Consensys’ suit against SEC—Security and Exchange Commission, has been immediately scheduled by Judge Reed O’Connor of the U.S. District Court for the Northern District of Texas. The case attracted the interest of the crypto community because of its possible influence on the regulation of digital assets.

This expedited timeline emphasizes the relevance of the lawsuit and the speed with which the court is handling the issue, therefore implying major consequences for the direction of cryptocurrency regulation.

Consensys Suit Against SEC: The Expedited Timeline: A Closer Look

Judge O’Connor’s decision to set a swift schedule occurs amid escalating tensions between the SEC and cryptocurrency entities, notably Consensys. This legal confrontation highlights the ongoing disputes over the regulation of digital currencies.

According to court documents filed on July 1, Judge O’Connor has allowed the SEC a 28-day extension to respond to Consensys’ complaint. This complaint challenges the SEC’s authority, accusing it of exceeding its regulatory jurisdiction by attempting to classify Ethereum as a security.

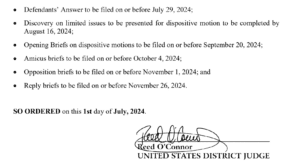

Judge O’Connor has approved a schedule that mandates both parties to submit their opening briefs and opposition replies by set dates in September and November, respectively. Additionally, all five SEC commissioners and the regulator are required to file their answers by July 29, with reply briefs due by November 26.

This established timeline indicates that a ruling could be expected around December. This anticipation is echoed by Bill Hughes, Consensys’ Senior Counsel, who noted the potential ruling timeline in a recent post on X FKA Twitter.

Hughes stated:

“Important News about @Consensys v. Gensler. Judge O’Connor granted our request that he consider the merits of our case on an expedited basis: whether the SEC has Congressional authority to regulate MetaMask as a securities broker and issuer. Those questions would be considered alongside any arguments the SEC would make that we don’t get to bring a case against them.

As for the timing of a ruling?

🎶It’s beginning to look a lot like Christmas 🎶”

Consensys Suit Against SEC: Implications for Ethereum and the Crypto Landscape

The legal community and cryptocurrency enthusiasts are closely watching this case, given its potential to influence the SEC’s future regulatory approach. Earlier this year, Consensys challenged the SEC’s actions, which it described as a concerted effort to control the trajectory of cryptocurrency. This lawsuit followed the SEC’s abrupt discontinuation of its investigation into whether Ethereum should be classified as a security, only to reinitiate legal actions against Consensys shortly thereafter, labelling the firm as an unregistered broker.

This legal confrontation arrives at a crucial time, as the SEC has active lawsuits against other major players in the cryptocurrency sector, including Coinbase, Binance, and Ripple. The outcome of the Consensys case could set a precedent, affecting not only these companies but the broader regulatory landscape for digital assets in the United States.

Consensys Suit Against SEC: A Regulatory Reckoning?

Adding to the complexities, recent Supreme Court decisions might also affect how the SEC manages enforcement actions moving forward. One ruling affirms that defendants in SEC civil proceedings involving securities fraud are entitled to a jury trial; another mandates that courts evaluate whether agencies such as the SEC are working within their legal authority.

These rulings have major implications since they might redefine the extent of the SEC’s power in its enforcement strategies. Notably, SEC Commissioner Mark Uyeda has attacked the commission’s present approach to regulating cryptocurrencies as “problematic,” hence highlighting internal dissent within the agency itself.

The Road Ahead

The cryptocurrency community is eagerly waiting for a decision as the court processes might drastically change the regulatory environment for digital assets in the United States. This lawsuit can potentially set new precedents in how cryptocurrencies are governed legally.

The impact of this case is expected to extend beyond the courtroom, influencing future regulatory strategies and possibly leading to more organized governance of the cryptocurrency market. This makes the outcome highly consequential for stakeholders and observers alike.

According to news sources, the crypto industry is at a pivotal juncture, with this lawsuit representing a critical test of the SEC’s reach and authority. As the deadlines approach and legal arguments are sharpened, all eyes will be on the Northern District of Texas, where the future of cryptocurrency regulation may well be written.

Stay updated with The BIT Journal to see how the Consensys Suit Against SEC unfolds and other latest crypto news and crypto updates, including BTC ETH updates.