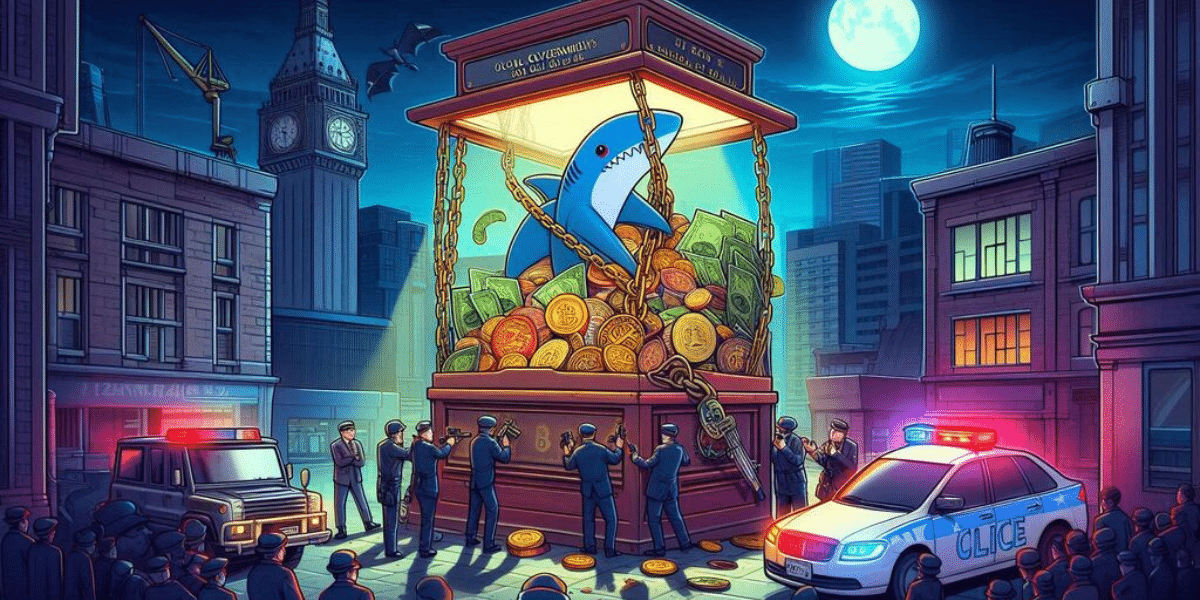

Chinese local governments are reportedly intensifying efforts to manage and deal with billions of dollars’ worth of criminal crypto stashes confiscated from illicit activities.

According to a report in Reuters, the absence of a unified rule has triggered concerns over potential corruption and inconsistent enforcement. This has prompted local governments to try to find ways of cashing out the hordes of digital assets, igniting calls from courts and the financial industry for better regulation.

Over 3,000 Cases on Criminal Crypto Stashes

Besides not being recognized as property or legal tender and that trading in Bitcoin and other cryptocurrencies is illegal in China, local governments and courts have large criminal crypto stashes, and they regularly seize from perceived criminal activities ranging from internet fraud to unlawful gambling. Reuters reports that Judges, police, and lawyers are now seeking regulatory reform to bring transparency and structure to this grey area.

Transaction records reviewed by Reuters show that in some cases, government institutions have enlisted private firms to liquidate the criminal crypto stashes in their possession and convert the digital assets into cash to supplement government funds. Court records also indicate a rapid rise in crypto-linked criminal prosecutions, with authorities filing over 3,000 cases against individuals relating to crypto-linked money laundering.

Government Should Clarify Property Attributes

According to blockchain security firm SAFEIS, the total amount of funds involved in these cases was $59 billion. In addition to the enforcement practices, local governments collected at least $51.8 billion in penalties and confiscations associated with the criminal crypto stashes, representing a 65% increase from 2028.

Bitcoin investment firm River estimates that Chinese local governments held at least 15,000 Bitcoins by December 2023, with the federal government having an estimated 194,000 BTC worth approximately $16 billion.

Chinese blockchain service provider Bit Jungle observed that it was legitimate for the government to use private companies to dispose of any criminal crypto stashes in their possession as long as they sold them through offline exchanges.

According to crypto-focused lawyer Sun Ju, a senior partner at Shanghai Landing Law Offices, the government should clarify the property attributes of virtual currencies, set up an agency or a system for cryptocurrency disposal, and vet third-party companies. He added:

“It is a highly profitable business that attracts more and more participants.”

Conclusion

Although China has banned digital asset trading and mining, thousands of Chinese citizens regularly use offshore exchanges and other peer-to-peer methods to access cryptocurrencies, mostly routing their transactions through overseas platforms or VPNs. This practice complicates the government’s enforcement efforts as it becomes difficult to differentiate between digital assets for personal use and criminal crypto stashes.

As debates about the seized criminal crypto stashes rage, policymakers could soon be forced to take the bull by the horns and draft new national-level guidelines. Most observers believe it’s about time the government reviewed its position and developed a formal regulatory response that could reshape how China handles digital assets caught in its legal net.

Frequently Asked Questions (FAQs)

What’s behind China’s cryptocurrency ban?

China banned cryptocurrencies because its government believed it would destabilize its currency at a time when it was working on expanding its economy. The government plans to create its own CBDC and is participating in cryptocurrency regulatory development efforts.

Is it illegal to own crypto in China?

Individuals are allowed to hold, buy, and sell crypto in China. However, crypto-related business activities such as token issuance, trading, and initial coin offerings remain prohibited.

What is the crypto policy in China?

Bitcoin and other cryptocurrencies are illegal in China. You can own crypto for personal use, but you can’t use it as an investment or a payment method.

Appendix: Glossary to Key Terms

Bitcoin: Bitcoin is the first decentralized cryptocurrency. It is based on a free-market ideology and was invented in 2008

VPN: VPN stands for “Virtual Private Network” and describes the opportunity to establish a protected network connection when using public networks.

Money laundering: Disguising financial assets so they can be used without detecting the illegal activity that produced them.

Source