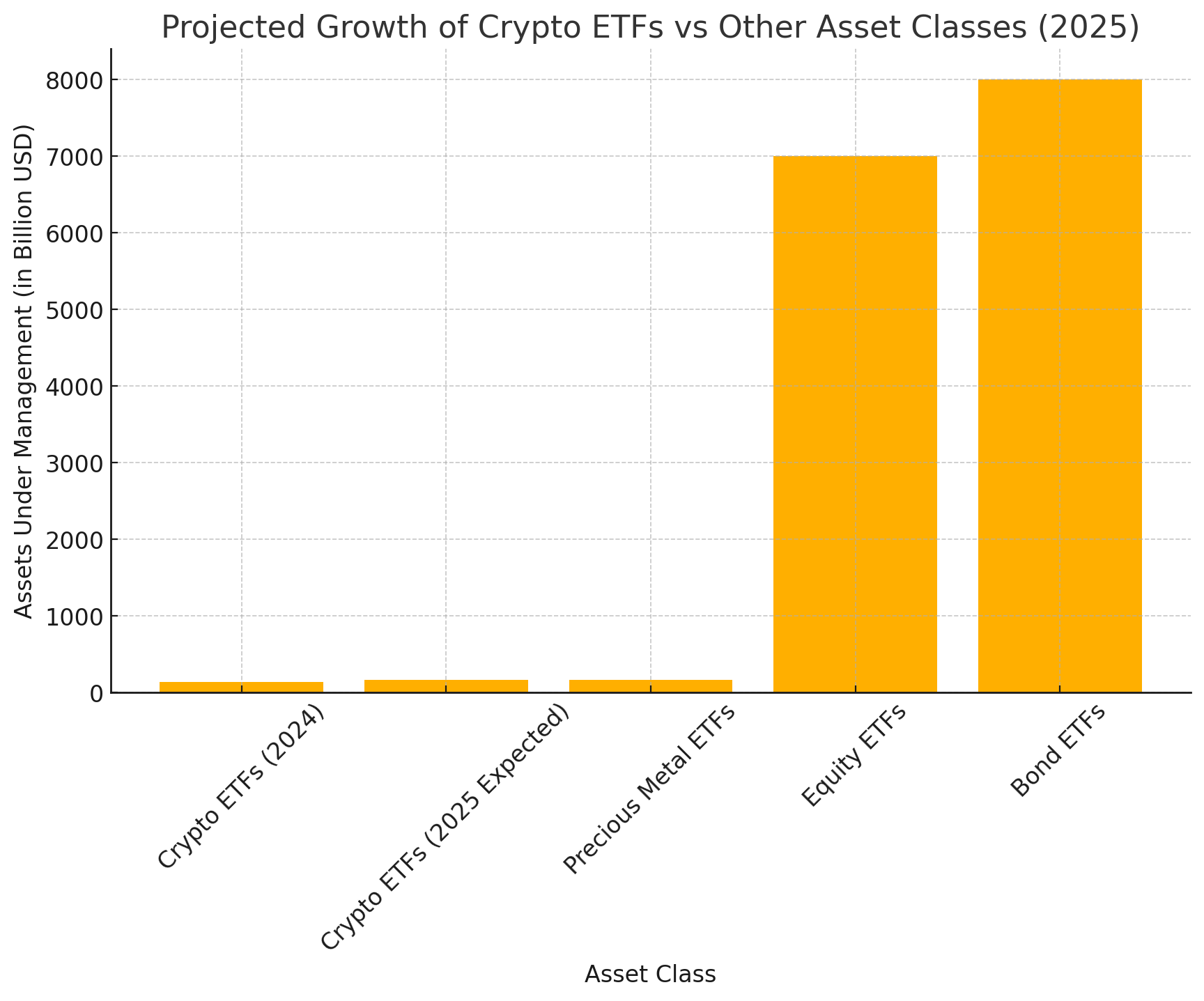

Cryptocurrency exchange-traded funds (ETFs) are poised to become a dominant force in the U.S. financial landscape. State Street, a leading financial services firm, forecasts that by the end of 2025, crypto ETFs will surpass precious metal ETFs in North America, establishing themselves as the third-largest asset class in the $15 trillion ETF industry, following equities and bonds.

