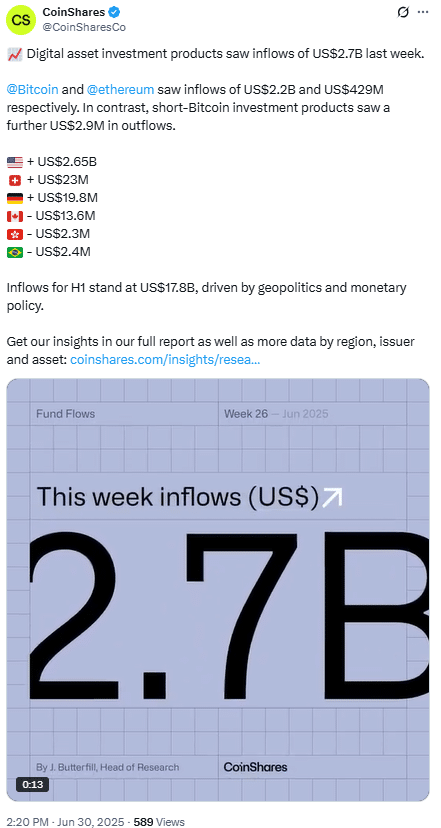

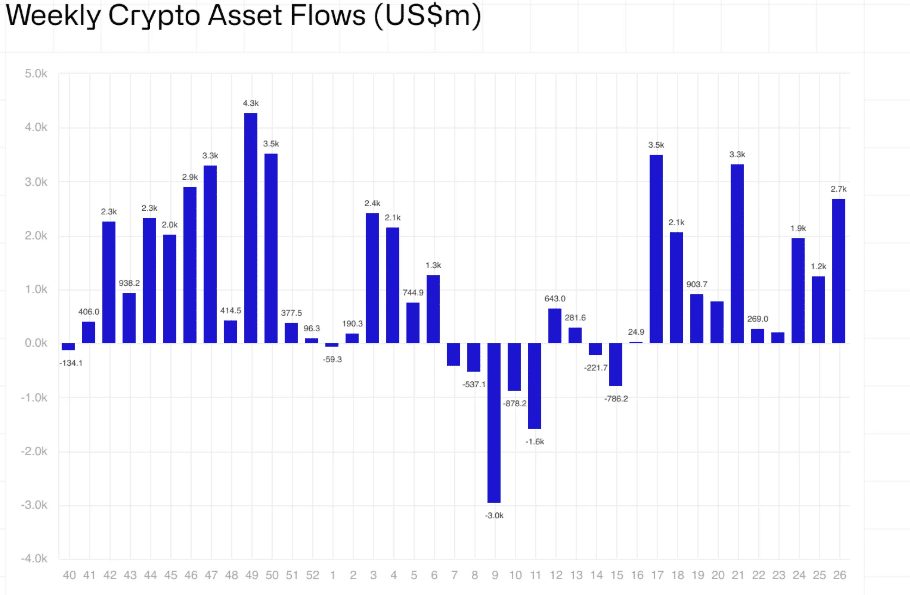

Crypto exchange-traded products (ETPs) have posted impressive growth in the first half of 2025, continuing the positive trend from 2024. According to a recent report from digital asset manager CoinShares, global crypto ETPs saw $2.7 billion in inflows during the week ending Friday, marking the 11th consecutive week of positive inflows. This performance reflects growing investor interest and confidence in cryptocurrency as a mainstream investment product.

Crypto ETPs See $17.8B Inflows, Bitcoin Leads the Way

CoinShares revealed that total inflows for the first half of 2025 reached $17.8 billion. While this is slightly down by 2.7% from last year’s $18.3 billion, it is still a strong showing for the sector. The ongoing streak of inflows, spanning 11 weeks, accounted for nearly 95% of the total year-to-date inflows by the end of June 2025.

Bitcoin continues to dominate the crypto exchange traded products space. With $14.9 billion in year-to-date inflows, Bitcoin investment products account for nearly 84% of total inflows in 2025. This reflects Bitcoin’s strong market position and its appeal to both retail and institutional investors.

