The XRP price took a significant hit on Thursday following new developments in the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). Judge Analisa Torres’ decision to deny a joint motion from Ripple and the SEC for an indicative ruling halted the XRP price today recovery, as it was on track to break through its nearest resistance at $2.23.

Legal Developments Weigh on XRP Price

The ongoing legal clash between Ripple Labs and the SEC continues to impact the XRP price. The SEC’s lawsuit has created a cloud of uncertainty over cryptocurrency, leaving traders and investors on edge. Judge Torres’ ruling added to the pressure, causing XRP’s recovery attempt to falter. As a result, market participants are closely watching the situation, hoping for more clarity from the legal proceedings.

XRP Price Today: Market Sentiment Shaken

XRP price today is currently facing significant volatility. The market sentiment has shifted from bullish to cautious, with many traders unsure about the next move. Despite optimism surrounding XRP’s potential, the legal developments and recent price action have made many investors wary. The cryptocurrency market as a whole is also experiencing heightened uncertainty, which has contributed to the fluctuation in XRP’s value.

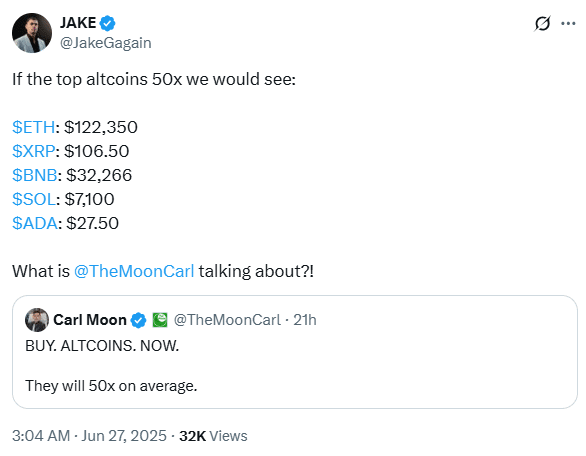

A Bold Prediction: Could XRP Surge 50x?

Amid the ongoing legal challenges, social media personality Jake Gagain made waves with a bold prediction for XRP. Gagain estimated that if XRP were to experience a 50x surge, its price could skyrocket to $106.5.

This projection came in response to Carl Moon’s claim that altcoins are primed for massive growth. However, Gagain expressed skepticism, warning that such a surge may be overly optimistic given the current market environment.

The potential for a 50x increase in XRP’s price would push the cryptocurrency far beyond its previous all-time high of $3.84. If XRP were to reach $106.5, its market capitalization would soar to $6.28 trillion, a level that would be unprecedented in the cryptocurrency market.

XRP Market Analysis: Key Indicators Signal Bearish Pressure

XRP’s recent price action has been shaped by increased volatility. The Volume indicator, which tracks buying and selling pressure, showed a sharp spike after a period of consolidation between June 13th and June 22nd. This increase in volume has led to heightened market fluctuations, indicating a growing divide between buyers and sellers.

The Stochastic RSI, a widely used tool to assess market sentiment, shows that XRP is currently in oversold territory. This suggests that the cryptocurrency is under significant bearish pressure. The Moving Average Convergence Divergence (MACD) indicator is also showing a rising red histogram, signaling that the bearish trend may continue in the short term.

Support and Resistance Levels to Watch

XRP is currently testing critical support levels. If the price continues to fall, it may test the $2.08 level, which has been identified as a key point of interest. If the downward pressure persists, XRP could drop further to $2.00.

On the flip side, if the market sentiment shifts in favor of buyers, XRP may retest the resistance level at $2.15. A break above this level could see XRP push toward $2.23 later this week.

Legal Uncertainty and Market Volatility Create Challenging Environment

The ongoing legal battle between Ripple Labs and the SEC continues to create uncertainty in the XRP market. The latest ruling by Judge Torres has added to the volatility, leaving traders unsure about the future direction of the cryptocurrency. As long as the legal situation remains unresolved, XRP price today is likely to continue experiencing significant fluctuations.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| June | $2.14 | $2.16 | $2.18 | 1.9% |

| July | $2.17 | $2.32 | $2.46 | 15% |

| August | $2.21 | $2.30 | $2.38 | 11.2% |

| September | $2.22 | $2.32 | $2.41 | 12.6% |

| October | $1.98 | $2.12 | $2.26 | 5.6% |

| November | $2.14 | $2.22 | $2.29 | 7% |

| December | $1.78 | $1.98 | $2.18 | 1.9% |

The Road Ahead for XRP

Despite the recent setbacks, XRP still has potential for long-term growth. Analysts have pointed to several key factors that could drive the price higher, including XRP’s utility in cross-border payments and its potential integration into global financial systems. However, until the legal issues are settled, XRP’s price is likely to remain volatile.

Conclusion

XRP price today is facing significant challenges due to ongoing legal developments and market volatility. While the possibility of a bullish reversal remains, the legal uncertainty surrounding Ripple Labs and the SEC’s lawsuit will continue to weigh on XRP price. Traders should keep an eye on the situation, as it will play a crucial role in determining the cryptocurrency’s future direction.

Summary

Frequently Asked Questions (FAQs)

1- What caused the recent decline in XRP price today ?

The recent dip in XRP price was driven by a ruling in the ongoing legal battle between Ripple Labs and the SEC, leading to uncertainty in the market.

2- Can XRP reach $100?

While some analysts predict long-term growth, including a potential $100 price point, legal uncertainties and market conditions must first stabilize.

3- What is the 50x surge prediction for XRP?

Some influencers have suggested that XRP could soar by 50x, reaching as high as $106.5. However, many believe this forecast is overly optimistic given current market conditions.

4- What are the key support levels for XRP?

XRP is currently testing critical support at $2.08, with further potential declines to $2.00, depending on market sentiment.

Appendix: Glossary of Key Terms

SEC (Securities and Exchange Commission) – A U.S. government agency that enforces federal securities laws and regulates the securities industry.

XRP – A digital asset used for fast, low-cost cross-border payments. It is the native cryptocurrency of the Ripple network.

Resistance Level – A price level at which an asset’s price tends to struggle to rise above due to selling pressure.

Support Level – A price level where an asset’s price tends to find support due to buying interest, preventing it from falling further.

Bullish – A market sentiment where investors expect the price of an asset to rise.

Bearish – A market sentiment where investors expect the price of an asset to fall.

MACD (Moving Average Convergence Divergence) – A technical analysis tool used to identify changes in the strength, direction, momentum, and duration of a trend in an asset’s price.

References

The Crypto Basic – thecryptobasic.com

Crypto Times – cryptotimes.io