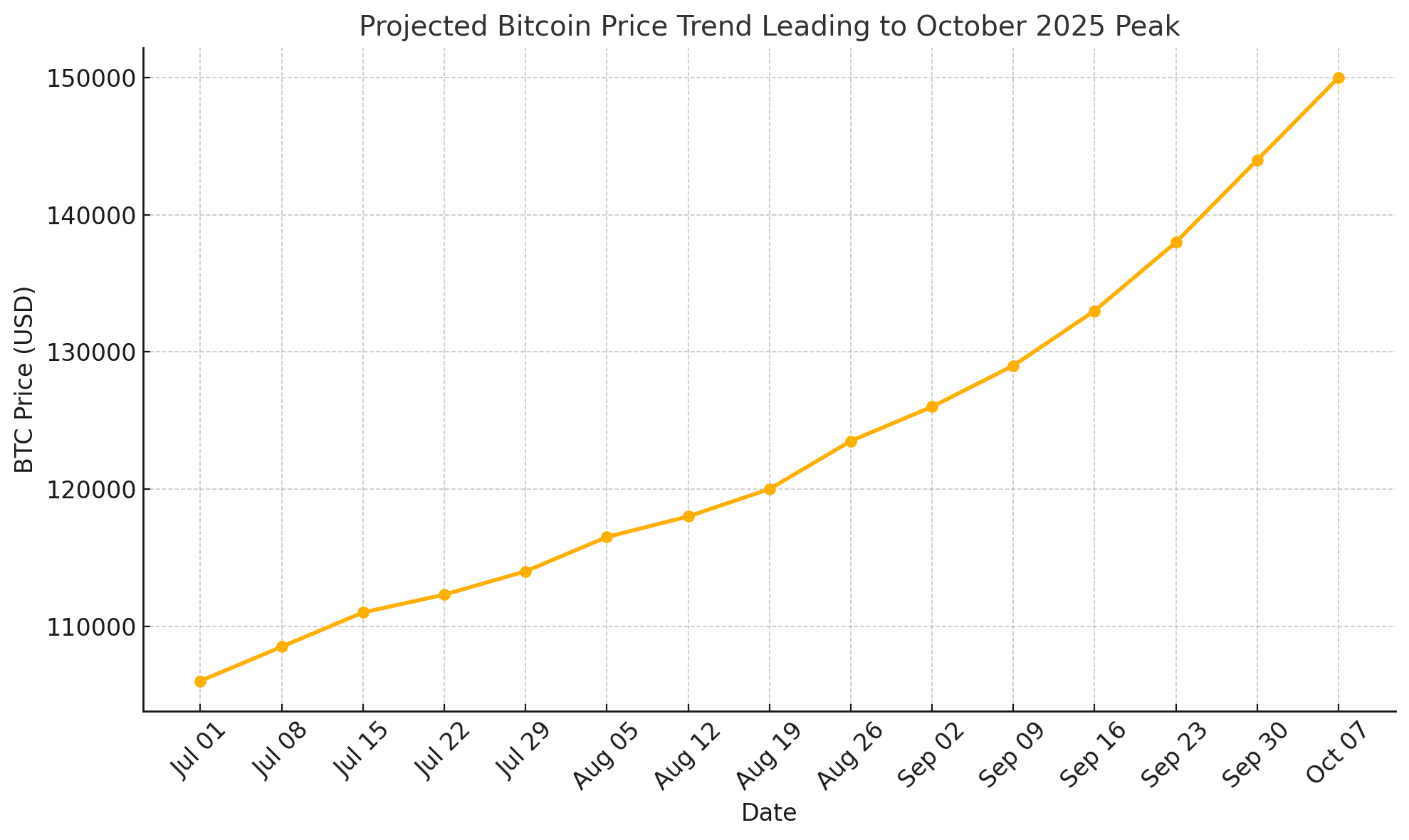

Technical experts, on-chain researchers, and even global banks are all agreeing that the current Bitcoin bull run will reach a climax in around three months. CoinoMedia’s most recent breakdown of halving-cycle timing marks the anticipated top 518-546 days after the April 2024 incentive drop, placing the window between mid-September and mid-October 2025.

Halving Cycles Still Rule the Rhythm

Each of the last three cycles (2013, 2017, and 2021) reached fresh all-time highs 17-18 months following the halving, followed by sharp retracements. On X, market observer Rekt Capital highlighted that “if history rhymes, the next peak sits only 2-3 months away.”

On-Chain Thermometer: Mayer Multiple Signals Room to Run

While prices are reaching six-figure territory, the Mayer Multiple indicates a neutral 1.1×, far from the 1.5× overheated zone. According to Bitbo analysts, “Bitcoin remains undervalued near all-time highs, suggesting the market has not yet reached euphoria.”

