CoreWeave, a prominent AI-focused cloud computing provider, has officially filed for an initial public offering (IPO) in the United States, aiming to raise approximately $4 billion at a valuation exceeding $35 billion. This move underscores the company’s rapid growth and its strategic positioning within the burgeoning artificial intelligence (AI) infrastructure sector.

CoreWeave’s Company Overview

Established in 2017, CoreWeave began as a cryptocurrency mining enterprise but swiftly transitioned to offering cloud-based GPU (graphics processing unit) services tailored for AI workloads. This pivot has positioned the New Jersey-based firm as a formidable competitor to established cloud providers like Microsoft’s Azure and Amazon’s AWS, particularly in the realm of high-performance computing for AI applications.

Financial Performance

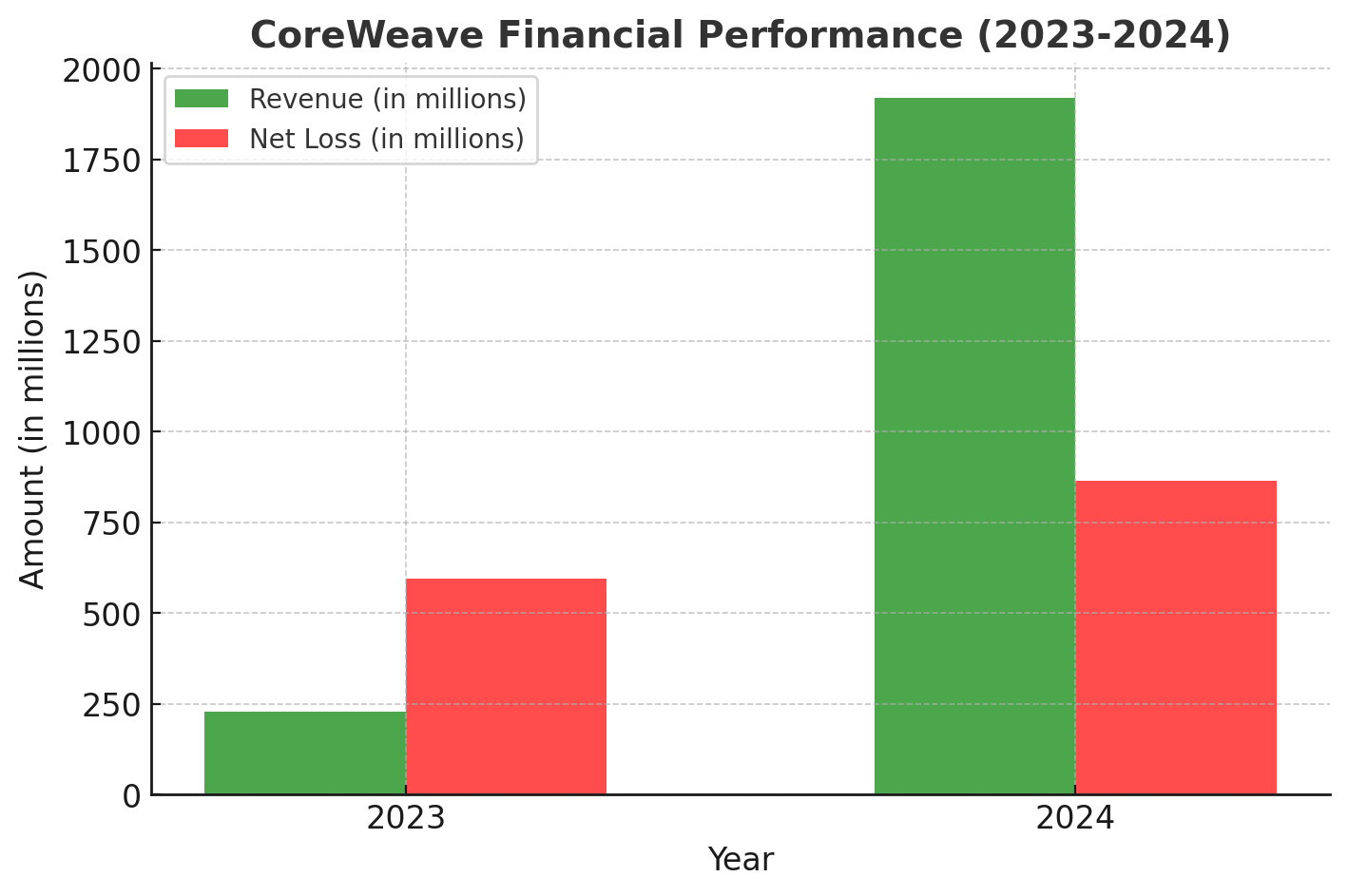

CoreWeave’s financial trajectory has been remarkable. In 2024, the company reported revenues of $1.92 billion, a substantial increase from $228.9 million in 2023, marking an over eight-fold surge. However, this rapid expansion has been accompanied by increased expenditures, leading to a net loss of $863.4 million in 2024, up from $593.7 million the previous year.

Strategic Partnerships and Investments

A significant factor in CoreWeave’s growth has been its strategic alliance with Nvidia. The company utilizes Nvidia’s advanced GPUs to deliver high-powered computing solutions essential for AI model training and deployment. In 2023, Nvidia invested $100 million in CoreWeave, further solidifying this partnership. Additionally, CoreWeave has secured substantial funding from prominent investors. In May 2024, the company raised $1.1 billion in a Series C funding round led by Coatue Management, valuing CoreWeave at $19 billion. Subsequently, a secondary share sale in November 2024, with participation from investors like Cisco, elevated the company’s valuation to $23 billion.

CoreWeave’s Market Position

CoreWeave’s rapid ascent reflects the escalating demand for AI infrastructure. The company’s ability to provide specialized GPU cloud infrastructure has attracted major clients, including Microsoft, which has committed to investing over $10 billion in CoreWeave’s services by 2030. This positions CoreWeave to capitalize on the anticipated growth in AI applications across various industries.

Risk Factors

Despite its impressive growth, CoreWeave faces several challenges. The company’s significant net losses highlight the high costs associated with scaling operations in the competitive cloud computing market. CoreWeave’s heavy reliance on major clients like Microsoft also introduces concentration risk. Any shifts in these clients’ strategies could impact CoreWeave’s revenue streams. Furthermore, the company’s dependence on Nvidia’s GPUs makes it vulnerable to supply chain disruptions and technological changes.

