Today marks a significant event in the cryptocurrency market, with approximately $7.7 billion worth of Bitcoin and Ethereum options set to expire. This includes $5.8 billion in Bitcoin options and $1.9 billion in Ethereum options. Traders are bracing for potential market volatility as these options reach their expiration.

Bitcoin and Ethereum Options Expiring!

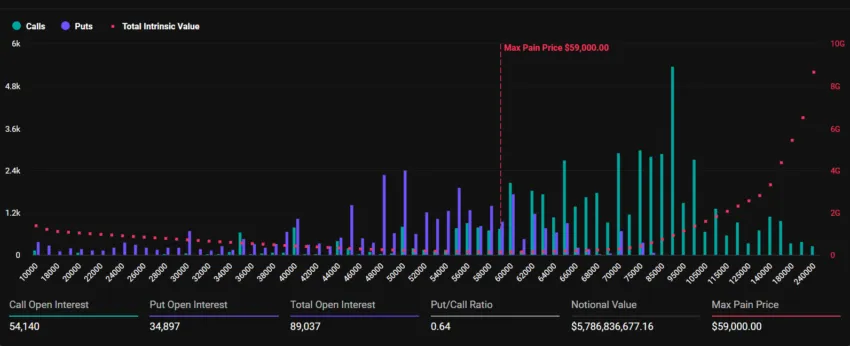

According to Deribit data, a total of 89,037 Bitcoin options contracts will expire on September 27. This is a notable increase from last week’s 20,037 contracts. The put/call ratio for these options is 0.64, with the maximum pain point sitting at $59,000.

Similarly, Ethereum’s options market will see the expiration of 719,130 contracts today, with a put/call ratio of 0.47 and a maximum pain point of $2,550.

What Does the Expiration of These Options Mean for Bitcoin and Ethereum?

In options trading, investors use the put/call ratio to gauge market sentiment. Bitcoin’s ratio suggests a relatively balanced market, with a slight preference for call options, indicating expectations of further bullish momentum. Meanwhile, Ethereum’s lower ratio reflects even stronger bullish sentiment among traders.

The maximum pain point signals where Bitcoin and Ethereum prices could settle at the expiration, potentially causing losses for both bulls and bears. As these options expire, the potential for sudden price fluctuations increases, leading to market volatility. Analysts at Greeks.live note the influence of broader market trends on this event, commenting:

“Today marks the end of the third quarter, and crypto markets have shown strong growth over the past three weeks, buoyed by the Federal Reserve’s 50 basis point rate cut that boosted market confidence. Historically, the fourth quarter is generally positive, especially with two more rate cuts expected and the U.S. elections approaching.”

Market Sentiment Remains Positive, But Volatility Looms

As reported by The Bit Journal, Bitcoin’s price has steadily climbed since the Fed’s rate cut on September 18, rising from $57,000 to $65,470. Meanwhile, Ethereum’s price surged from $2,278 to $2,659. Traders are repositioning themselves for the traditionally strong fourth quarter, and analysts expect continued volatility in the market.

Despite the positive momentum, experts caution investors to remain vigilant. Historically, the expiration of options often leads to short-term market instability. The coming days will be crucial in determining whether Bitcoin and Ethereum can maintain their upward trends or if a correction is imminent. As volatility is expected, how prices react after the expiration of these large options will likely shape market trends in the weeks ahead.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!