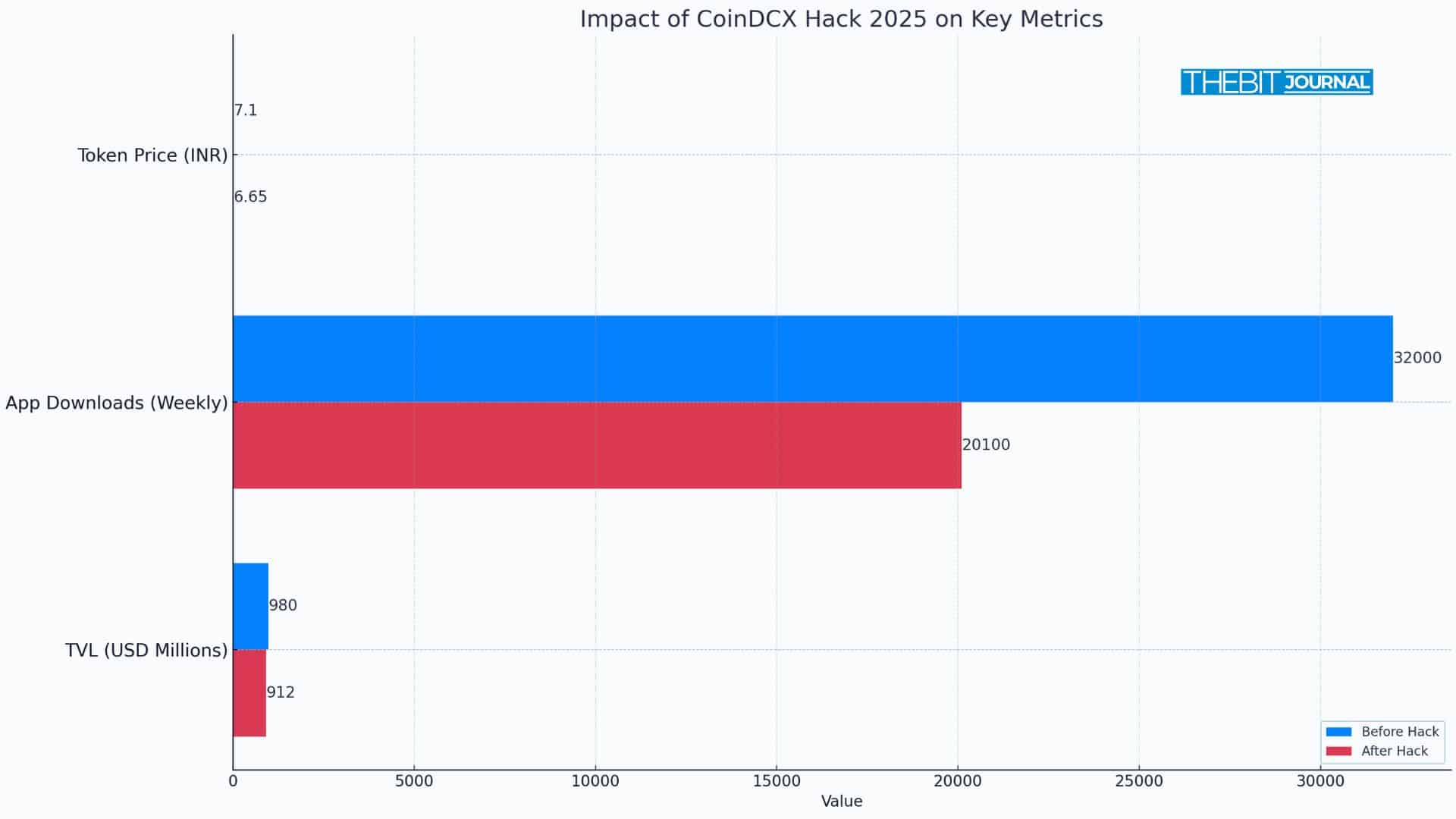

According to official reports, the CoinDCX hack 2025 caused a $44 million loss from one of the exchange’s internal wallets. Hackers used advanced tools to steal funds without touching customer accounts.

Around the same time, news reports linked Coinbase to a possible deal with CoinDCX. The hack raised serious concerns about how crypto platforms protect their systems.

What Happened in the CoinDCX Hack 2025

The hack took place on July 19, 2025. Hackers gained access to a wallet used by CoinDCX to manage liquidity on other platforms. They stole over 4,400 ETH and 155,000 SOL, worth about $44 million. The attackers utilized Tornado Cash to conceal the stolen funds and transferred them across various blockchain networks.

CoinDCX quickly confirmed the attack. They stated that the stolen funds originated from their treasury. User funds stayed safe in cold wallets, which are offline and more secure.

