Crypto has emerged as the main subject of a fierce controversy while Donald Trump is getting ready to come back to the White House for another four-year term. The industry is supporting his plans to roll back what many consider to be an unjust regulatory pressure stemming from Operation Choke Point 2.0.

The program that was said to have been started under the Biden administration is seen as a deliberate attempt to make it difficult for crypto companies to access banking services. Critics have said it picks up where Operation Choke Point left off, a probe that began in 2013 under President Obama to investigate certain industries. Trump ended the original programme in 2017, as in his view, it was an example of regulatory overreach.

Crypto Banking Risks

Critics of the crypto industry have accused the government of reviving Operation Choke Point 2.0 to force banks to sever relations with digital currency companies with the help of threats of regulatory action. The SEC, FDIC, and OCC, among other financial regulators, have, at one time or another, dismissed its existence.

The policy appears to have been announced in January 2023 when the federal regulators issued a joint statement to the banks about the potential risks of crypto assets. Two months later, the crypto banking sector was hit with two major setbacks as Silvergate Bank and Signature Bank encountered considerable trouble.

Silvergate Bank, which is closely linked with the crypto industry, was under pressure not just from its connection with FTX but also from other regulatory actions. The bank was criticized for being at risk due to restrictions on crypto-related deposits that are said to be not more than 15% of the total deposits made with the institution.

Another bank that has been working with the digital assets industry, Signature Bank, also suffered from pressure from the authority. Although it was financially sound, the bank was seized by regulators in March 2023 after a series of withdrawals in response to panic. Barney Frank stated that the move is deliberate to chase away financial institutions that do business with companies.

Other banks associated with cryptocurrencies have come under similar pressure. Custodia Bank, which specializes in digital assets, was recommended to remove its application for a master account with the Federal Reserve. New restrictions have been stated across the industry and are putting further pressure on the connection between digital currency companies and the mainstream banking sector.

Industry Voices Alarm

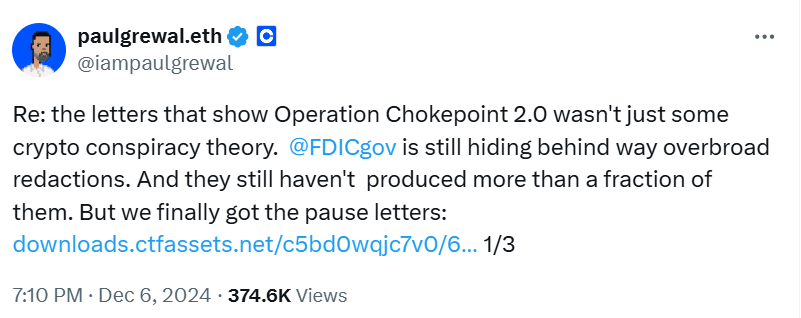

Coinbase has recently joined other big names in the crypto niche to denounce what they believe is a campaign to discredit the industry. The company’s Chief Legal Officer, Paul Grewal, came forward with the documents that were obtained from the Freedom of Information Act requests; the FDIC pushed the banks to stay away from cryptocurrencies.

The problem has also been noticed by other representatives of the IT industry. Tech investor Marc Andreessen recently claimed that more than 30 crypto and tech founders have told him they have been “debunked.” These accounts contribute to the increasing belief that Operation Choke Point 2.0 is not just an idea but has material implications for businesses operating in the digital asset industry.

A Wall Street Journal report cited a survey of 120 crypto hedge funds that struggled with banking issues over the past three years. Most of these funds received notice that their banking arrangements would be discontinued or perhaps even severed without prior notice or explanation. These challenges point to the problems that the digital assets industry experiences under the present legal framework.

Trump has pledged to stop what he called a war against the crypto industry. At the 2024 Bitcoin conference, he declared that if elected, he would cease Operation Choke Point 2.0 on the first day. He also pledged on his first day of office to fire SEC Chair Gary Gensler, another person blamed for imposing strict rules on the sector.

As Gensler and FDIC Chair Martin Gruenberg have plans to vacate their positions in early 2025, industry stakeholders are optimistic about the changes in the regulatory environment. Some of the program’s critics, such as venture capitalist Nic Carter, considered these exits as a chance for a shift.

Conclusion

Crypto companies are hopeful but still guarded as they look forward to Trump’s comeback to office. People, therefore, see this time as a perfect chance to reclaim the availability of banking services and the protection of the industry. The coming months will be crucial in understanding whether Trump will fulfil his pledges, with the situation for the industry more delicate than ever.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What is Operation Choke Point 2.0?

It is claimed to be a regulatory attempt to block the banking services for the cryptocurrency business.

Why are crypto companies supporting Trump?

It is their hope that he will relieve undue pressure from the regulations and bring back ethical banking practices.

How have crypto regulations impacted banks?

Some of the leading banks that support cryptocurrencies, such as Silvergate and Signature, have been dealt with severe sanctions.

What are Trump’s plans for crypto?

Trump has also vowed to discontinue the operation choke point 2.0 and remove some critical regulatory officials.