Bitcoin and Ether ETP Performance

Bitcoin ETPs remain the most popular investment product in the crypto sector. Last week, Bitcoin ETPs accounted for $2.2 billion, or 83% of the total weekly inflows. This demonstrates Bitcoin’s continued dominance in the market. Ether ETPs, on the other hand, saw $429 million in inflows, accounting for 16% of total inflows for the week.

Year-to-date, Ether ETPs have attracted $2.9 billion in inflows, making up 16.3% of total inflows in the first half of 2025. This performance indicates a strong demand for Ether-based products, following Ethereum’s significant role in decentralized finance (DeFi) and smart contracts.

XRP’s Performance in the Crypto ETP Market

XRP also made notable strides in the crypto ETP market, ranking third in both weekly and half-year inflows. Last week, XRP saw $10.6 million in inflows, bringing its year-to-date total to $219 million. Despite the delay of spot XRP exchange-traded funds in the U.S., Canada launched XRP ETPs on June 18, helping to drive the product’s popularity.

XRP’s strong showing comes as it ranks among the top three crypto assets in terms of ETP inflows. This marks a significant achievement, especially considering the regulatory challenges faced by XRP in various markets.

BlackRock’s Dominance in Crypto ETP Issuers

BlackRock, the world’s largest crypto investment firm, has solidified its leadership in the crypto exchange traded products space. The firm’s crypto funds attracted $17 billion in inflows during the first half of 2025, accounting for 96% of total inflows in crypto exchange traded products. This underscores BlackRock’s strong influence in the sector and its dominant position as the leading issuer of Crypto exchange traded products.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| June | $107,872.35 | $107,872.35 | $107,872.35 | -0.2% |

| July | $118,801.70 | $127,864.65 | $136,927.60 | 26.7% |

| August | $102,210.16 | $112,561.48 | $122,912.79 | 13.7% |

| September | $104,043.51 | $106,476.18 | $108,908.85 | 0.75% |

| October | $100,265.42 | $100,046.45 | $99,827.47 | -7.7% |

| November | $106,937.61 | $101,569.41 | $96,201.21 | -11% |

| December | $100,341.37 | $99,932.75 | $99,524.13 | -7.9% |

Following BlackRock, ProShares and Fidelity saw notable inflows of $526 million and $246 million, respectively. However, other firms, such as Grayscale Investments, experienced outflows, with nearly $1.7 billion leaving their funds during the same period. This contrast highlights the competitive nature of the crypto exchange traded product market, with some firms outperforming others.

