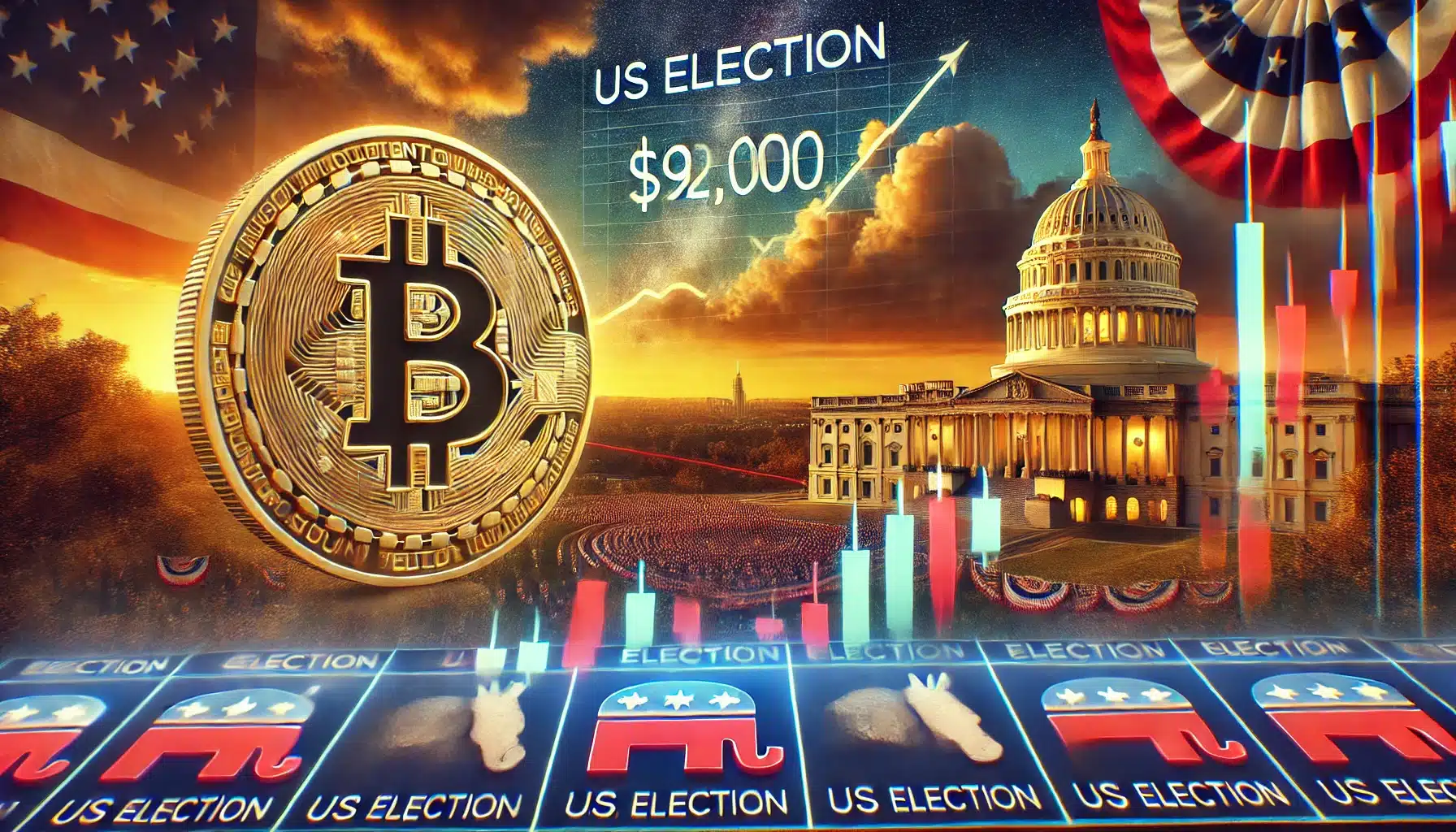

The Bitcoin price could surge to as much as $92,000 if Donald Trump is re-elected in the upcoming United States presidential election in November, said Jeff Park, head of alpha strategies at Bitwise Asset Management. According to crypto reporters, Park made this prediction on the 22nd of October, in a post on X and he said that a Trump win would boost Bitcoins by 70%.

