The crypto market is on edge as Bitcoin and Ethereum prepare for significant price swings. Amidst declining investor sentiment, Bitcoin slipped below $92,000, with Ethereum following suit. These movements coincide with the global crypto market cap dropping to $3.25 trillion. Adding to the tension, $2.27 billion worth of BTC and ETH options are set to expire today, potentially triggering short-term volatility.

Bitcoin and Ethereum Investors Eye Key Expiry Levels

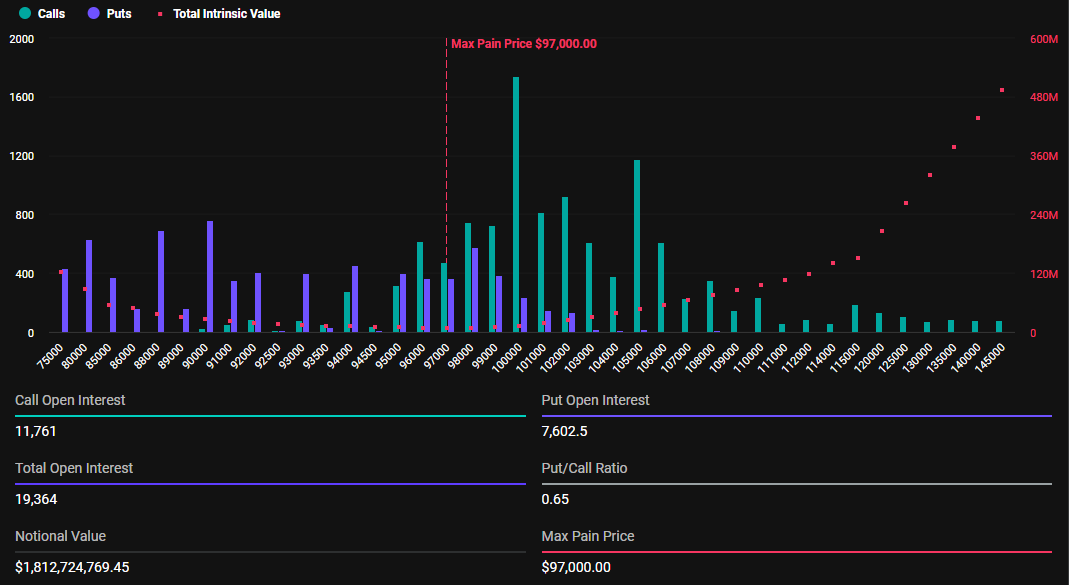

As reported by The Bit Journal, the market remains in a bearish trajectory. Today’s options expiry could further amplify market movements. According to Deribit data, 19,364 Bitcoin options contracts are expiring, slightly down from last week’s 19,885 contracts. The put/call ratio for these options is 0.65, with a maximum pain point at $97,000. Despite BTC remaining below $100,000, this ratio indicates a generally bullish sentiment.

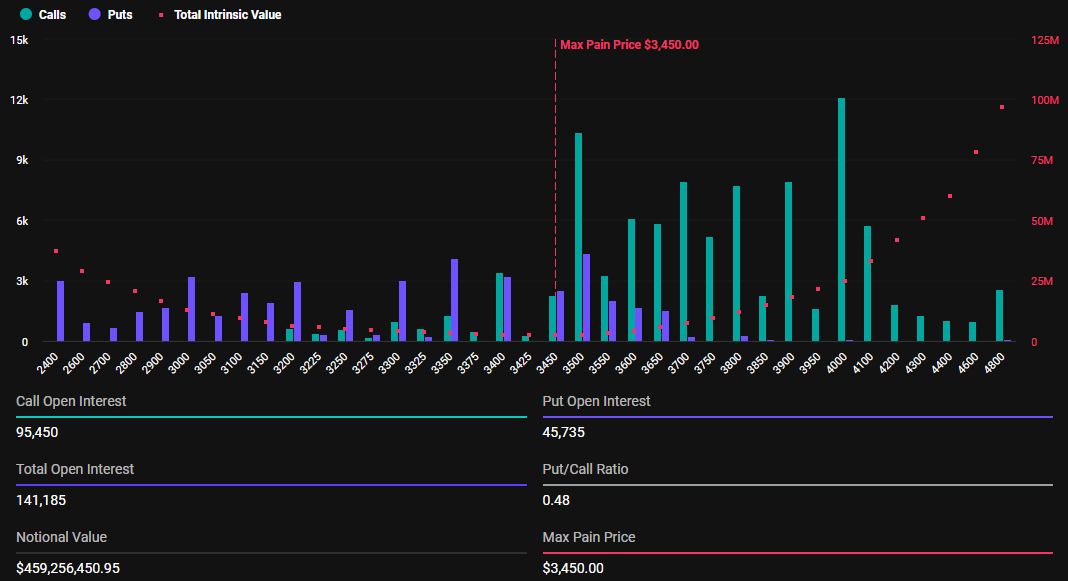

On the Ethereum front, 205,724 ETH options contracts are expiring, with 141,185 of them set to close today. These contracts have a put/call ratio of 0.48, and the maximum pain point for ETH is $3,450. The expiry could influence ETH’s short-term price action as traders anticipate movements toward these levels.

The Significance of Maximum Pain Points

With today’s options contracts reaching maturity, market participants expect BTC and ETH prices to gravitate toward their respective maximum pain levels. According to the Max Pain theory, option prices tend to converge where the highest number of contracts expire worthless, aligning with both call and put contracts’ strike prices.

After Deribit processes these contracts at 11:00 AM UTC, the pressure on BTC and ETH prices may ease. However, the sheer volume of these expirations could lead to heightened volatility. As Deribit aptly questioned, “Is this the start of a breakout or another phase of consolidation?”

Bitcoin’s Next Move: Analysts Divided

Analysts are split on the next direction for Bitcoin. While some anticipate further gains, others warn of a downside risk if BTC breaks below the $92,000 support level. Glassnode data shows weakening short-term demand momentum. Notably, the “Hot Money” metric—representing capital revived within seven days—has plummeted from its December 12 peak of $96.2 billion to $32 billion, a staggering 66.7% drop.

Ethereum’s Position Amid Market Tensions

For Ethereum, the $3,450 maximum pain level remains critical. Analysts expect ETH’s price movement to mirror BTC’s as the broader market reacts to today’s developments. Whether these expirations will lead to a breakout or continued consolidation remains a central question.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!