Today marks a significant moment for the crypto market, as nearly $3 billion worth of Bitcoin and Ethereum options contracts are set to expire. The expiration of these contracts often triggers noticeable price volatility, prompting traders and investors to keep a close eye on market movements.

Large Bitcoin and Ethereum Options Expirations Loom

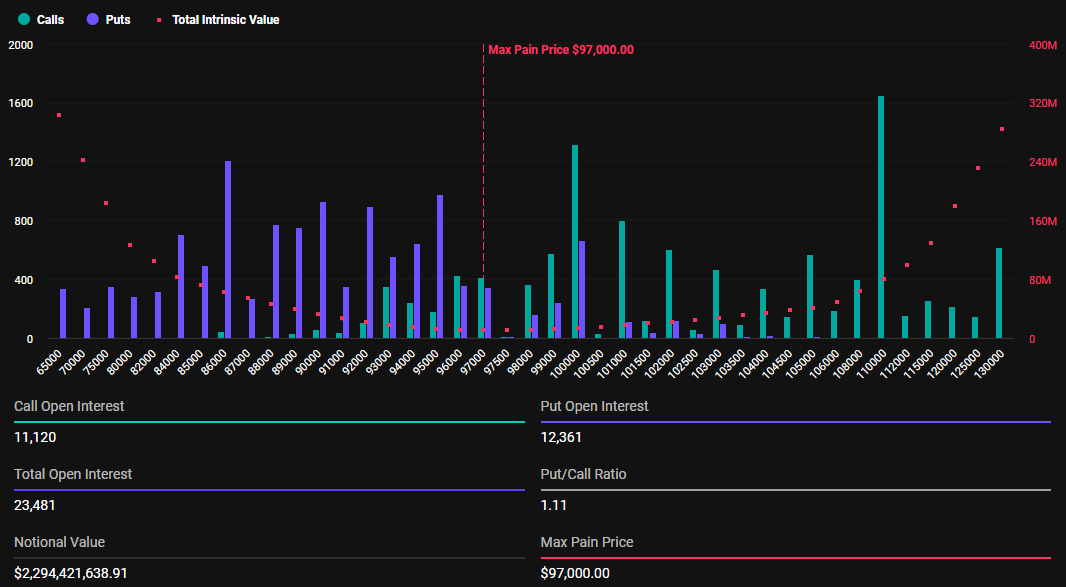

As reported by The Bit Journal, data from Deribit shows that approximately 23,481 Bitcoin contracts, with a nominal value of $2.29 billion, will expire today. The put/call ratio for Bitcoin options stands at 1.11, signaling a bearish sentiment. The max pain point, or the price level where the most options will expire worthless, is at $97,000.

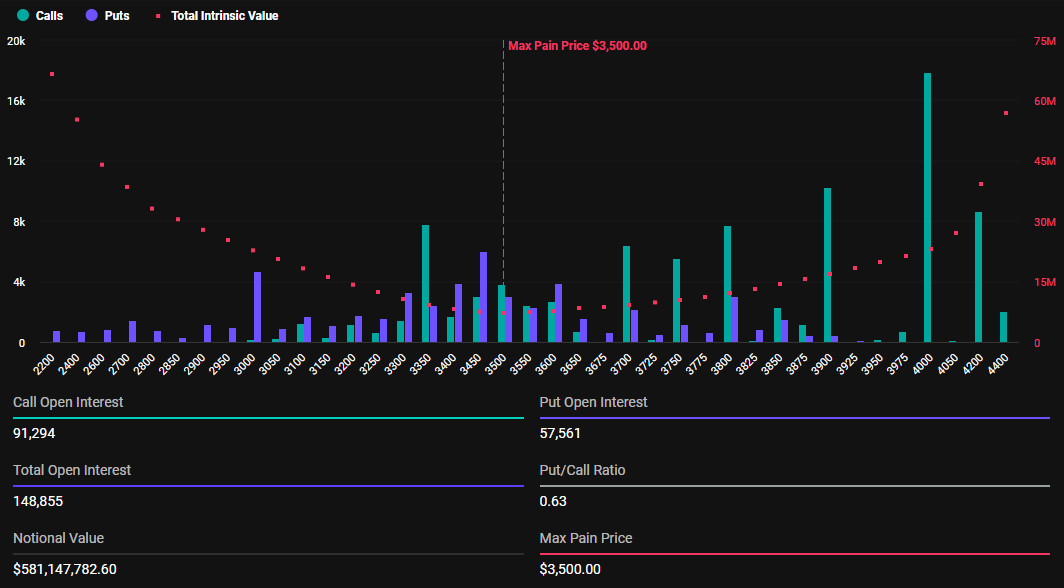

For Ethereum, over 148,733 options contracts, valued at approximately $581 million, are nearing expiration. Ethereum’s max pain point is $3,500, while its put/call ratio of 0.63 suggests a bullish market sentiment. As of writing, Ethereum is trading around $3,900, showing a modest 0.73% gain in Friday’s early session.

What the Options Data Tells Us About BTC and ETH

Bitcoin’s high put/call ratio indicates a bearish tilt, while Ethereum’s lower ratio reflects optimism among traders. Analysts at Greeks.live point to Bitcoin’s remarkable journey from zero to $100,000 in just a decade, with major milestones like Donald Trump’s congratulatory tweets contributing to its mainstream adoption.

However, recent leverage-driven corrections and profit-taking near the $100,000 mark caused Bitcoin to retreat to $98,201. Large sell orders near the $110,000 threshold also contributed to this pullback.

Leverage and Liquidation Risks in Focus

The elevated funding rates for leveraged contracts suggest excessive bullish bets, increasing the likelihood of a market pullback. Traders should note that options expirations often pull prices towards max pain levels, but these effects are typically short-lived, with the market returning to normalcy soon after.

Conclusion

As Bitcoin and Ethereum options reach expiration, the crypto market is poised for potential volatility. Investors should remain cautious and focus on long-term fundamentals rather than short-term fluctuations. The Bit Journal will continue to monitor this critical period, providing timely insights into the evolving crypto landscape.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!