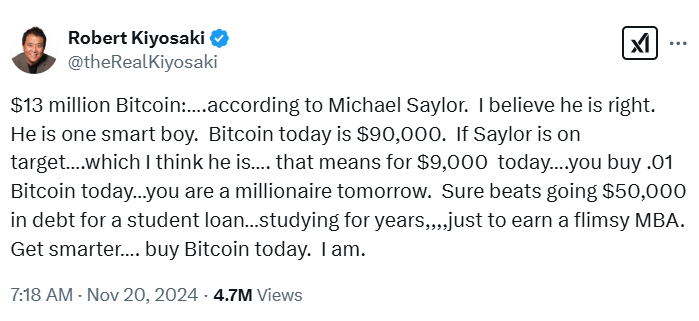

The author of Rich Dad Poor Dad Robert Kiyosaki, has backed Michael Saylor for predicting that the price of Bitcoin to rise and hit $13 million per coin. On November 20, 2024, in a post on X, Kiyosaki agreed with Saylor’s forecast, claiming that the latter was right and valued his opinions. This endorsement is indicative of the road that Bitcoin has gained in terms of being seen as a tool for creating wealth. This is compared to traditional pricing and even the costs people have to pay to get a Master of Business Administration (MBA).

Key Developments

The endorsement comes after the interaction between Michael Saylor, the CEO of MicroStrategy, and Patrick Bet-David, an entrepreneur. Bet-David expressed his concern regarding the sustainability of MicroStrategy thanks to its large BTC investments. Regarding whether Bitcoin can reach the $13 million price, Bet-David also explained that at such a scenario, MicroStrategy could bring its value to $10 trillion in two decades. Saylor then proceeded to expound on why his outlook was more optimistic; stating that based on available Bitcoins in circulation, the cryptocurrency was likely to rise in value.

Bitcoin’s Role in Wealth Building

In a PBD podcast, Kiyosaki to likened the possibility of Bitcoin to other investment opportunities like education. He went on to note that even investing 0.01 BTC at $9,000 today could have a potential worth of $130,000 if it reaches $13 million per coin. This made more monetary sense to Kiyosaki than pursuing an MBA education, which usually entails going through a significantly large amount of student loans. He described it as the better way to achieve financial freedom as well as the attainment of wealth in the long run.

Rising Popularity of Bitcoin

Bitcoin has shown significant performance and has risen by 87% in the last one year. But surely, the change in world economies toward Bitcoin worth $13 million requires great transformation. This has entailed broad adoption by institutions and a possible transition to the hyperinflationary stage of fiat money. Due to the scarce and limited supply of BTC in the market, demand will lead to an increase in the value of BTC in stock, making it attractive to investors with long-term horizons.

Saylor’s $13 Million Bitcoin Forecast

Michael Saylor made this prognostication assuming that Bitcoin adoption rates will skyrocket. Its current number of adopters is a mere 0.1% of the global population. According to Saylor, this number could rise to 7% in the international market. The more crypto adoption, the more demand for BTC and other cryptocurrencies, which could push the value upwards. The growing demand coupled with the supply constraint characteristic of BTC’s value would, therefore, result in a steep upward trend of the value.

Bitcoin Vs. Traditional Education Costs

Kiyosaki has been well-known for pointing out the essence of misleading thought when students go deep into debt for an MBA degree. The MBA program cost for better-ranked US universities may go as high as $50,000 and as low as $200,000. This leaves many students with enormous student loans with no certainty of getting back the investment that they made. According to Kiyosaki, investing in BTC is definitely a far superior option in terms of obvious potential and carrying no debt with it.

Bitcoin’s Price Action and Market Dynamics

Bitcoin price is currently stuck in the trading range of $89,000 to $96,000, with strong support near $89,000. The resistance stands out near the $109 thousand level. The following few days will prove critical in determining the direction of the next BTC movement beyond the mentioned resistance levels. If it does manage to reclaim level with $98,500 and includes volume, it is quite possible to see it touch $104,000-$109,000. However, if the price fails to maintain a price level above $94,000 then it may slide towards the $89,000 support level.

Conclusion

The faith in the ability to generate wealth improves with Kiyosaki supporting BTC as better than higher education investment. Since, Bitcoin is all the rage at the moment, the possibility of the ape a high growth rate has become a constant topic of discussion, spearheaded by key opinion-makers such as Kiyosaki and Saylor. While it is still on its tentative trajectory, whether it can even reach $13 million per single Bitcoin or not, it is plainly clear that BTC has a force behind it.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

1. Why is Kiyosaki backing Saylor’s BTC prediction?

Kiyosaki believes Bitcoin could generate immense wealth, agreeing with Saylor’s $13 million forecast.

2. How does Bitcoin compare to an MBA?

Kiyosaki views Bitcoin as a smarter investment than the debt-heavy cost of an MBA.

3. What could drive Bitcoin to $13 million?

Saylor expects the shortage of Bitcoin and the growing adoption would push BTC price to $13 million.

4. What is BTC’s current price range?

BTC is fluctuating between $89,000 and $96,000, facing key resistance at $109,000.

Appendix: Glossary of Key Terms

Bitcoin (BTC): BTC operates as a decentralized virtual currency that lacks both central bank authority and administrator oversight to enable transactions between peers through internet networks.

Michael Saylor: The CEO of MicroStrategy, is one of the most enthusiastic proponents of the BTC asset and believes that its price will rise in the future.

Robert Kiyosaki: Author of Rich Dad Poor Dad, advocates for alternative investments like Bitcoin over traditional financial education.

Hyperinflation: The rapid depreciation of national money, which happens under conditions of extreme inflation, is called Hyperinflation.

Market Resistance: The selling pressure caused by market forces stops asset price growth from continuing upward beyond certain price levels.

BTC Fixed Supply: BTC Fixed Supply sits as a Bitcoin feature which sets an upper limit of 21 million coins for mining so the value could potentially rise because of reduced supply.

References

TheStreet – thestreet.com

PBD Podcast – Youtube.com