Crypto.com has now revealed that it will no longer support Tether’s USDT and nine other tokens in Europe due to the MiCA regulation. This makes Crypto.com one of the first major platforms that is complementing with the MiCA’s regulations. The delisting will come into force on the 31st of January 2025. This is a big move towards the proper oversight of the cryptocurrency industry in the European Union.

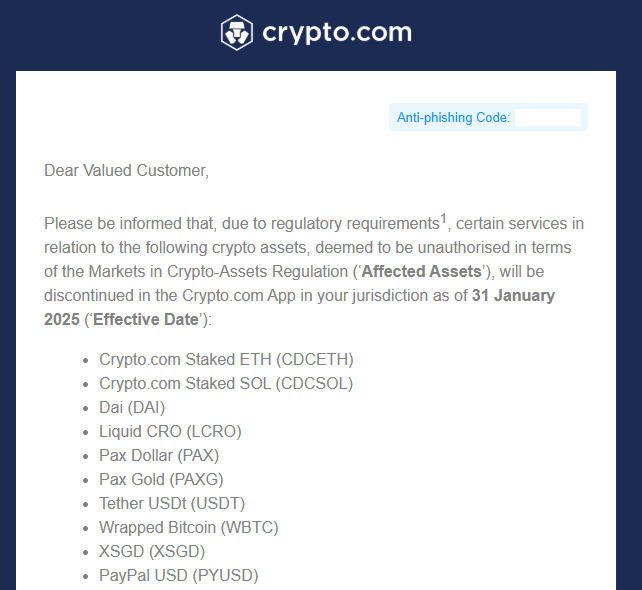

Effective January 31st, Crypto.com will cease all purchases of USDT and other non-compliant tokens. This includes Wrapped Bitcoin, Pax Dollar (PAX), Pax Gold, PayPal USD, Crypto.com Staked ETH (CDCETH), Crypto.com Staked SOL (CDCSOL), Liquid CRO (LCRO), and XSGD. The suspension of these tokens is due to the strict rules of MiCA. The exchange will stop accepting deposits of these assets but will allow withdrawals until the 31 of March, 2025. Full delisting will happen by that date.

All the token holders who have been affected need to take action before the set time. Crypto.com has granted them a deadline of March 31 to switch their assets to MiCA-compatible tokens. Subsequently, the tokens will be exchanged for stablecoins or other assets of similar market value. This change is to safeguard users and to meet the new legal framework in place in the market.

MiCA’s Regulatory Impact

The decision comes as other European crypto exchanges have already taken similar steps. For instance, Coinbase Europe suspended the trading of USDT in December 2024. They allowed their clients to swap USDT for other MiCA-compliant assets, including the USD Coin (USDC). With MiCA, which was fully effective from December 2024, several CASPs had to conform to its stipulated rules. Crypto.com, just like other companies, is in the process of obtaining a MiCA license in Malta.

MiCA regulations are now a very important part of the European crypto landscape. It also tries to safeguard investors and increase the level of disclosure. The European Securities and Markets Authority (ESMA) has noted that non-compliant products must be prohibited. On January 17, 2025, the European Securities and Markets Authority (ESMA) called on crypto service providers to remove tokens that did not meet the requirements. The authority fixed March 31 of the year the deadline for the disposal of such assets.

Juan Ignacio Ibanez, a member of the MiCA Crypto Alliance, also pointed to this deadline. He said that there should not be any non-compliant tokens on the platform after March 31. Ibanez’s statements echo the increasing concern in the European crypto space. Compliance with MiCA is becoming paramount to avoid sanctions or even damage to the reputation of the exchanges.

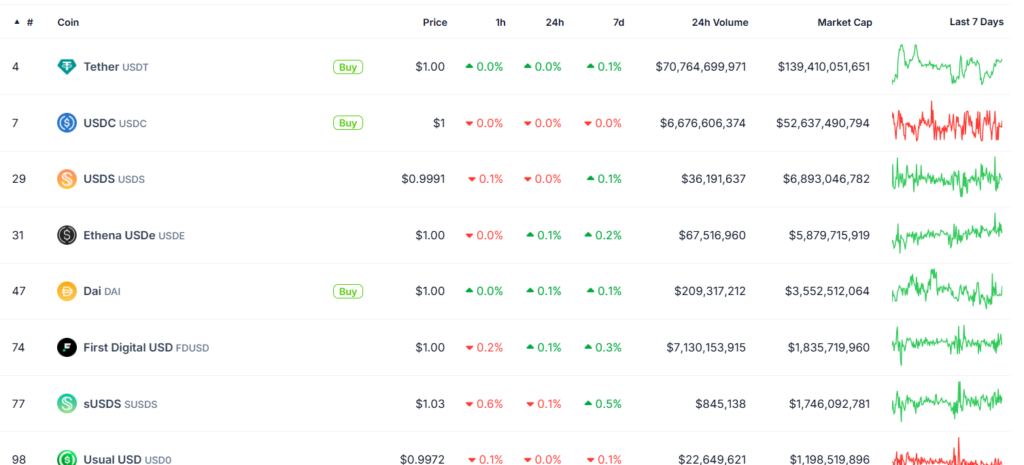

USDT Vs. USDC Market Capitilzation

The most popular Stablecoin is USDT, which has a market capitalization of $139.41 billion. Nevertheless, the company has failed to meet MiCA regulations, and this has caused problems in Europe. At the moment, USDC, USDT’s main rival, has been granted approval to operate as a stablecoin under MiCA. USDC has a market capitalization of $52.63 billion at the moment. This divergence between USDT and USDC is a result of the increasing regulation of stablecoins.

As more MiCA regulations are put into place in the European market, other exchanges will most likely take the same route as Crypto.com. Some of these platforms will have no choice but to decide which tokens they want to support.

Conclusion

The establishment of MiCA has led to stringent measures to force adaptation of regulatory compliance in the market in the coming years. If it happens that USDT and other tokens will be delisted it will mean that the industry may face such changes. The deadline of March 31, 2025, will be important for both exchanges and their users.

Crypto.com’s move shows that compliance is becoming more important in the crypto sector as firms seek to avoid global scrutiny. In the wake of increasing regulatory pressure in Europe, exchanges will have to change in order to keep up. Failure to do so could lead to withdrawal from the European market or being taken to court. The rest of the broader crypto community will be observing the development of events further on.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

Why is Crypto.com delisting USDT and other tokens in Europe?

Crypto.com is delisting USDT and other tokens to comply with the European Union’s MiCA regulations.

When will the delisting of USDT and other tokens take effect?

The delisting will take effect on January 31, 2025, with full removal by March 31, 2025.

What happens to users holding non-compliant tokens after the deadline?

Users must convert their tokens by March 31, 2025, or they will be automatically swapped for MiCA-compliant assets.

Which other platforms have taken similar actions regarding MiCA compliance?

Coinbase Europe also delisted USDT in December 2024, offering users the option to swap it for compliant assets like USDC.