The team paused some services to fix the issue and informed India’s cybercrime agency and blockchain experts.

“All user funds are secure in multi-party computation (MPC) wallets and cold storage. The impacted wallet is isolated from user operations.”

CoinDCX kept trading open. They restored all services shortly after the breach.

Coinbase Rumors After the CoinDCX Hack 2025

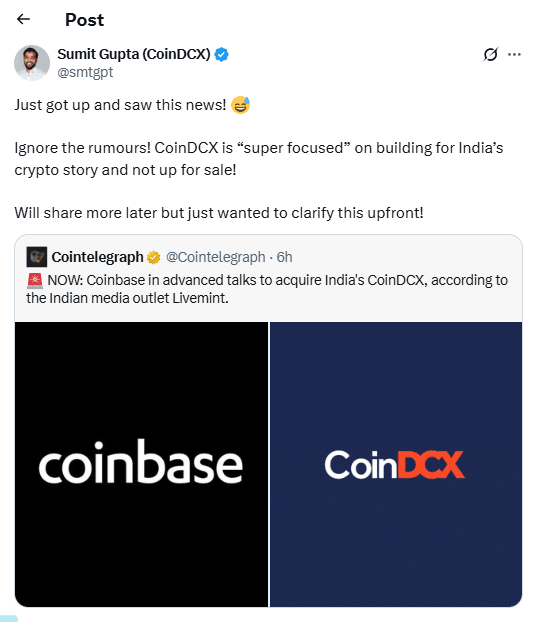

Just days after the hack, several reports claimed that Coinbase was planning to acquire CoinDCX. Media outlets, such as Cointelegraph and CryptoBriefing, stated that the deal could be worth less than $1 billion.

This report came at a time when CoinDCX was dealing with the breach. Coinbase already has a license to operate in India. It also made other large purchases in 2025, including Deribit.

CoinDCX CEO Sumit Gupta denied the reports. He said the company had no plans to sell.

“Ignore the rumours! CoinDCX is super focused on building for India’s crypto story and not up for sale.”

While nothing is confirmed, the news added more attention to an already serious situation.

How CoinDCX Handled the Situation

CoinDCX acted fast after the breach. They launched a bug bounty program, offering up to 25% rewards for anyone who helps recover the stolen funds. The team also collaborated with blockchain companies, such as Chainalysis, to trace the stolen assets.

“We are working with leading cybersecurity firms and Chainalysis to trace funds. We are also offering a bounty to white-hats who help us recover assets.“

Experts praised CoinDCX for responding fast. However, they also noted that this event highlighted the need for robust security in internal systems, not just for user wallets.

“The hack has not affected users directly, but it does raise questions about operational wallet safety across global exchanges.”

The CoinDCX hack 2025 brought more attention to how platforms handle internal risks. It reminded the crypto world that backend wallets need just as much protection as user-facing tools.

Conclusion

Based on the latest research, the CoinDCX hack 2025 revealed how internal systems can become a weak point, even in established crypto exchanges. Although the platform protected user funds and responded quickly, the breach raised new concerns about the safety of its backend wallet.

As CoinDCX collaborates with experts to recover assets and rebuild trust, the event serves as a potent reminder that continuous security updates are just as important as customer service in the cryptocurrency space.

For more expert reviews and crypto insights, visit our dedicated platform for the latest news and predictions.

Summary

The CoinDCX hack 2025 led to a $44 million loss from an internal wallet, though all user funds stayed safe. CoinDCX acted fast, launched a recovery bounty, and denied rumors of a Coinbase buyout. Experts praised the response but highlighted security gaps in backend systems. The incident raised essential questions about exchange security and reminded the crypto community that even trusted platforms must remain vigilant.

FAQs

What was the CoinDCX hack 2025?

Hackers stole $44 million from an internal wallet used for liquidity. No customer funds were affected.

How did CoinDCX respond?

The exchange paused some services, investigated the issue, launched a bug bounty program, and collaborated with cybersecurity experts.

Did Coinbase plan to buy CoinDCX?

Reports suggested so, but CoinDCX’s CEO denied the rumors, stating that the company is not for sale.

Are services on CoinDCX working now?

Yes. Trading and withdrawals continued to be active throughout the incident.

Glossary of Terms

Cold Wallet: An offline crypto wallet that provides strong security.

Operational Wallet: A wallet used by an exchange to manage liquidity or daily operations.

Tornado Cash: A tool that hides where crypto funds go by mixing transactions.

Bug Bounty: A reward offered to people who help find and report bugs or security issues.

Liquidity: The ability to buy or sell assets quickly without significant price changes.