Rapid Growth of Crypto ETFs

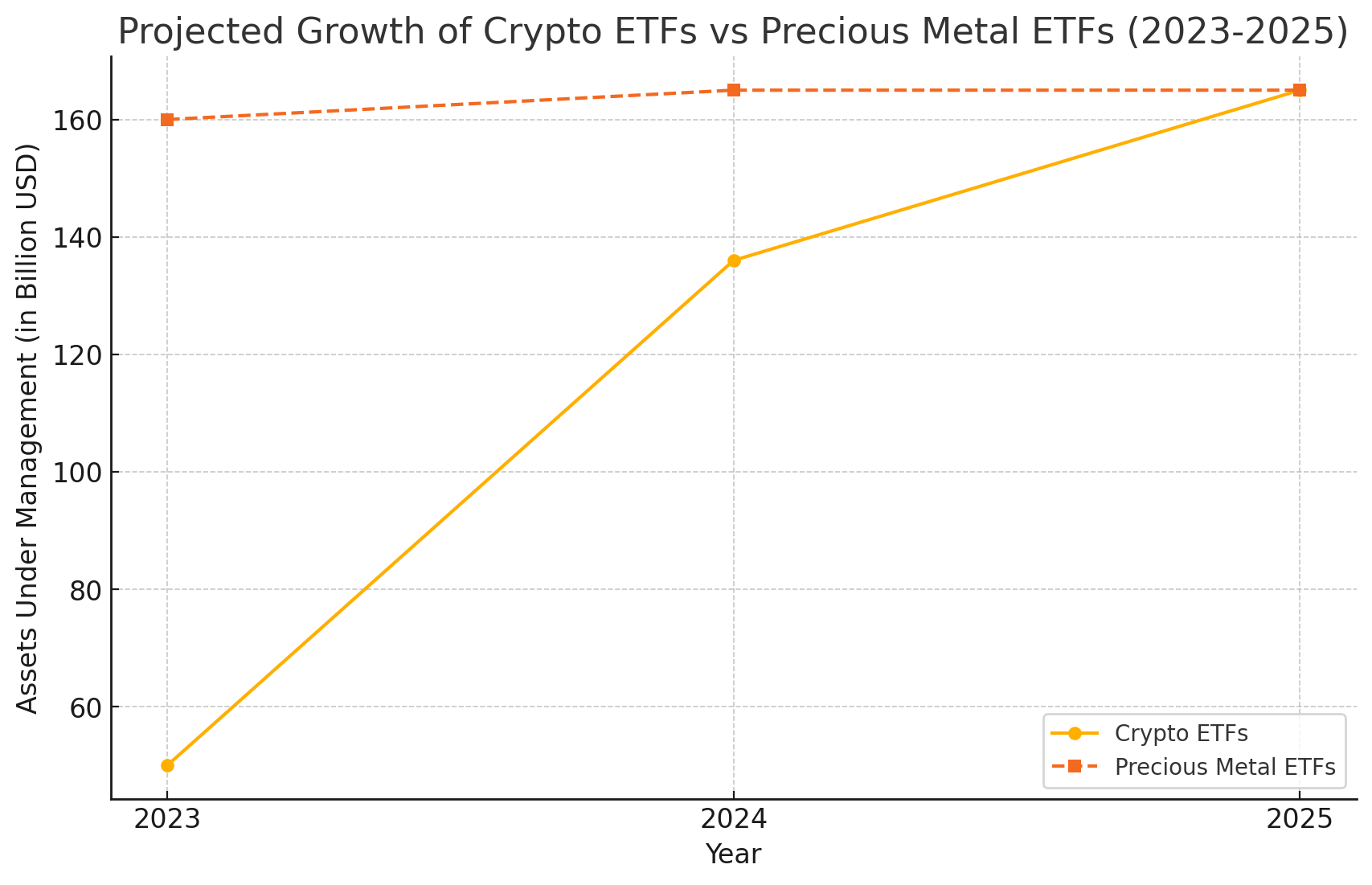

The swift ascent of crypto ETFs has been remarkable. Spot cryptocurrency ETFs were introduced in the U.S. just last year but have already amassed $136 billion in assets. This rapid growth is attributed to increasing interest from financial advisors and support from major asset managers like BlackRock. Frank Koudelka, State Street’s global head of ETF solutions, expressed surprise at the pace, noting,

“We have been very surprised by the speed of growth of crypto. I expected there to be pent-up demand, but I didn’t expect it to be as strong as it was.”

