The US job market showed slower-than-expected growth in August, and Bitcoin initially responded positively to this development. The US unemployment rate dropped from its multi-year peak of 4.3% in July to 4.2% in August. Friday’s job report surprised markets, with over 160,000 job positions remaining unfilled. This data provided a clearer picture of what the Federal Reserve might do in the coming weeks, causing Bitcoin to rise towards $57,000 before pulling back to around $55,000.

Bitcoin Price Initially Rises, Then Drops

The US Department of Labor reported that local employers added only 142,000 new jobs in August, falling below expectations. When combined with the figures from July and June, the three-month average fell to 86,000, significantly lower than last year’s summer average of 202,000. The positive news for the US economy was the decline in unemployment rates, with a slight dip to 4.2% in August, aligning with expert forecasts.

These figures suggest that the Federal Reserve will likely lower interest rates by the end of September. Chairman Jerome Powell hinted at this possibility last month, with most reports predicting a 25 basis point cut. Bitcoin quickly reacted to the US government report, as it has been particularly sensitive to any major news from the world’s largest economy. BTC surged from $55,500 to $57,000 in a matter of minutes, but failed to maintain those gains and retraced back to the $55,000 level.

What’s Next for Bitcoin?

Following the weaker-than-expected US employment data, Bitcoin saw a brief rise on September 6, just before the opening of Wall Street. The price of BTC touched $57,000 before pulling back, reaching a new monthly low of $54,919 on Bitstamp. The disappointing non-farm payroll numbers for August have raised concerns about the strength of the labor force.

Meanwhile, a senior Fed official signalled that the time to cut interest rates had arrived, with the decision expected on September 18. Speaking at the Council on Foreign Relations, New York Fed President John Williams remarked, “Our current restrictive monetary policy has effectively restored balance to the economy and reduced inflation.” He added, “Now that the economy is stable, and inflation is moving towards 2%, it is appropriate to reduce the degree of restrictiveness by lowering the target range for the federal funds rate.”

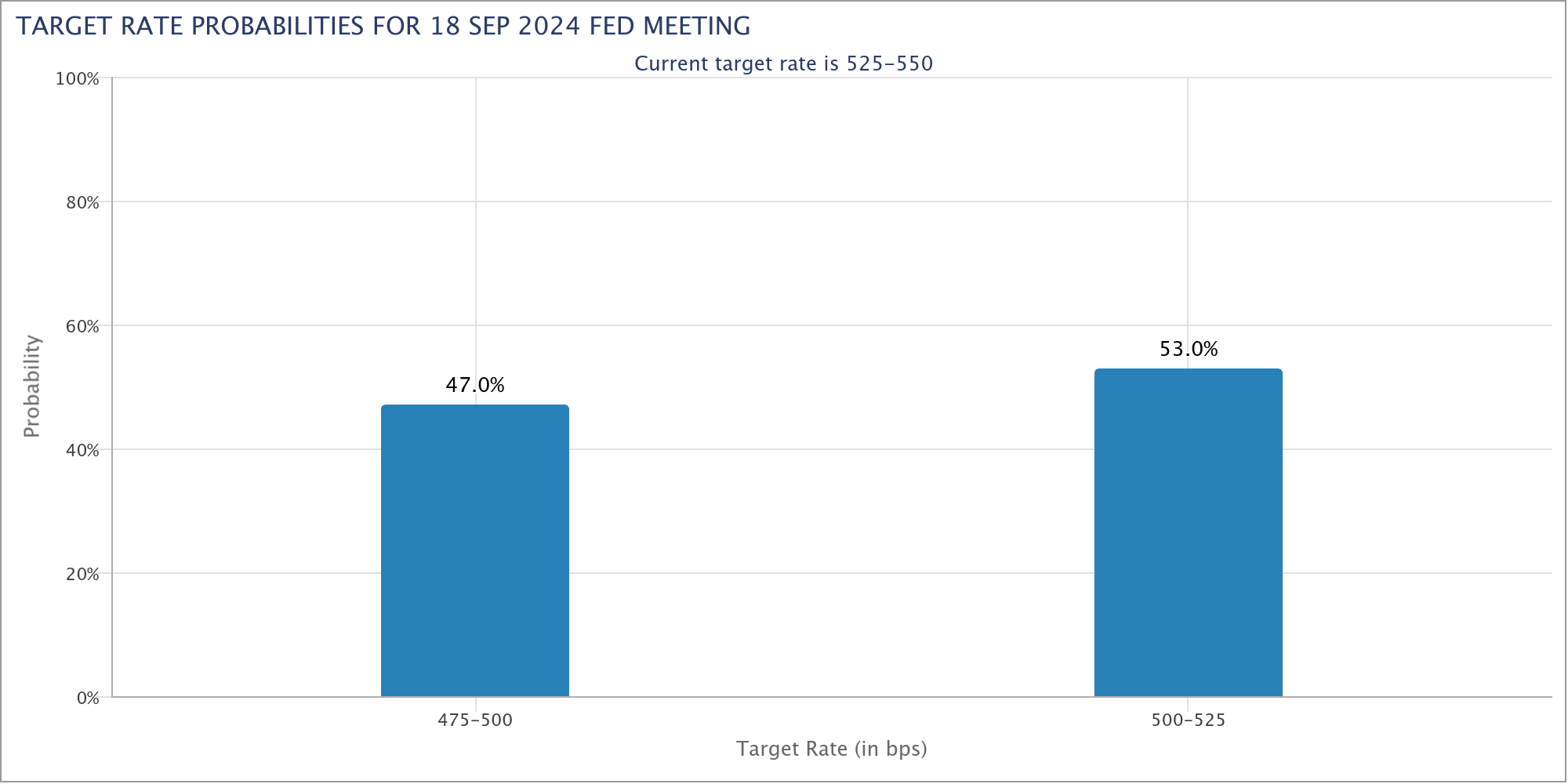

The CME Group’s FedWatch Tool shows that the market is now evenly split between 25 and 50 basis point rate cuts, with probabilities standing at 53% and 47% respectively. While the US dollar saw its own rise after the data release, crypto analysts like Daan Crypto also weighed in. The analyst commented on the US dollar index (DXY), “The DXY remains weak, hovering above the 101 support level.”