Global crypto market soared as crypto trading volumes on centralized exchanges surged 19% in July 2024, driven by new Ethereum ETFs and positive U.S. political sentiment, with Bybit’s trading volume rising nearly 23%.

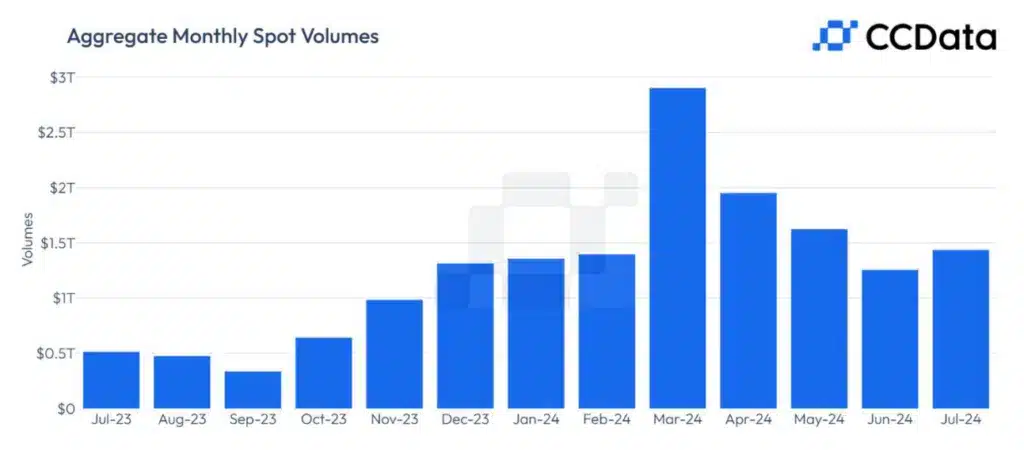

The cryptocurrency market is abuzz with excitement following a notable uptick in global crypto trading volumes on centralized exchanges. After four months of decline, July 2024 saw a remarkable 19% increase, bringing the total to an impressive $4.94 trillion. This resurgence has sparked optimism among traders and analysts alike, according to CCData’s latest research report.

Several factors have driven this substantial increase in trading volumes. One of the primary catalysts has been the introduction of spot Ethereum exchange-traded funds (ETFs) in the United States. This development has rejuvenated market interest, allowing investors to engage with Ethereum through regulated financial products. Additionally, positive sentiment from U.S. political figures at the Bitcoin conference in Nashville, Texas, has further boosted market confidence. These two elements combined have created a fertile ground for increased trading activities.

The CCData report reveals that both spot and derivatives trading volumes on centralized exchanges saw notable growth. Spot trading volumes rose by 14.3%, reaching $1.44 trillion, while derivatives trading volumes surged by 21%, totaling $3.50 trillion. The derivatives market share climbed to 70.9%, the highest since December 2023, underscoring the growing importance of these financial instruments in the crypto industry. The integration of these instruments has provided traders with more tools to navigate the market, leading to increased engagement.

Bybit’s Noteworthy Performance

Among the exchanges, Bybit stood out as a top performer in July. Its spot trading volume jumped by nearly 23%, hitting $132 billion, marking the third-highest monthly volume in the exchange’s history. This significant growth helped Bybit secure a record market share of 9.18%, solidifying its position as the second-largest spot exchange. The success of Bybit can be attributed to its innovative trading solutions and user-friendly interface, which have attracted a growing number of traders.

Despite Bybit’s impressive performance, Binance retained its status as the largest spot exchange with a market share of 28.1%, though this represents a 4.9% decline from the previous month. The intense competition among exchanges means market dynamics can shift quickly, but Binance’s continued dominance highlights its pivotal role in the crypto ecosystem. Binance’s extensive range of services and robust security measures continue to make it a preferred choice for many traders.

Dominance in the Derivatives Market

In the derivatives sector, Binance maintained its stronghold with a commanding 43.5% market share. OKX followed with 19%, and Bybit held 15.1%, demonstrating its significant presence in both spot and derivatives trading. The report also notes a significant spike in volatility in early August, leading to the second-highest daily spot trading volume since May 2021, a period marked by China’s ban on Bitcoin mining, which disrupted global markets.

The increased volatility and trading volumes emphasize the dynamic nature of the cryptocurrency market. Traders and investors must remain vigilant and adapt to changing conditions to navigate the market effectively. The rise in derivatives trading indicates that market participants are increasingly using these instruments to hedge their positions and manage risk. This trend reflects a maturation of the market as traders become more sophisticated in their strategies.

Future Prospects

The resurgence in trading volumes on centralized exchanges is a positive indicator for the cryptocurrency market. It reflects renewed interest and confidence among investors, potentially paving the way for further growth in the coming months. However, it’s crucial to approach these developments with a balanced perspective.

The launch of spot Ethereum ETFs in the U.S. is undoubtedly a significant milestone, but it also comes with its challenges. Regulatory scrutiny and market dynamics will play vital roles in shaping the future of these financial products. Furthermore, the competitive landscape among exchanges means market shares can fluctuate, and new players may emerge as major contenders. Investors and traders will need to stay informed about these regulatory changes to adapt their strategies accordingly.

For now, the focus remains on the factors driving this surge in trading volumes. The impact of U.S. political sentiment and the introduction of new financial products will continue to influence market trends. Traders and analysts will closely monitor these developments to gauge their long-term effects on the cryptocurrency ecosystem. The potential for innovation in financial products and regulatory adjustments will likely shape the market’s trajectory in the near future.

Conclusion

In conclusion, July 2024 marked a turning point for the cryptocurrency market, with global trading volumes on centralized exchanges experiencing a much-needed boost. The introduction of spot Ethereum ETFs in the U.S. and positive political sentiment were key drivers of this resurgence. Bybit’s strong performance and Binance’s continued dominance in both spot and derivatives markets highlight the dynamic and competitive nature of the crypto space.

As we move forward, the market’s ability to sustain this momentum will depend on various factors, including regulatory developments, market sentiment, and the introduction of innovative financial products. For traders and investors, staying informed and adaptable will be crucial to navigating the ever-evolving landscape of cryptocurrency trading. The future looks promising, but vigilance and adaptability will be key to capitalizing on these opportunities.