Institutional Tailwind: Standard Chartered Doubles Down

In a July 2 paper, Standard Chartered forecast new records of $135 k by Q3 and $200 k by late 2025, discounting the notion that post-halving dips would derail momentum due to ETF inflows and corporate treasury purchasing.

“ETF and treasury demand has broken the old 18-month decline pattern, prices should accelerate, not soften, into Q4 2025.”, Geoff Kendrick, Head of Digital-Asset Research, Standard Chartered

Short-Term Jitters vs. Final Leg

After failing twice around $111 k, Bitcoin fell below $109 k this week, causing peak-cycle concerns. Analyst Ted Pillows described the drop as “a simple leverage flush” and plotted a 140-day parabolic stretch that often begins just before the halving-cycle apex.

Price Snapshot

| Date (UTC) | Close (BTC-USDT) | 24 h Δ |

|---|---|---|

| Jul 09 2025 | $108,791.85 | −0.13 % |

| Jul 08 2025 | $108,934.44 | +0.59 % |

| Jul 07 2025 | $108,292.50 | −0.85 % |

| Jul 06 2025 | $109,221.58 | +0.95 % |

| Jul 05 2025 | $108,198.63 | +0.18 % |

| Jul 04 2025 | $108,004.53 | −1.47 % |

| Jul 03 2025 | $109,612.51 | +0.73 % |

ETF Momentum Building Despite Short-Term Volatility

While Bitcoin’s price has momentarily fallen below $109,000, institutional investors remain optimistic. Spot Bitcoin ETFs continue to attract net inflows from BlackRock, Fidelity, and Ark Invest, with over 250,000 BTC accumulated year to far.

Analysts consider this a strong fundamental indication. “The short-term price noise is largely irrelevant when long-term demand is clearly flowing in,” said a Galaxy Digital strategist. As the Q4 window approaches, ETF momentum might act as a stimulus for the last upward push.

Altcoin Cycle May Trail Bitcoin Peak Slightly

Historically, altcoin seasons are several weeks behind Bitcoin peaks. Analysts believe that Ethereum, Solana, and Layer 1 tokens will surge through Q4 2025 and into early 2026, even if Bitcoin rises first. As capital shifts from BTC earnings to higher-beta assets, the whole crypto market capitalization may reach new highs. According to researcher Michaël van de Poppe, while Bitcoin is the market leader, altcoins frequently contribute to the party. This post-peak rotation may provide investors with second-wave possibilities even after Bitcoin has reached its peak.

What Could Extend or End, the Rally?

ETF flow resilience: Net inflows above 250 k BTC year-to-date bolster demand.

Macro liquidity: A dovish Fed tilt or renewed global easing could push fresh capital into risk assets.

Dormant-wallet supply shocks: The revival of 20,000 BTC from 2011-era wallets underscores latent sell pressure but, so far, sales are being handled OTC.

Conclusion

With technical timing, on-chain undervaluation, and big-bank confidence pointing to Q3-Q4 2025 as Bitcoin’s peak, the market has a limited timeline to catch the cycle’s final substantial gain. Vigilant risk management is critical: the rise to six-figure territory may be quick, but so is the historical decline that follows.

The Final Sprint

If past rhythm holds, a 10-week explosive leg may begin as early as late July, pushing prices into the upper six-figure range until weariness occurs around mid-October. Caution is still warranted: past peaks were overturned by 70-85% within months.

Frequently Asked Questions

Q1. When is the next expected Bitcoin peak?

Most cycle models indicate mid-September to mid-October 2025, roughly 520–540 days post-halving.c

Q2. How high could Bitcoin go in this cycle?

Forecasts range from Standard Chartered’s $200 k to stock-to-flow targets near $368 k, but no model guarantees outcomes.

Q3. Does the Mayer Multiple prove a top isn’t in?

A reading of 1.1× indicates price remains within neutral territory; previous peaks printed above 2.4×.

Q4. Could ETF outflows derail the bull market?

Short bouts of redemptions are normal; the broader trend of institutional accumulation remains intact.

Glossary of Key Terms

Bitcoin halving: A programmed 50 % cut in block-reward issuance every 210,000 blocks, roughly four years.

Mayer Multiple: Ratio of Bitcoin’s price to its 200-day simple moving average, used as an overbought/oversold gauge.

ETF inflows: Net capital entering spot Bitcoin exchange-traded funds, often viewed as institutional demand.

Leverage flush: Rapid liquidation of over-leveraged derivatives positions, typically causing short-term volatility.

Stock-to-flow: A scarcity-based valuation model comparing existing supply with annual production.

OTC desk: Over-the-counter trading venue for large block trades executed off-exchange.

Bull-market peak: Cycle high before a prolonged bear-market drawdown.

200-day SMA: A widely observed long-term moving average indicating trend direction.