Industry Context

The AI infrastructure sector is experiencing rapid growth, with companies like CoreWeave pivoting in meeting the computational demands of AI applications. Investments in AI infrastructure are projected to increase significantly, driven by the proliferation of AI technologies across various sectors. CoreWeave’s IPO is among several anticipated public offerings in the tech industry, signaling a potential resurgence in the IPO market after a period of relative inactivity.

Conclusion

CoreWeave’s planned IPO represents a significant milestone in the AI infrastructure landscape. The company’s rapid revenue growth, strategic partnerships, and substantial investments underscore its potential to become a leading provider of AI cloud services. However, prospective investors should carefully consider the associated risks, including operational losses and client concentration, when evaluating the company’s long-term prospects.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What services does CoreWeave provide?

CoreWeave offers cloud-based GPU infrastructure services, primarily catering to artificial intelligence workloads.

Who are CoreWeave’s main competitors?

In the high-performance computing sector, CoreWeave competes with major cloud service providers like Microsoft Azure and Amazon AWS.

What is the significance of CoreWeave’s partnership with Nvidia?

The partnership enables CoreWeave to utilize Nvidia’s advanced GPUs, enhancing its capacity to deliver robust AI computing services.

Why is CoreWeave planning an IPO?

The IPO aims to raise capital to support CoreWeave’s expansion and solidify its position in the rapidly growing AI infrastructure market.

What are the risks associated with investing in CoreWeave?

Potential risks include the company’s current net losses, reliance on major clients, and dependence on specific hardware suppliers like Nvidia.

Glossary

GPU (Graphics Processing Unit): A specialized processor designed to accelerate graphics rendering and computational tasks, essential for AI model training and inference.

IPO (Initial Public Offering): The process by which a private company offers shares to the public for the first time to raise capital.

AI (Artificial Intelligence): The simulation of human intelligence processes by machines, especially computer systems, including learning, reasoning, and self-correction.

Cloud Computing: The delivery of computing services over the internet, allowing for scalable resources and flexible computing power.

Series C Funding: A stage in venture capital financing where a company raises capital to expand, develop new products, or enter new markets.