Multi-chain decentralized crypto exchange Nexera has suffered a $1.5 million exploit, forcing it to stop all trading operations. The decentralized crypto exchange Nexera, also known as AllianceBlock Nexera, has fallen victim to a hacker attack, resulting in a loss of $1.5 million worth of liquidity. The breach was first reported by blockchain forensic firm Cyvers through a post on X, which flagged a “suspicious transaction” involving Nexera’s proxy contract.

Crypto Exchange Nexera Details of the Exploit

According to Cyvers, the attacker managed to gain control over Nexera’s proxy contract, subsequently upgrading it with new permissions. This allowed the hacker to utilize the withdraw admin function to transfer all NXRA tokens. Cyvers stated, “The hacker is actively selling all the exchange’s liquidity for Ethereum, and some of the funds have already been bridged to the BNB chain.”

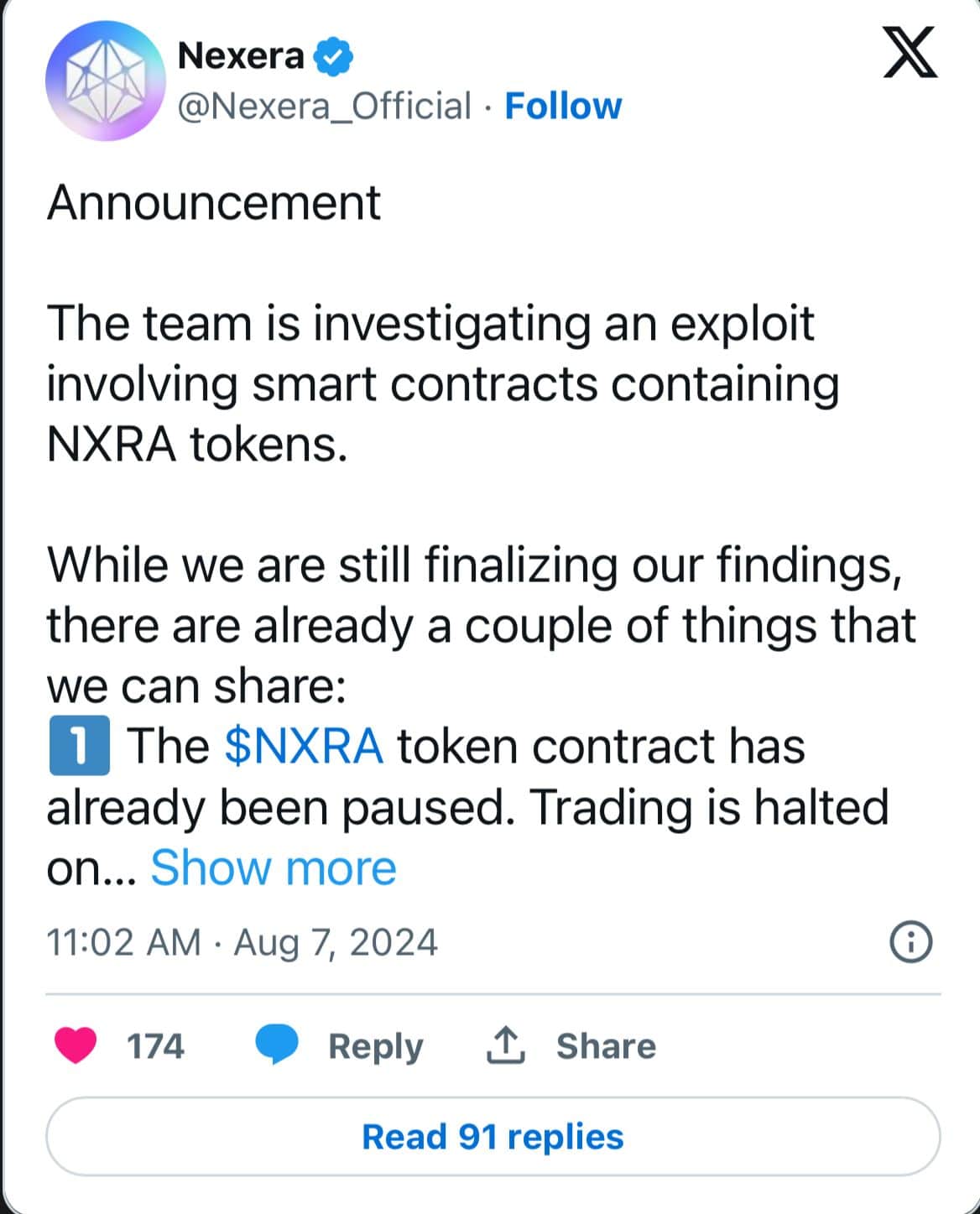

Shortly following the attack, the Nexera team confirmed the exploit in a separate X post, saying the team is “investigating an exploit involving smart contracts containing NXRA tokens.” While the exact nature of the hack remains unclear, the NXRA token contract has been paused, with trading halted as the exchange’s team is still finalizing its “findings.” Nexera added, “We continue to investigate the exploit now and will come back here ASAP with follow-up steps. Thank you for your understanding and patience while we sort this out with the utmost priority.”

Background of Nexera and the Impact

Nexera, established in 2018 by Rachid Ajaja and Matthijs de Vries, facilitates trading between the Ethereum network and the Arbitrum layer-2 solution. The platform’s native token, NXRA, is used for various functions, including transaction fees and rewards within the ecosystem. Following the news of the exploit, the value of NXRA plummeted by over 40%, now trading at $0.037, per data from crypto.news.

The Nexera exploit highlights the vulnerabilities that even established platforms can face in the rapidly evolving crypto space. This incident serves as a reminder of the ongoing security challenges in decentralized finance (DeFi). As Nexera investigates the breach, the focus will likely be on identifying the weaknesses in their system and implementing measures to prevent future attacks.

Additionally, the exploit underscores the need for enhanced security protocols and rigorous testing procedures across all DeFi platforms. It is crucial for companies to stay ahead of potential threats by continuously updating their defenses and educating their teams about emerging risks. The incident may also prompt broader industry discussions on creating more standardized security practices and regulatory frameworks to safeguard the rapidly growing DeFi ecosystem.

Implications for the DeFi Sector

The exploit on crypto exchange Nexera has broader implications for the DeFi space. As decentralized platforms grow in popularity, they become increasingly attractive targets for hackers. The $1.5 million loss suffered by Nexera underscores the need for robust security measures and constant vigilance in the industry. It also raises questions about the safety of user funds on decentralized platforms and the measures these platforms take to protect against such exploits.

Industry experts emphasize the importance of thorough smart contract audits and ongoing security reviews. Blockchain forensic firm Cyvers, which first reported the breach, plays a crucial role in identifying and mitigating such threats. Their swift action in flagging the suspicious transaction provided valuable time for Nexera to respond to the exploit.

The Final Thoughts

The $1.5 million exploit suffered by crypto exchange Nexera has forced the multi-chain decentralized trading platform to halt all trading operations. This incident, first reported by Cyvers, has highlighted the vulnerabilities in DeFi platforms and the critical importance of security in the rapidly evolving crypto space. As Nexera works to address the breach and restore confidence, the broader DeFi community must take this as a cautionary tale, underscoring the need for continuous security enhancements and proactive measures to protect user funds. Keep following TheBITJournal for latest crypto updates.