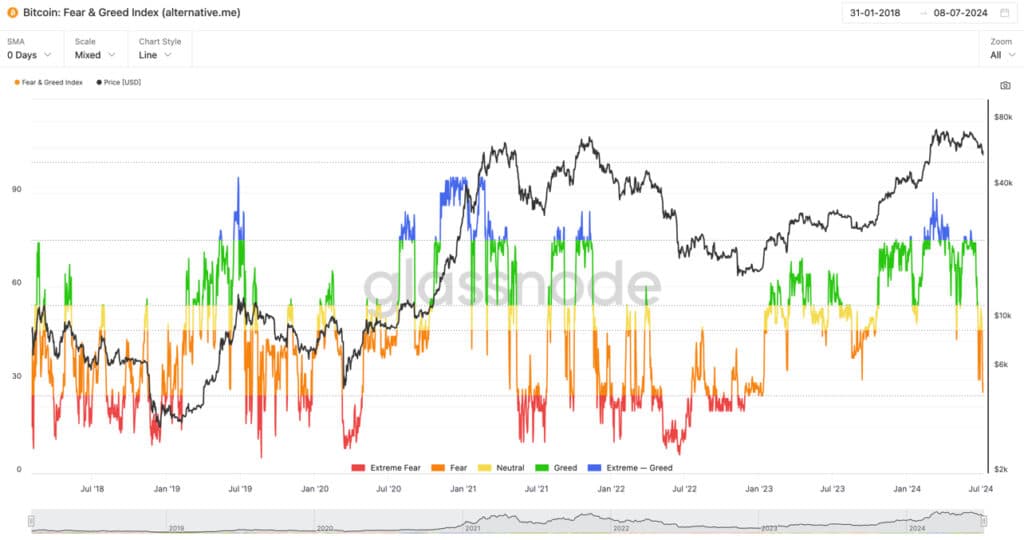

According to Glassnode, as of July 9, the Crypto Fear and Greed Index, a crucial indicator of market mood, has plummeted to its lowest level since January 2023, resting at a concerning 27.

This index measures investor sentiment and provides a snapshot of the emotions driving the market: fear and greed. Low scores hint at prevailing fear, suggesting that investors are anxious, while high scores indicate a fear of missing out (FOMO), driving more speculative investments.

Crypto Fear and Greed Index: Factors Fueling Market Fears

This drop in sentiment takes us back to January 2023, a period shadowed by the recent collapse of the notable crypto exchange FTX. At that time, the index briefly touched 26, while Bitcoin hovered around $16,500. Surprisingly, towards the end of that month, Bitcoin saw a surge, climbing to about $22,000. Fast forward to today, and the scenario seems grimmer with new challenges.

Recent market unease stems from actions by the German government and the legacy of the Mt. Gox saga. The German government has begun offloading significant Bitcoin holdings, transferring an astounding $276 million worth of Bitcoin recently, with approximately 22,800 BTC still under its belt. This sell-off has undoubtedly contributed to Bitcoin’s price dip from June’s high of $63,000 to $53,570 on July 5.

Adding to the sell-off, the infamous Mt. Gox exchange has initiated repayments to creditors, dispersing roughly $9 billion, predominantly in Bitcoin. This move is likely to lead to a flood of Bitcoin hitting the market as creditors opt to cash out, potentially driving prices down further.

Crypto Fear and Greed Index: Silver Linings Amidst the Sell-Off

However, it’s not all doom and gloom. The Bitcoin Exchange Reserve, indicating the amount of Bitcoin held on exchanges, has been on a decline since 2021, reaching a multi-year low. This reduction can be seen as a buffer against the selling tide, suggesting a potential stabilization in store.

Additionally, indicators such as the Miner Supply Ratio and the Miners Position Index show that miners have largely depleted their reserves, which should minimize selling pressure from this quarter moving forward. Interestingly, despite the price dip, there’s a silver lining as fund investors have shown resilience by “buying the dip.” This has marked the strongest weekly performance for Bitcoin funds in more than a month, signalling a possible turnaround or at least a temporary respite from the ongoing sell-off.

Crypto Fear and Greed Index: The Ripple Effects of Market Movements

The fluctuations in the Crypto Fear and Greed Index mirror the direct impacts of governmental actions and old debts and reflect a broader sentiment that encompasses all sectors of the cryptocurrency market. Ethereum, for instance, has also felt the ripples of the market’s downturn, with its value experiencing adjustments reflective of the broader crypto ecosystem’s struggles.

Understanding these dynamics is crucial for investors and enthusiasts. The index serves as a barometer for the emotional state of the entire market, not just Bitcoin. Movements in this index often precede large price swings, offering a predictive glance at potential market behaviour, particularly useful in a landscape as volatile as cryptocurrency.

Wrapping Up on Crypto Fear and Greed Index

This significant downturn in the Crypto Fear and Greed Index underscores a pivotal moment for cryptocurrency markets, mirroring broader economic sentiments and specific upheavals within the crypto space. As we navigate through these turbulent waters, the actions of governments and institutional players will play crucial roles in shaping the path ahead for Bitcoin and other cryptocurrencies. Whether this dip represents a fleeting scare or a more prolonged bear market remains to be seen, but for now, the crypto community remains on alert, watching the market’s reaction to these unfolding events closely.

A Look Forward: What Comes Next?

As we continue to monitor these developments on Crypto Fear and Greed Index , staying updated with reliable sources like The BIT Journal can provide ongoing insights and updates in these turbulent times. For investors, the current market conditions offer both challenges and opportunities. It is essential to approach such periods with a strategy that includes both short-term responses and long-term planning.