In comparison, precious metal ETFs, which had a two-decade head start with products like the SPDR Gold Trust (GLD) launched in 2004, currently hold a combined $165 billion in North America. State Street anticipates that crypto ETFs will overtake this figure within the year.

Regulatory Developments and Market Expansion

The regulatory environment is evolving to accommodate the burgeoning interest in digital assets. The U.S. Securities and Exchange Commission (SEC) has begun approving spot cryptocurrency ETFs, starting with Bitcoin and Ethereum. Looking ahead, State Street predicts that the SEC will authorize ETFs based on the top ten cryptocurrencies by market capitalization in 2025. This expansion will provide investors with diversified exposure to a broader range of digital assets.

Additionally, the SEC is expected to approve “in-kind” transactions for crypto ETFs, allowing market makers to trade directly in cryptocurrencies rather than converting to fiat currencies. This change would enhance tax efficiency and reduce transaction costs, making crypto ETFs more attractive to investors.

Implications for Investors and the Financial Industry

The rise of crypto ETFs signifies a shift in investor preferences and the financial industry’s adaptation to new asset classes. The convenience and accessibility of ETFs have democratized investment in cryptocurrencies, enabling investors to gain exposure without the complexities of managing digital wallets or private keys. This development aligns with the broader trend of integrating digital assets into traditional financial systems.

Moreover, the anticipated approval of ETF share classes for mutual funds could revolutionize the fund industry. Previously unique to Vanguard, this structure allows mutual funds to offer ETF shares, enhancing liquidity and tax efficiency. State Street forecasts that the SEC will grant approval to the 45 asset managers that have filed for this structure, with the first launches expected in the first half of 2026.

Global Perspectives

The growth of crypto ETFs is not confined to North America. European markets are also experiencing significant expansion, with assets under management expected to rise by at least 25% to $2.8 trillion this year, driven by greater retail adoption. Similarly, the Chinese ETF market is projected to surpass Japan’s, becoming the largest in the Asia-Pacific region, with assets topping $700 billion.

As the ETF landscape evolves, active management is gaining prominence. In North America, active ETFs are projected to account for 30% of ETF inflows this year, up from 26.7% in 2024. This trend reflects investors’ desire for strategies that can navigate complex markets and deliver superior returns.

Conclusion

The projected rise of cryptocurrency ETFs to the third-largest asset class in … U.S. by the end of 2025 underscores the rapid evolution of the financial industry. As regulatory frameworks adapt and investor interest grows, crypto ETFs are poised to play a pivotal role in the investment landscape, offering diversified and efficient access to digital assets.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is a cryptocurrency ETF?

A cryptocurrency exchange-traded fund (ETF) is a financial product that tracks the value of a specific cryptocurrency or a basket of cryptocurrencies, allowing investors to gain exposure to these assets without directly owning them.

Why are crypto ETFs growing so rapidly?

The growth is driven by increasing interest from investors and financial advisors, support from major asset managers, and the convenience of gaining cryptocurrency exposure through traditional investment vehicles.

What does “in-kind” transactions mean for crypto ETFs?

“In-kind” transactions allow market makers to trade directly in cryptocurrencies when creating or redeeming ETF shares, enhancing tax efficiency and reducing transaction costs.

How do crypto ETFs compare to traditional ETFs?

Like traditional ETFs, crypto ETFs offer diversified exposure and trade on exchanges. However, they specifically track the performance of cryptocurrencies, providing a bridge between digital assets and conventional financial markets.

What are the risks associated with investing in crypto ETFs?

Investing in crypto ETFs carries risks such as market volatility, regulatory uncertainties, and the potential for technological issues related to the underlying digital assets.

Glossary

Cryptocurrency: A digital or virtual form of currency that uses cryptography for security and operates independently of a central authority.

Exchange-Traded Fund (ETF): An investment fund that trades on stock exchanges, holding assets such as stocks, commodities, or bonds, and typically tracking an index.

Spot ETF: An ETF that invests directly in the underlying asset, such as a specific cryptocurrency, rather than derivatives or futures contracts.

In-Kind Transactions: Transactions where assets are exchanged directly without converting to cash, often used in ETF operations to enhance tax efficiency.

Sources