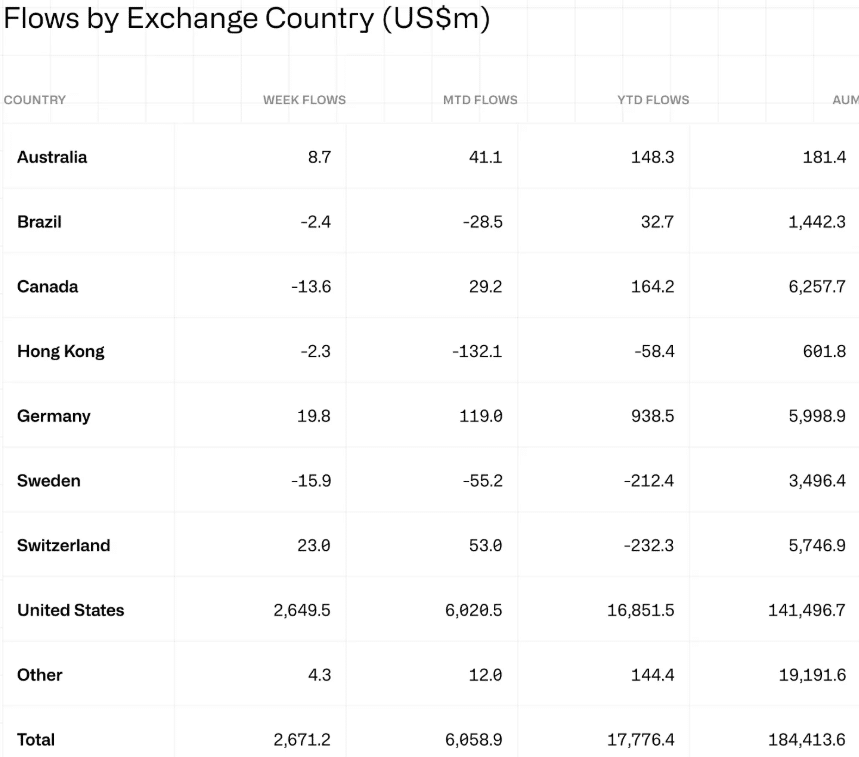

Regional Trends in Crypto Exchange Traded Products Inflows

Regionally, the United States has been the dominant source of inflows, contributing $2.67 billion to the global total. Switzerland and Germany also saw minor inflows of $23 million and $19.8 million, respectively. In contrast, some regions experienced outflows.

Canada, Hong Kong, and Brazil saw minor outflows of $13.6 million, $2.3 million, and $2.4 million, respectively. Hong Kong, in particular, has seen consistent outflows, totaling $132 million in June.

These regional trends show the varying levels of interest in crypto exchange traded products across different markets. While the U.S. leads in inflows, other markets, such as Hong Kong, are experiencing challenges, possibly due to recent market fluctuations.

Conclusion

Crypto exchange-traded products continue to be a strong performer in the global financial markets, reflecting the growing acceptance of cryptocurrencies as investment assets. Bitcoin and Ether ETPs lead the way, with XRP also gaining significant traction. The dominance of major issuers like BlackRock underscores the institutional interest in the sector.

Despite minor fluctuations in inflows across regions, the overall trend remains positive. As the demand for crypto ETPs continues to grow, the market is poised for further expansion in the second half of 2025. Investors and institutions alike are increasingly looking to crypto exchange traded products as a means to gain exposure to the digital asset market while navigating the complexities of cryptocurrency investments.

Summary

Crypto exchange-traded products (ETPs) have seen strong growth in 2025, with $2.7 billion in weekly inflows, marking 11 consecutive weeks of positive performance. Bitcoin leads the market, accounting for nearly 84% of total inflows, followed by Ether and XRP. BlackRock dominates the sector, capturing 96% of the total Crypto exchange traded products inflows.

While the U.S. leads in investments, regions like Hong Kong experienced outflows. Despite minor fluctuations, the crypto exchange traded products market continues to show resilience and growing institutional interest.

Frequently Asked Questions (FAQ)

1. What are crypto exchange traded products (ETPs)?

Crypto exchange traded products are investment products that track the performance of cryptocurrencies, offering investors exposure to digital assets like Bitcoin and Ether without directly holding the underlying assets.

2. Why are Bitcoin ETPs so popular?

Bitcoin ETPs are popular due to Bitcoin’s market dominance and its established reputation as the first and most well-known cryptocurrency. They offer a simple and regulated way for investors to gain exposure to Bitcoin.

3. Are Ether ETPs performing well?

Yes, Ether ETPs have seen strong performance, with significant inflows in 2025. Ethereum’s role in decentralized finance (DeFi) and smart contracts has contributed to Ether’s strong position in the market.

4. Why is BlackRock dominating the crypto ETP market?

BlackRock’s dominance is due to its large scale, experience in investment management, and the substantial inflows into its crypto funds. These factors make it the leading issuer in the crypto ETP market.

Appendix: Glossary of Key Terms

Crypto Exchange-Traded Products (ETPs): Investment products that track the performance of cryptocurrencies, offering indirect exposure to digital assets like Bitcoin and Ether.

Inflows: The total amount of funds invested into crypto ETPs over a specific period, representing investor demand.

Bitcoin ETP: A financial product that mirrors the price movement of Bitcoin, allowing investors to gain exposure without owning the cryptocurrency directly.

Ether ETP: An exchange-traded product that tracks the performance of Ethereum, enabling investment in the cryptocurrency’s price movement.

Spot XRP Exchange-Traded Funds (ETFs): Investment funds that hold XRP tokens directly and aim to reflect the real-time price of XRP, pending in some markets.

Institutional Investors: Large financial organizations, such as investment firms or pension funds, that invest substantial amounts of capital into financial markets like crypto.

Grayscale Investments: A digital asset management firm known for offering cryptocurrency investment products, including the Grayscale Bitcoin Trust (GBTC).

Reference

Cointelegraph – cointelegrapgh.com