So how did Park use mathematics, specifically Polymarket and the movements of Bitcoin price, to forecast Trump’s upping odds? He employed what’s called merger arb-style probability math. Using his models, he estimated that the Bitcoin price might hit $92,000 if Trump regains his presidency. “To put it into perspective,” Park said, “I think this will be the price of Bitcoin if tomorrow Trump wins the elections.”

This prediction has attracted the attention of many analysts and investors, who view the proximity of Trump to cryptocurrencies such as Bitcoin very positive.

Trump’s Crypto Push Could Help Bitcoin

Cryptocurrency has become part of mainstream politics, particularly the campaign of Donald Trump in the upcoming 2024 elections. He has pledged to turn the United States into the “crypto capital of the world” and has a vow to fire Gary Gensler – the SEC Chair, on his first day in the White House. Gensler, particularly has been very patient with the regulations on cryptocurrencies which has been a concern to many in the crypto space.

It stays in line with these promises that Park has made. He also thinks that Trump’s policies could help Bitcoin price and other digital assets to become more popular. “A Trump victory could lead to new rules that will promote Bitcoin,” said Park who has been tracking political events in relation to digital currency markets.

However, some scholars have downplayed the idea in the manner that such growth cannot be sustained in the long run.

Short-Term Surge or Long-Term Strain?

Some experts are less enthusiastic about Bitcoin’s prospects under the Trump administration. Democratic activist and businessman Mark Cuban, who openly opposes Trump, noted that he feared the rally would not be sustainable. In an interview with Cuban, features such as Trump’s planned tariffs in his economies can lead to inflation that may, in the long run, harm the Bitcoin market even when it grows.

“If Trump wins, then the crypto markets will ride high for a couple of weeks,” Cuban said to a crypto news source. “However, his economic policies firm might introduce inflation, which would not be good for the bitcoin value.”

This concern is echoed by some of the market predictors, who state that though, in the short run, bitcoin may go up high, the macroeconomic environment under the Trump administration may present some challenges to the high bitcoin price worth. Cuban’s comments inject some realism into the otherwise rosy scenario envisaged by Park and other crypto pundits.

Betting Markets vs. Polls: What’s Next for Bitcoin Price?

The unpredictability of the U.S. election for the Bitcoin price and the traditional polls as well as betting markets have placed investors at alert. Today, polls indicate that Kamala Harris, the Democratic vice president, is slightly ahead, while betting markets, as seen in Polymarket, have a different story to tell. Going by the Polymarket numbers, Trump has outperformed Harris by a margin of 18.8% – a percentage that has been creeping up as choices made by bettors indicate more confidence in the former president’s win. If Trump’s chances continue to get better it will add more credibility to what Park said about Bitcoin reaching as high as $92,000.

This possibility of a Trump win and how it could impact Bitcoin price is on everyone’s lips in trading circles. As more analysts are projecting that there will be an uptrend after the elections, the next few months will be important for those that want to profit from this view.

Conclusion: Will Bitcoin price Hit $92K?

While the election race in the United States ramps up the anticipation effect for the Bitcoin price surge, if Donald Trump comes to the top, as predicted by Bitwise’s Jeff Park and other analysts, the currency could surge to as high as $92,000 thanks to the policies that the candidate would support as well as people’s perception towards the same. However, as the words of Mark Cuban, an experienced businessman, have pointed out, the future of the crypto market after Trump’s presidency looks rather vague.

While betting markets predict a completely different scenario in the election outcome, the traditional polls paint a different picture of the next few weeks for Bitcoin price. Whether Trump’s pro-crypto promises translate into real growth or create short term gains and pump dump followed by inflation pressure remains to be seen. Still, buyers and sellers of Bitcoin will be looking out for the chance to get in on the rising action or maybe get out before a dip takes hold. Keep following TheBITJournal and stay updated on Bitcoin prices.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!